The U.S. is defending its position in the semiconductor market...

The U.S. is defending its position in the semiconductor market...

China and the U.S. have been the dominant players in the chipmaking industry for years.

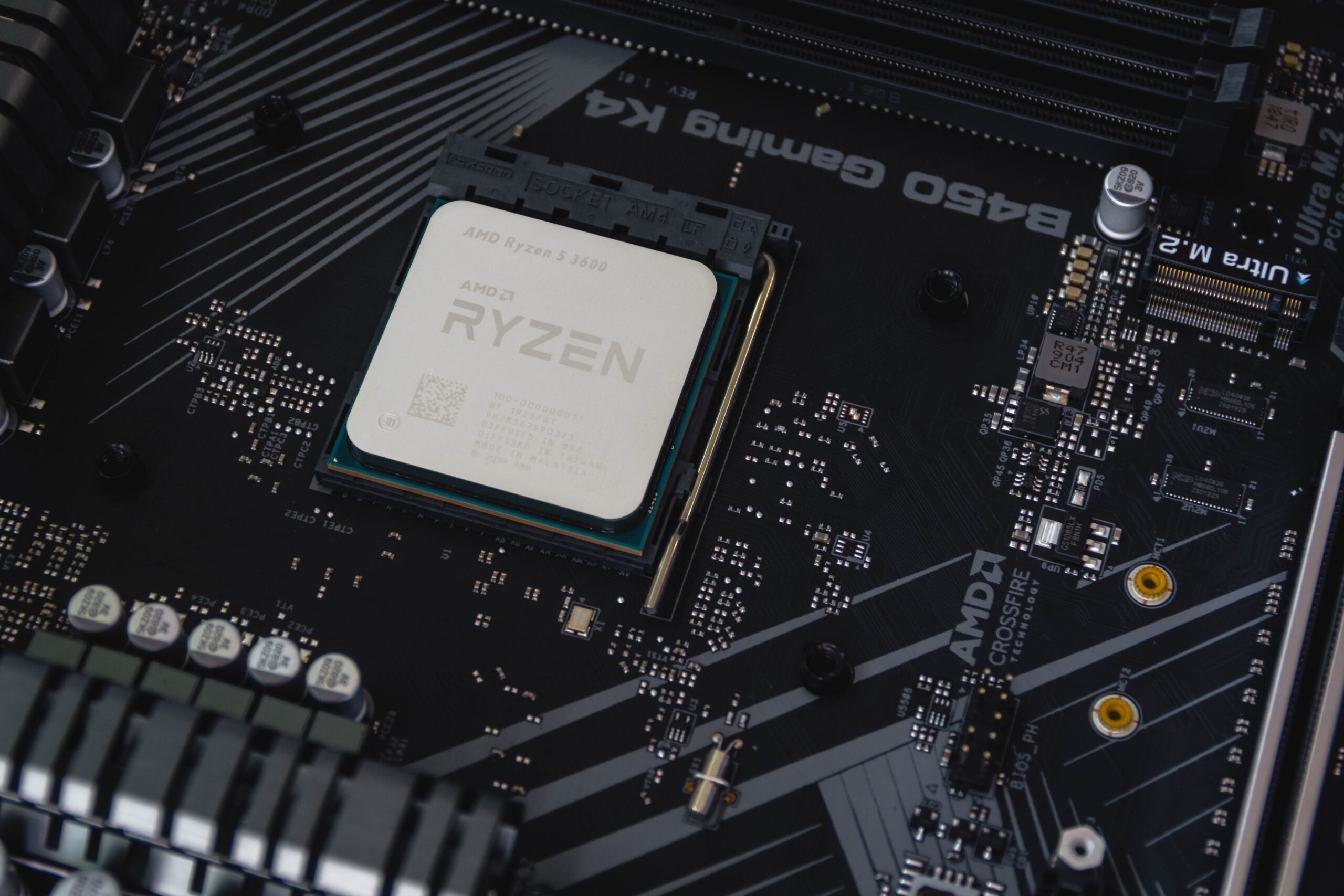

These tiny silicon wafers are essential to powering our everyday lives. They're so critical that despite pandemic-related shortages, the industry is expected to nearly double in the next eight years... surpassing $1 trillion by 2030.

We've previously talked about a trend called the "supply-chain supercycle." In short, supply-chain disruptions and geopolitical tensions have opened U.S. companies' eyes to the need to produce more on American soil.

A number of sectors will benefit from the coming wave of massive investment in U.S. industry. Semiconductors are a prime example.

Controlling the production of chips is one of the biggest advantages any country could have. And earlier this month, President Joe Biden announced his latest move to take this control outright.

On October 7, the Biden administration imposed sweeping restrictions on U.S. technology exports to China. The new rules prevent companies from selling U.S. chips and tools to China. They also bar U.S. citizens from working on Chinese chip development.

These moves follow the $52 billion CHIPS Act, which was signed into law in August. It helped fund more semiconductor production on U.S. soil.

The latest sanctions focus on all the areas the U.S. views as national interests. Despite its growing semiconductor industry, China still ultimately relied on U.S. technology for much of its needs.

Now, Chinese companies are essentially on their own for building semiconductors, supercomputers, and weapons technology.

Biden is doing what he can to preserve U.S. dominance in tech innovation. This is the administration's most drastic move to date.

It's too early to tell exactly how this will play out. But so far, many folks seem more concerned than excited.

These restrictions have hit the market while it's down...

These restrictions have hit the market while it's down...

You see, in the short term, this latest set of rules might actually hurt U.S. chipmakers. Most of them have big businesses in China, and Chinese companies buy a lot of their products.

That's one of the reasons U.S. semiconductor stocks are getting crushed.

To see this, we can look at the PHLX Semiconductor Index. It tracks the 30 biggest U.S. semiconductor companies... And it's down 44% this year. That's about twice as much as the S&P 500's loss in the same time frame.

Some of the biggest companies in the index have dropped by astounding amounts.

Industry staple Intel (INTC) has fallen 50% year to date. Lam Research (LRCX), which supplies parts used in chipmaking, is down 55%. Roughly 20% of that drop has occurred since Biden announced his latest round of restrictions.

Despite investor fears, these policies are actually a push in a right direction...

Despite investor fears, these policies are actually a push in a right direction...

China still relies on U.S. chipmaking parts and expertise. That's why an estimated 43 U.S. citizens work as executives at the biggest Chinese semiconductor companies.

Now, China needs to figure out how to handle its industry alone. This should buy the U.S. several more years to pull ahead.

With China out of the picture for a lot of companies, big parts of the chip supply chain will rebuild in and near the U.S. That long-term stability will be a boon for investment in U.S. chipmaking.

Investment in U.S. chipmakers will circulate through not only our companies, but our economy as a whole. That should further strengthen the supply-chain supercycle.

The market is worried about short-term implications. That's why semiconductors continue to sell off. But Biden's new restrictions against Chinese chipmakers shouldn't sound the alarm bells. This is a long-term opportunity that will protect the U.S. semiconductor industry.

Regards,

Rob Spivey

October 20, 2022

The U.S. is defending its position in the semiconductor market...

The U.S. is defending its position in the semiconductor market...