The Federal Reserve isn't trying to ruin the economy...

The Federal Reserve isn't trying to ruin the economy...

But it's still not willing to ease up on interest rates.

Policymakers voted to leave the federal-funds rate in the range of 5.25% to 5.50% at their meeting earlier this month. That's the highest level since early 2001... and rates have been there since July.

Fed Chair Jerome Powell has made it clear that he's more focused on the labor market than inflation at this point. And in his most recent press conference, he said he's willing to keep rates this high through next year if needed.

Hopefully, it doesn't come to that... because a lot of companies could lose out along the way.

We recently covered how bankruptcies are skyrocketing. Rising bankruptcies mean that companies are struggling to stay afloat... And they can't secure financing either because it's too expensive or because banks are too nervous to lend.

Normally, this is when the Fed eases interest rates.

Instead, rates remain at a 22-year high. And as we'll cover today, there are two concerning signs that suggest far more bankruptcies are on the way...

Companies aren't borrowing...

Companies aren't borrowing...

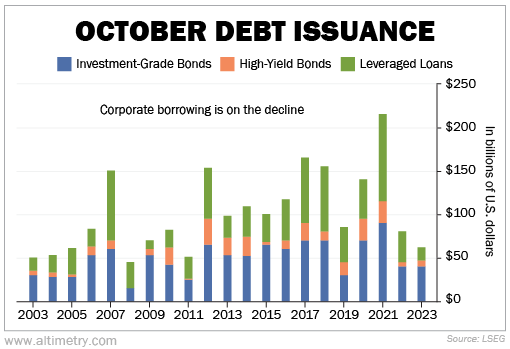

October was the slowest month for borrowing so far this year.

Across investment-grade bonds, high-yield bonds, and even riskier leveraged loans, U.S. companies only borrowed about $70 billion.

Take a look...

As you can see, it was the worst October since 2011. It was also the lowest number of monthly transactions in 20 years.

Now, by itself, this isn't all that concerning. Some companies may not need to borrow.

But if we look at corporate America's upcoming debt maturities, we can see that's not the case...

U.S. companies have about $100 billion of debt due this year.

And over the next two years, the pressure will only intensify. Companies have $250 billion due next year and $389 billion due in 2025.

Already, we're seeing an uptick in defaults on this high-risk debt. The default rate climbed from 2.5% in March to 4% in October.

And the situation could deteriorate further...

And the situation could deteriorate further...

High interest rates make corporate borrowing costs more expensive. And these high costs are steering companies away from issuing debt.

That's a problem... as, starting next year, it's going to become harder and harder for companies to meet all their financial commitments.

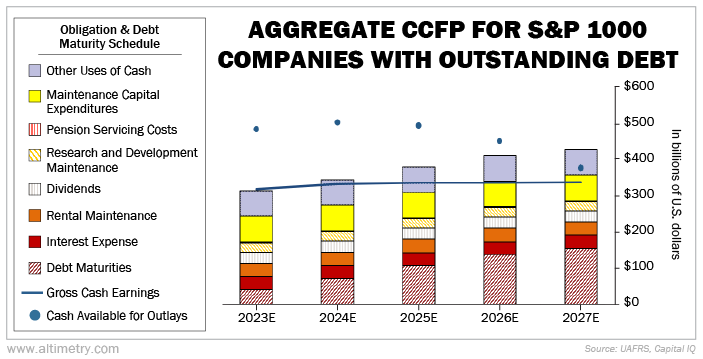

We can see this by looking at our comprehensive Credit Cash Flow Prime ("CCFP") analysis.

Our macro CCFP takes the Uniform cash flows and cash reserves for U.S. companies outside the banking and real estate sectors and compares them with their annual obligations.

The chart below shows the aggregate CCFP for the S&P 1000 Index, which tracks 1,000 small- and mid-cap companies in the U.S.

Compared with the S&P 500, looking at the S&P 1000 gives us a more accurate picture of which companies may struggle during an economic downturn.

Generally, banks prefer lending to larger companies, as they have more room to raise equity. That means smaller firms are at higher risk when economic conditions worsen.

And over the coming years, debt maturities will surge to a level where earnings alone won't be able to sustain all of these companies' obligations.

Take a look...

Beginning next year, cash flows alone (the blue line) won't cover all the financial commitments for the S&P 1000.

And when banks see that companies will struggle to pay off their debts, they may be even less willing to lend in the future. That, in turn, could lead to more defaults.

It might get even uglier over the next two years...

It might get even uglier over the next two years...

Right now, we're getting close to the moment when companies need to refinance.

Our CCFP for the S&P 1000 shows that debt obligations step up significantly in 2024 and in 2025.

But remember, the Fed recently warned that rates will likely remain high next year...

In other words, companies need to borrow soon, and it doesn't seem like they'll be able to.

We have a long way to go before corporate America gets any relief from interest rates – which means we'll likely see far more bankruptcies from here.

Regards,

Rob Spivey

November 13, 2023

The Federal Reserve isn't trying to ruin the economy...

The Federal Reserve isn't trying to ruin the economy...