After numerous malfunctions... lawsuits... and government-ordered inspections... you might think Boeing (BA) must be due for a win.

After numerous malfunctions... lawsuits... and government-ordered inspections... you might think Boeing (BA) must be due for a win.

Boeing's spacecraft, CST-100 Starliner, was tasked with shuttling two astronauts to and from the International Space Station back in June.

It was the first test flight for the Starliner with astronauts.

The first leg of the journey was a success. But when the spacecraft returned to Earth on September 7, it was empty.

Helium began leaking from the spacecraft shortly after launch. And after months of surveying the situation, NASA decided the risks were too high.

NASA didn't trust Boeing's vehicle. So both astronauts are stuck in space until early next year. Elon Musk's SpaceX is expected to send a craft to bring them home.

As if its failed Starliner mission wasn't enough, Boeing's workers have been on strike for three weeks. The company now can't produce anything. It's burning $50 million per day on continuing costs and lost revenue.

Credit-ratings agencies have finally had enough of Boeing. And unsurprisingly, that has really spooked investors. So today, we'll take our own look "under the hood" of Boeing's operations...

Boeing is one downgrade away from losing its investment-grade rating...

Boeing is one downgrade away from losing its investment-grade rating...

"Big Three" ratings agency Fitch currently gives the company a "BBB-" rating. Back in 2019, the company boasted a safe "A" rating. However, as the issues piled up, ratings agencies like Fitch reconsidered their outlook for this business.

Fitch lowered Boeing's credit rating three times in 2020, and they may do so again soon. Fitch announced that if the strike lasts longer than a few weeks – which it already has – it could be enough to warrant a credit downgrade.

That could really cause the market to panic.

Boeing's last strike lasted 57 days in 2008. It led to a 52-day production shutdown... And the company took between four and six weeks to return to prestrike levels.

Today's strike will already hurt Boeing's ability to meet its fourth-quarter 737 Max target production rate. We expect it to struggle meeting fourth-quarter guidance as well.

But all that said, Fitch is being too reactionary...

But all that said, Fitch is being too reactionary...

While an extremely long strike could be damaging to Boeing, its financial picture still looks good enough to survive... for the time being.

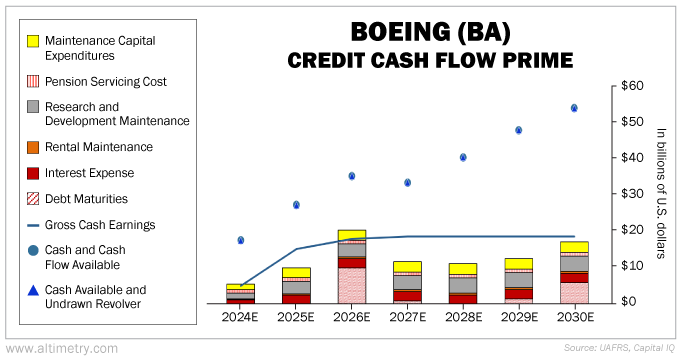

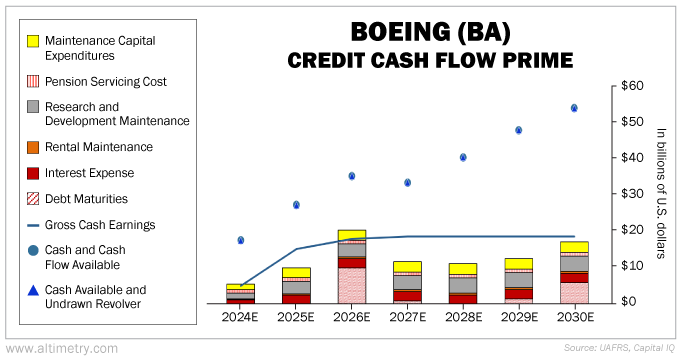

To get a clearer view of Boeing's credit quality, we need to compare the company's obligations with its actual cash flows. So, we turn to our Credit Cash Flow Prime ("CCFP") analysis...

The CCFP gives us a more accurate sense of a company's overall health. It compares financial obligations against cash position and expected cash earnings.

In the following chart, the stacked bars represent Boeing's obligations through 2030. This is what it needs to pay in order to keep the lights on... and prevent the company from collapsing.

We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

As you can see, Boeing has plenty of cash today. It will have enough cash to sustain the strike in the short term...

Fitch is likely most concerned with Boeing's cash flows. A prolonged strike means the company won't have any cash coming in for weeks, if not months.

But Boeing has a solid amount of cash on hand. And it has a revolver from its banks, which it can tap if the situation gets dire.

Of course, an unfavorable resolution to this labor strike could also hurt Boeing's production costs. Labor already constitutes 15% of aircraft costs for the 737 Max. Any cost increase could shrink Boeing's margins.

At the moment, we can only speculate on how this strike will end...

At the moment, we can only speculate on how this strike will end...

So instead, we're going to focus on what we know.

Boeing is a massive company with more than $142 billion in assets on its books. Banks aren't going to let a company that big go bankrupt because of a strike.

We've been vocal about our thoughts on Boeing's stock. A turnaround could be years away... And in the meantime, it's still plagued by repeated problems. You're far safer watching the fireworks from a distance.

But the ratings agencies are going a step too far. Boeing's business isn't going anywhere. There's no reason its credit rating should fall into speculative territory.

Regards,

Rob Spivey

October 9, 2024

After numerous malfunctions... lawsuits... and government-ordered inspections... you might think Boeing (BA) must be due for a win.

After numerous malfunctions... lawsuits... and government-ordered inspections... you might think Boeing (BA) must be due for a win.