After bolstering its risk controls, the market has left JPMorgan Chase (JPM) in the dust...

After bolstering its risk controls, the market has left JPMorgan Chase (JPM) in the dust...

JPMorgan CEO Jamie Dimon is known for calling it how it is, and he certainly pulled no punches on the company's earnings call a few weeks ago.

Dimon delivered the news that the bank has built a $900 million credit reserve, which reflects the bank's expectations that the war in Ukraine will have widespread financial implications, potentially increasing the odds for a recession.

This is the bank's first increase in reserves since the beginning of the pandemic in 2020, when there were definite expectations for a recession. Even though there are different reasons for a recession today, the market was spooked all the same.

Dimon stated that American consumers and businesses are in good shape, but it is the company's job to be prepared for the storm clouds on the horizon blowing in from the war and rising inflation.

This announcement was not the message markets were looking to hear from one of the oracles of Wall Street. Investors rushed for the exit, causing a big sell-off in JPM shares.

After the pullback the day of the earnings call, the stock tanked to fresh 52-week lows where it has languished since. Investors are worried that the market consensus agrees with Dimon about the potential for a recession on the horizon.

However, we look at this bad news a little differently. With low prices and the current macro backdrop we see, investors may have an opportunity to buy a best-in-class asset at a discount.

This is also what Dimon is seeing. He says chances of a recession are higher, but it's not a guarantee. So, let's look at the risk versus reward.

We can look at our Embedded Expectations Analysis ('EEA') framework to see where JPMorgan may be going in the future...

We can look at our Embedded Expectations Analysis ('EEA') framework to see where JPMorgan may be going in the future...

Last week, we broke down JPMorgan's stellar performance over the last few years. However, past performance doesn't tell us anything about how cheap or expensive the stock is, so it's important to see what the market thinks.

By utilizing our EEA framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

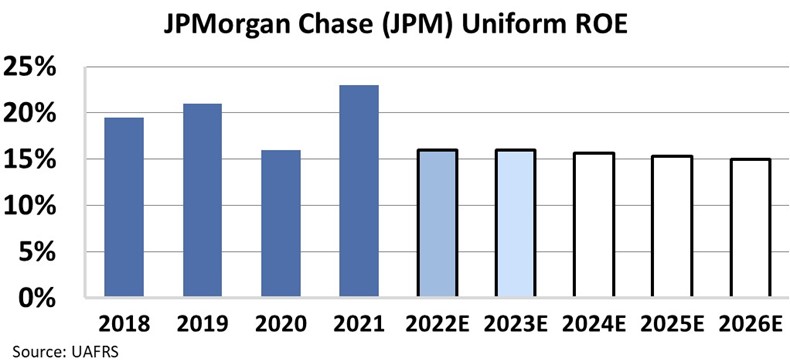

At prices around $130, the market expects JPMorgan's Uniform return on equity ("ROE") to drop to 15% over the next several years. This is a severe drop from the strong 23% ROE seen in 2021, and it's in line with pandemic lows of 2020.

An expectation for returns to fall to the lows of the pandemic in 2020 show how much the market sell-off is tied to fears of another crash in 2022. There might be an opportunity to benefit from the most recent decline, and we can see this at a glance thanks to the power of Uniform Accounting.

With this sell-off, it's clear that skittish investors selling JPMorgan are braced for a recession. However, as we've covered here in Altimetry Daily Authority, the market still has fundamental strength thanks to strong balance sheets and earnings potential.

Despite market fears, JPM shares could have plenty of upside thanks to this turbulent market environment.

Regards,

Rob Spivey

April 26, 2022

After bolstering its risk controls, the market has left JPMorgan Chase (JPM) in the dust...

After bolstering its risk controls, the market has left JPMorgan Chase (JPM) in the dust...