The pandemic's disruption to retail hasn't been evenly distributed, and the recovery won't be either...

The pandemic's disruption to retail hasn't been evenly distributed, and the recovery won't be either...

It's no surprise that some of the areas of the economy that have been hardest hit by the pandemic are retail and restaurants. But it's important to remember that disruption hasn't been linear...

A recent article in The Economist features a great table that shows different retail industries in terms of the percentage of employees that have been laid off versus the percentage of sales that have declined on average in the industry since January.

The least hit has been grocery stores, which have seen a slight increase in sales and seen no staff let go overall. Even general merchandise stores – which have seen a roughly 15% drop in sales – also haven't laid off employees in general.

But at the other extreme, clothing stores have seen a 90% drop in sales and have let over 60% of their staff go on average. For restaurants and bars, it's about 50% and 50% in terms of employment and sales dropping.

Some sectors have been much more resistant to disruption from the virus, and should be viewed as such.

The way you think about betting on clothier Gap (GPS) in the recovery and how you think about drugstore chain Walgreens Boots Alliance (WBA) should be vastly different.

The piece from The Economist also highlights that some niches in the retail market have been more hopeful about a recovery and laid off less people than may be warranted based on the sales drop, which could mean that profitability will be hit harder in those areas.

One example is the electronics space. Because of this discrepancy, stores like Best Buy (BBY) could struggle more if the economy doesn't recover as fast.

On the opposite side, restaurants and bars have been among the most aggressive in the reduction of staff relative to the actual drop in revenue. These businesses could be more resilient even if they stay shut down for longer, since they've been more aggressive when cutting costs.

Overall, the analysis serves as a good reminder that when looking at retail companies to invest in, remember that not all are created equal when it comes to how the virus has affected them.

'SaaS' isn't just a buzzword...

'SaaS' isn't just a buzzword...

It's somewhat of a revolution in the tech industry.

Historically, software has been treated like an asset or a "good" that can be purchased by a customer.

After the consumer bought the software, it was theirs forever. He could use it as much or a little as he wanted for as long as he wanted.

However, in recent years, we've seen an increasing push to move software from a good to a service.

That's where we get the expression Software as a Service ("SaaS"). It's a radical change in the way software companies make money.

We've talked about this trend before... in the May 13 Altimetry Daily Authority, we called this trend "going Adobe." This references how Adobe (ADBE) was one of the originators of switching from a perpetual license model to a subscription-based plan.

That's a big reason why ADBE shares are up roughly 1,300% since the beginning of 2012, when the company made a big push to transition to the SaaS model.

This same switch has also fueled successful transformations and stock runs for firms like Citrix Systems (CTXS) and Microsoft (MSFT).

That being said, one could argue that we shouldn't call this phenomenon "going Adobe" at all, because another software firm figured out the power of this business model long before Adobe did...

Thinking about how the video-game industry has changed over the past several decades, we've seen a similar industry transformation.

Of course, prior to the Internet, there was no real way for video games to be offered as a service... and most were sold as physical discs and chips for consoles and computers.

These games were snapshots in time – once they were purchased, they stayed the same forever.

Updates didn't exist, and eventually the game would be deemed obsolete. After that, you'd go to the store to purchase the latest and greatest version.

But Activision Blizzard (ATVI) helped bring a different type of game to the mainstream that revolutionized the industry – the massively multiplayer online role-playing game ("MMORPG").

That's a mouthful... but all it means is an online game where you play with others. In 2004, Activision Blizzard released World of Warcraft, which is still popular today.

The game has gone through its ups and downs, but it has stuck around for the past 16 years because it helped innovate SaaS... but in the gaming space rather than traditional software.

Though World of Warcraft costs money upfront, it also required a monthly subscription in order to continue accessing the servers.

The downside for consumers is that the game costs more money the longer you play... but on the flip side, the software is interactive and dynamic. It's constantly being updated and refreshed to keep it like new.

Unfortunately, being a pioneer in the SaaS model doesn't seem to have helped Activision Blizzard as much as it has helped traditional SaaS companies.

Perhaps because Activision Blizzard was testing uncharted territory, the company appears to have failed to price its software appropriately – its as-reported profitability has been weak.

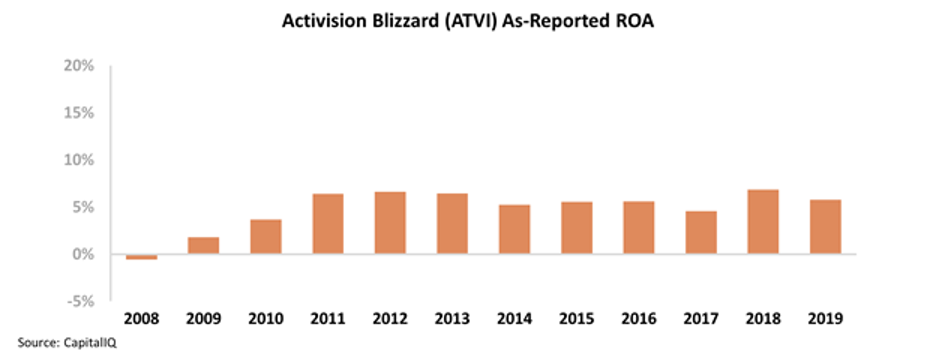

Since 2008, when Activision merged with Blizzard's parent company, the combined business' as-reported return on assets ("ROA") has mostly remained below long-term corporate averages... never improving past 7%.

Compared to the massive profitability improvements that companies like Adobe and Microsoft underwent, these returns feel lackluster at best.

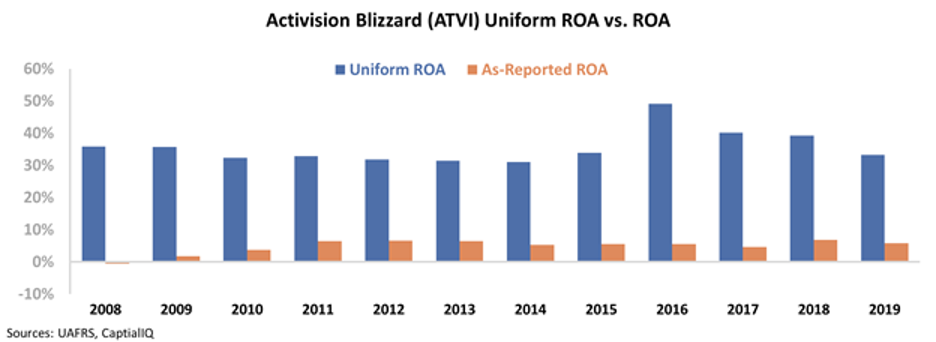

Luckily for Activision Blizzard, the financial numbers are wrong. The as-reported metrics don't reflect reality.

Once we apply our Uniform Accounting metrics – which adjust for the company's massive goodwill balance, excess cash, and the effect of research and development (R&D) costs, we can see that Activision Blizzard could have been used as a model for what SaaS firms can expect to return.

The company's Uniform ROA has been much stronger and stable since 2008 – remaining above 31% and reaching as high as 49% in 2016.

That's more in line with what we've seen from other SaaS firms. It highlights just how misleading as-reported financial metrics can be, and how resilient this business model is.

These types of steady and strong returns are why the SaaS fad has taken over the traditional software industry... and even the gaming space, with everything from other MMORPG titles to sports games creating SaaS-like offerings to boost profitability.

Regards,

Joel Litman

June 11, 2020

The pandemic's disruption to retail hasn't been evenly distributed, and the recovery won't be either...

The pandemic's disruption to retail hasn't been evenly distributed, and the recovery won't be either...