Bankruptcy really is just about the worst-case scenario for a company...

Bankruptcy really is just about the worst-case scenario for a company...

It probably sounds obvious when I put it like that. Yet it's also an important reminder – because when measuring economic health, folks often get way too caught up with bankruptcies.

They're certainly a factor, and they're not looking good today. U.S. bankruptcies are on track for their worst year since the Great Recession.

However, when companies are under stress, they have more options than simply declaring bankruptcy.

Most companies will try their best to restructure first. Or they might get as close to default as possible without actually entering default... like Chinese developer Country Garden, which came within days of defaulting twice this year. It managed to make payments both times.

If you're only paying attention to bankruptcies, you're missing the bigger picture. Today, we'll examine other overlooked categories that measure the health of corporate America.

Bankruptcies aren't even the biggest form of default this year...

Bankruptcies aren't even the biggest form of default this year...

That title goes to the "distressed exchange."

A distressed exchange happens when a company is struggling with its debt and wants to avoid bankruptcy. The company has the option to try negotiating with its lenders.

It might offer to buy back the debt at a steep discount. Or it might exchange it for a much smaller debt. For instance, the company may offer to buy back its bonds at a lower price... like 15 cents for each dollar of the bond's value.

The key point is it's not like normal refinancing – the lender is taking a discount. This move helps the company avoid bankruptcy and lets creditors get back some of their money.

This is what Swedish real estate company SBB attempted earlier this year. SBB wanted to buy back some of its bonds for an 85% discount. Credit-ratings agency S&P warned it would be labeled as a "selective default."

If you've only been paying attention to bankruptcies, you know the U.S. economy is struggling. However, when we zoom out our view of corporate health... we can see just how many companies are struggling.

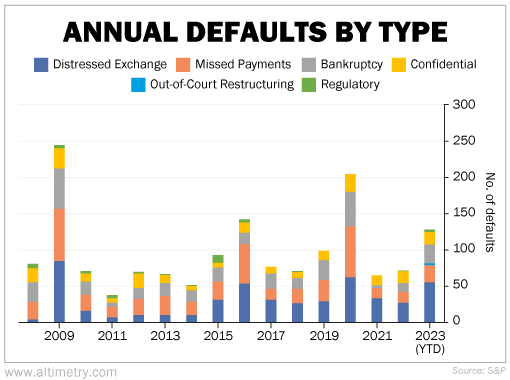

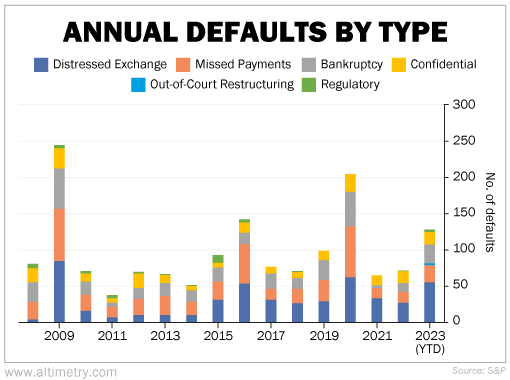

This year, even more companies have undergone distressed exchanges than have gone bankrupt. And plenty have missed interest payments, entered out-of-court restructuring, or started confidential restructuring procedures that don't show up in the bankruptcy numbers.

Only three years have looked worse since 2008... the height of the Great Recession in 2009, the midst of the energy-price rout in 2016... and the start of the pandemic in 2020.

Take a look...

Corporate stress is building... and more companies are on the brink of bankruptcy than many folks realize. They're missing it because they're only paying attention to companies that have already gone bankrupt.

Today's signs of stress are now matching the tough times of 2020. The numbers make for a grim outlook.

No matter where you look, pretty much every credit metric is going south...

No matter where you look, pretty much every credit metric is going south...

Bankruptcy data is important. However, it's better for seeing how bad the economy is... rather than how bad it might get.

Distressed exchanges and overall corporate stress point to a recession on the horizon.

Many of these companies have skirted bankruptcy this year. That doesn't guarantee they'll stay solvent forever. It's a good reminder of just how much worse the outlook could get in the coming months.

Regards,

Joel Litman

December 18, 2023

P.S. Hundreds of folks have taken action after hearing the latest warning from myself and my friend Marc Chaikin... and if you're not one of them, you risk getting left behind during a tumultuous year.

Marc and I have worked closely to put together your "Financial Lifeline" for 2024 – including exactly what stocks could see gains of 100%... 200%... or even 500% from here. Plus, we shared 10 of the most dangerous stocks that could tank your portfolio in the coming months. Click here to learn more.

Bankruptcy really is just about the worst-case scenario for a company...

Bankruptcy really is just about the worst-case scenario for a company...