The U.S. has too many banks...

The U.S. has too many banks...

That might be hard to imagine, considering how many we used to have. In the early 1920s, there were more than 30,000 banks across the country. We're down to around 4,000 these days.

Of course, things were quite different back then. Banks were local affairs that couldn't legally operate more than one branch. They were also poorly run, going bust all the time.

And since this was before the establishment of the Federal Deposit Insurance Corporation ("FDIC"), there was no government-backed protection of customers' deposits.

Even in the "modern" era of the 1980s, we had a whopping 14,000 different banks operating. Today's 4,000-plus number seems almost reasonable by comparison.

That said, the U.S. still has more banks than any other country. It even has more than the entire European Union combined.

We've spent the past week talking about the state of U.S. banking. We started on Tuesday with a story about finding opportunity during the 1980s savings and loan crisis.

On Wednesday, we covered the recent events that led to the March 2023 bank collapses.

And yesterday, we discussed the growing number of "zombie" financial institutions... and what a new wave of deregulation could mean for the industry.

Today, we'll wrap up our four-part series by explaining the changes that could soon come to the banking sector... and where to look for the best profits.

The banking sector popped after the election results were announced...

The banking sector popped after the election results were announced...

And it was one of the best-performing corners of the market through the rest of November 2024. The SPDR S&P Regional Banking Fund (KRE), which tracks a basket of regional bank stocks, ended the month up 15%.

Part of the reason is due to Donald Trump's policy approach. The president-elect has pushed a deregulation agenda before, and he plans on doing so again.

But the market isn't just reacting to a return to Trump's deregulation agenda. It's arguably more excited that the Biden era is over.

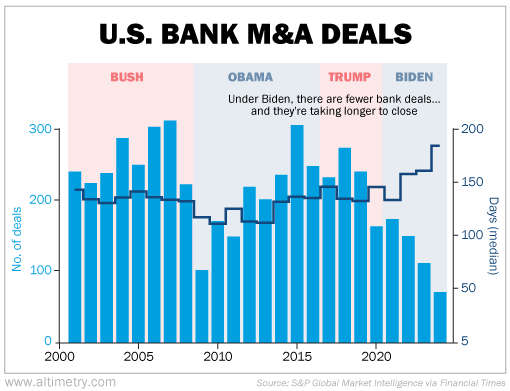

Across the George W. Bush, Obama, and first Trump administrations, the U.S. averaged more than 200 bank merger and acquisition (M&A) deals per year. Those deals consistently closed within five months.

The Biden administration invested a lot of efforts into more regulation. Bank deals came to a standstill. Just over 500 deals have gone through during his time in office. The number of deals has fallen every year.

Not to mention, those deals are taking longer than ever to close. Take a look...

The Biden administration has seen the slowest M&A era of this millennium. No wonder the industry is celebrating his departure.

We're poised for the biggest bank M&A surge in modern history...

We're poised for the biggest bank M&A surge in modern history...

Banks want to combine. As we discussed yesterday, this industry is home to hundreds of zombies that would like nothing more than to sell... and put their cash to work.

Many industry experts are calling for consolidation to surge under Trump. We agree... All signs point to more bank M&A.

And while that's generally a good thing for the financial sector...

...it's great for the companies that are trying to scoop up smaller competitors.

It's time to get exposed to the banking sector. Investors looking for an extra edge should focus on banks that are talking about consolidating.

Regards,

Joel Litman

January 10, 2025

The U.S. has too many banks...

The U.S. has too many banks...