America needs to take a page out of China's chipmaking playbook...

America needs to take a page out of China's chipmaking playbook...

Semiconductors are essential to our everyday lives. They're used in everything from our computers and phones to kitchen appliances and even banking. So it's no surprise that the semiconductor shortage has taken its toll.

For example, despite record-high auto demand in 2021, manufacturers were unable to ship cars. There just weren't enough chips for them. Last month, car deliveries were down 16% year over year thanks to supply-chain disruptions.

The troubles don't stop there. Prices for TVs are up about 30% this year thanks to a lack of chips. Ford Motor (F) has been forced to pause production of its ambulances.

To combat the shortage, Congress passed the CHIPS Act last year. The bill was intended to inject $52 billion dollars of government aid into the domestic semiconductor industry. It seemed like a no-brainer... But it still hasn't been financed.

Most politicians agree that it's vital to bring capital and chipmaking capacity to American shores. In the face of geopolitical tensions, America's ability to manufacture these chips has never been more crucial. Boosting domestic manufacturing would give the U.S. a massive competitive advantage over countries in similar positions.

China has passed similar laws to ensure chipmakers will choose to build in the country. Now, America must adopt this same strategy.

If the CHIPS Act remains unfunded, experts warn it will keep production out of the U.S. After all, why would you choose to make chips in America when costs are cheaper overseas?

But no matter what Congress decides, one U.S. company is positioned to profit...

But no matter what Congress decides, one U.S. company is positioned to profit...

Applied Materials (AMAT) makes the equipment needed to build semiconductors. And it's going to win no matter where companies choose to make new semiconductors.

Thanks to booming demand, investment in the chip industry isn't slowing down anytime soon. And Applied Materials will benefit at home or on the other side of the world.

We can use our Altimeter tool to take a closer look at Applied Materials... and to determine whether it's a strong opportunity today.

Using the power of Uniform Accounting, the Altimeter shows us easily digestible grades to rank stocks based on their real financials. It does this by eliminating the distortions in generally accepted accounting principles ("GAAP") financial metrics.

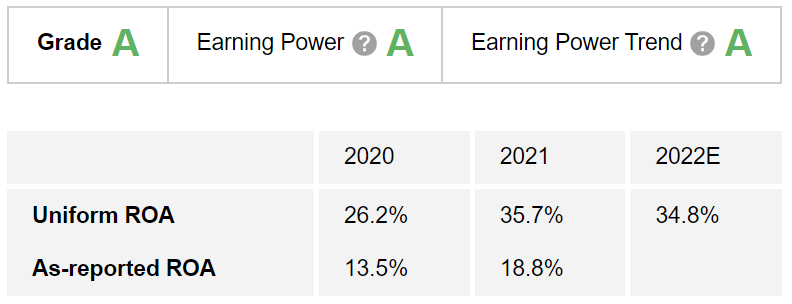

As-reported metrics paint Applied Materials as a decent company. Its return on assets ("ROA") was 14% in 2020, just a few points above the corporate average of 12%. Last year, ROA improved to 19%.

Those numbers are OK. But in such a hot cycle, you'd expect them to look better.

Uniform Accounting shows a different picture... Applied Materials' Uniform ROA was 26% in 2020. And it recorded a big jump in 2021, hitting 36%.

These metrics earn Applied Materials "A" grades for both Earning Power and Earning Power Trend.

But the fundamentals are only one piece of the puzzle...

But the fundamentals are only one piece of the puzzle...

To determine if a stock is a good buy, we must also consider valuations. That tells us whether the market realizes how much Applied Materials will benefit from semiconductor demand.

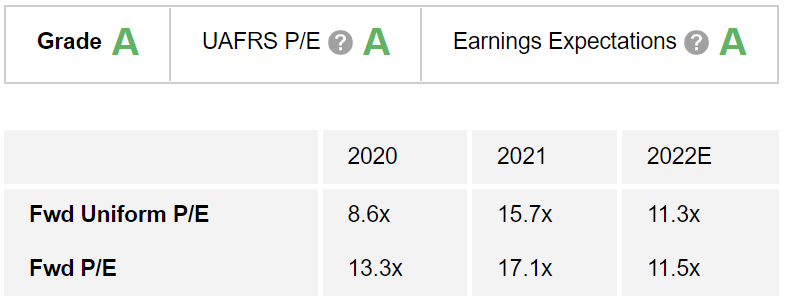

Based on as-reported metrics, Applied Materials looks like a relatively cheap company already. Its price-to-earnings (P/E) ratio is significantly below the market average of 20 times. It was 13 times in 2020 and 17 times in 2021.

But Uniform Accounting shows that the company is even cheaper than it appears. Applied Materials boasted a P/E ratio of 9 times in 2020 and 16 times in 2021. Its P/E metric is expected to be 11 times in 2022.

The Altimeter clearly shows us that the market isn't pricing in Applied Materials' potential. As strong demand continues to boost the chip industry, this company should reap the rewards.

Regards,

Rob Spivey

July 14, 2022