Jamie Dimon is changing his tune...

Jamie Dimon is changing his tune...

Back in April, the JPMorgan Chase (JPM) CEO gave Wall Street a warning. On the bank's first-quarter earnings call, he signaled that there could be a recession.

Dimon pointed out possible economic "storm clouds" on the horizon. JPMorgan increased its loan loss reserves by $900 million, a clear sign of concern.

The Russia-Ukraine war and inflation gave Dimon reason to worry... But he didn't commit to the recession narrative. He believed consumer wallets and companies were in good shape.

But all that changed earlier this month.

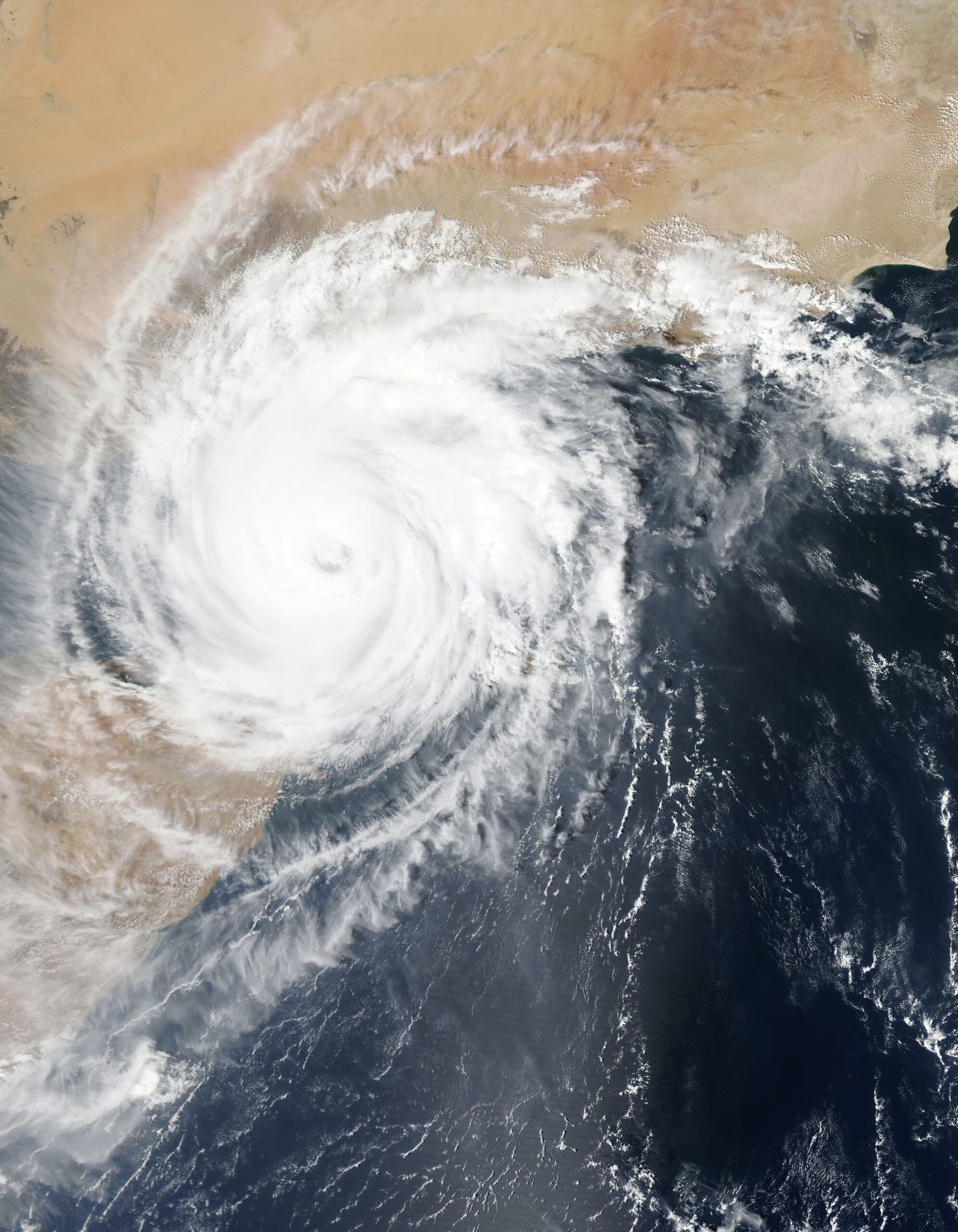

It looks like the hope Dimon held on to in April has faded. With oil prices staying higher, he now thinks a hurricane is coming.

