For the second year in a row, high-yield ('junk') bonds are disappearing...

For the second year in a row, high-yield ('junk') bonds are disappearing...

In 2022, junk-bond issuances fell by more than $280 billion – or 12% of the total market size. This year, they're set for another 10% decline.

And it's not immediately clear if that's a good thing or a bad thing...

Remember, these bonds are typically viewed as riskier than their investment-grade counterparts because the underlying companies are more likely to default. That's why they offer such high yields as compensation.

So fewer junk-bond issuances may be a sign that riskier companies have already borrowed all the money they need for now.

It could mean their financials are getting stronger... and they're not depending as much on risky, high-interest debt to grow their businesses.

Investors could look at this as a sign that these companies are "getting religion"... and getting better about managing their debt loads after years of feasting on low-interest-rate debt.

But as we'll discuss today, the falling volume of junk bonds isn't a positive development at all.

Neither investors nor banks want junk bonds, but companies still need to issue them...

Neither investors nor banks want junk bonds, but companies still need to issue them...

With interest rates rising above 5%, investors have more opportunities to get a good yield than in years past.

It used to be that if investors wanted a high yield, they needed to turn to junk bonds. U.S. Treasury bonds and investment-grade bonds could barely keep up with inflation, while junk bonds could offer investors yields above 7%.

That gap is now narrowing.

Some investors are fine taking a 5% yield for U.S. Treasurys today, considering how much safer they are than a junk bond yielding just a few percentage points more. As a result, demand for new junk bonds is falling.

Companies recognize this, but there's not much they can do about it. It's just not feasible for them to raise yields as fast as interest rates are rising.

And worse yet, some companies don't have a choice... They need cash.

Banks once again tightened their lending standards this quarter...

Banks once again tightened their lending standards this quarter...

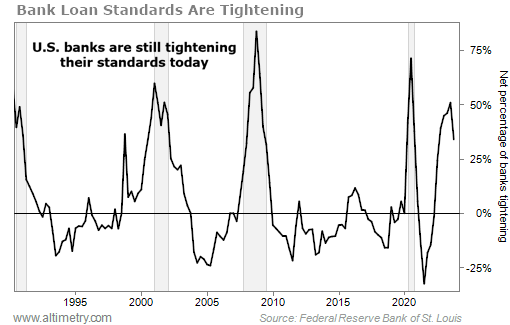

We can see this via the Senior Loan Officer Opinion Survey ("SLOOS"). It's one of our favorite ways to track credit standards.

The SLOOS is a quarterly survey from the Federal Reserve. In short, it gathers information about lending practices in the U.S... by asking loan officers if their lending rules have tightened, eased, or remained unchanged in the past three months.

During the second quarter, 51% of banks reported that they made their lending standards stricter. And in the third quarter, 34% of banks tightened their standards even more.

Take a look...

That's the sixth consecutive quarter of tightening lending standards.

And it's a compounding effect... So even though fewer banks are tightening their standards this quarter, overall lending was already much tighter.

It's going to keep getting harder for companies to borrow money.

This is also the biggest reason why junk bonds aren't flowing like they used to... Banks aren't willing to underwrite them.

This tougher environment is coming at a terrible time...

This tougher environment is coming at a terrible time...

The number of junk bonds coming due within the next 36 months is as high as it was in 2007, right before the Great Recession.

Companies that are strapped for cash are going to need to figure out something soon. And if banks aren't willing to lend, that likely means more defaults and bankruptcies are on the way.

Unless lending standards ease drastically in the coming quarter, we're on the verge of the credit market completely seizing up.

Remember, defaults and bankruptcies force banks to be more prudent with their lending. We've already started to see some high-profile bankruptcies... and by the looks of it, more junk-bond issuers could be joining in soon.

Regards,

Rob Spivey

November 20, 2023

Editor's note: Interest rates have topped 5%. A recession is right around the corner. And banks are aggressively tightening their lending standards.

There are bound to be more bankruptcies from here. But while the rest of the market panics... some of the world's top investors are turning to a strategy that's completely outside of stocks.

The coming credit crisis will create one of the best bond-market setups since the Great Recession. Each month in our Credit Cashflow Investor advisory, we handpick one of our favorite ways to take advantage of investor fear – with the potential for lower-risk, equity-like capital gains.

You don't need any prior experience with bonds to win big in the coming crisis... My team and I break it all down in simple-to-understand terms. To learn more – and claim 50% off one full year of research – click here.

For the second year in a row, high-yield ('junk') bonds are disappearing...

For the second year in a row, high-yield ('junk') bonds are disappearing...