As he told investors at a conference sponsored by AllianceBernstein (AB) on June 1...

That hurricane is right out there down the road coming our way. We don't know if it's a minor one or Superstorm Sandy. You better brace yourself.

But despite Dimon's certainty – and his industry credentials – the doom and gloom he's calling for might be unwarranted.

That's because credit isn't concerning yet...

That's because credit isn't concerning yet...

Wise investors know they can't simply read the financial headlines. You have to look at what the data is saying. And the numbers tell us to keep our faith in the market.

Oil prices and inflation are important. But the most critical indicator is still credit. It has been at the heart of every major recession. The ability to access capital and inject it into an innovative idea is key to growing the economy.

The Federal Reserve is raising rates to curb inflation. That means borrowing costs – the interest paid on corporate debt – are rising. But even with recent rate hikes, capital remains easily accessible for corporations.

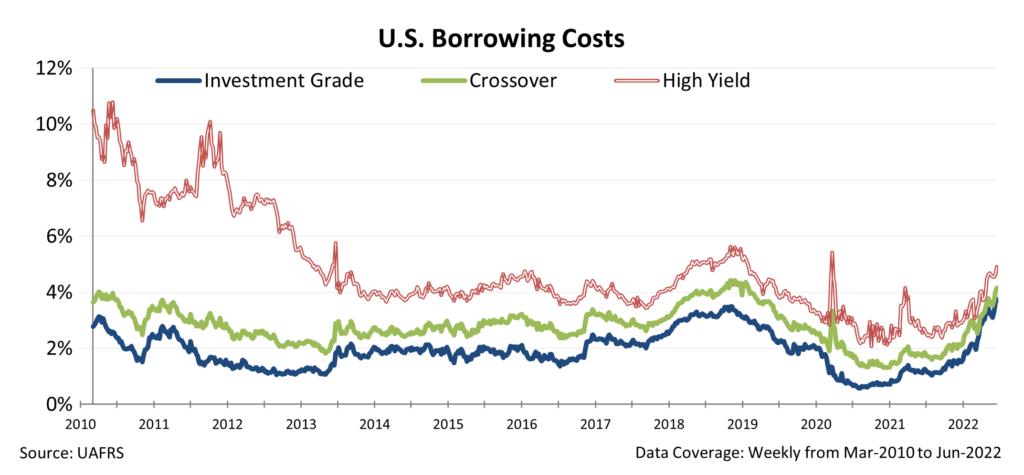

The following chart shows borrowing costs across three types of corporate debt... investment-grade (safe) bonds, high-yield ("junk") bonds, and crossover bonds (the lowest-rated safe bonds and the highest-rated junk bonds).

Borrowing costs are right around where they were in late 2018. Aside from a brief spike in high-yield bonds early in the pandemic, that's about as high as they've been since banks put the Great Recession behind them.

But even so, they're still historically low. Remember, rising rates don't cause recessions – high rates do.

Plus, corporate balance sheets look strong...

Plus, corporate balance sheets look strong...

The aggregate borrowing cost has risen to the high end of recent levels for the past eight or so years. But the key here is that it still remains low relative to history.

Borrowing costs have been rising again recently. But they remain in line with historical averages since the U.S. became an economic superpower.

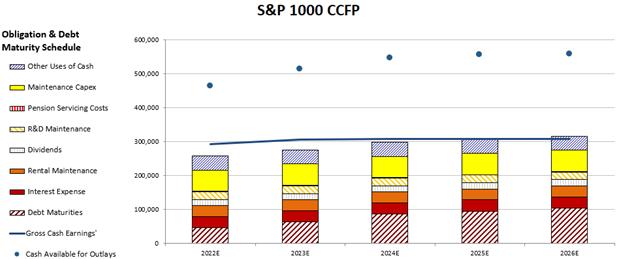

More important, let's take a look at corporate America's debt obligations. We can do this through the Credit Cash Flow Prime ("CCFP"). The CCFP visualizes cash flows and debt obligations together. That way, we can understand how strong corporate balance sheets really are.

Take a look...

The stacked bars represent corporate America's debt obligations each year through 2026. Then, we compare these obligations to aggregate cash flows (the blue line) and the cash on hand at the beginning of each period (the blue dots).

These companies' cash flows alone are enough to cover all their costs through 2025. Once you add in the cash they're holding, things look even better. You can see that they have flexibility, even with higher borrowing costs.

The average company has time to wait and see. Corporations have time to work through their debt maturities. And until they get a better picture of borrowing costs, they have room to breathe.

Best,

Joel Litman,

June 27, 2022