Each quarter, Berkshire Hathaway (BRK-B) gives us a glimpse into Warren Buffett's strategies...

Each quarter, Berkshire Hathaway (BRK-B) gives us a glimpse into Warren Buffett's strategies...

When the investing legend's flagship company updates its portfolio, investors pay close attention. And in the latest update, Berkshire revealed a staggering $325 billion in cash – the largest cash allocation in the company's history.

At first glance, it might seem like Buffett is sitting on the sidelines waiting for a market crash. But that's not his style. Buffett doesn't try to predict market moves.

He focuses on valuations... and adjusts his portfolio based on long-term expectations for returns.

Even with the market at all-time high valuations, Buffett isn't betting on a huge drop. But he knows how tough it is to find significant upside when valuations start at these high levels.

Today, we'll take a closer look at what Buffett is doing... and why valuations could start coming down without a major crash.

Valuations are high, but there's more to the story...

Valuations are high, but there's more to the story...

The S&P 500’s Uniform price-to-earnings ratio is sitting around 24 times... one of the highest levels in history.

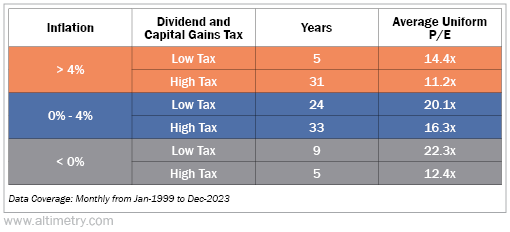

While it's true that the market is overvalued by that metric, valuations should be on the higher side. As with so many aspects of the market, you have to consider other factors as well... in this case, inflation, tax rates, and real cash earnings growth.

Borrowing is cheaper in a low-inflation environment. So businesses can invest more in growth and operations. And doing so tends to drive higher returns for corporations.

At the same time, favorable tax rates allow companies to retain more of their earnings. Again, they can reinvest that cash to boost long-term profitability. And again, that drives higher returns.

Together, inflation and taxes shape how much it costs to do business (sometimes called the cost of capital)... which ultimately determines how much investors are willing to pay for earnings.

Inflation expectations are holding steady at 2% to 2.25% for the foreseeable future. And corporate tax rates are still favorable today. So this environment is perfectly suited for continued earnings growth.

And earnings growth is the key to bringing valuations back to average levels without any sort of stock market correction.

The long-term corporate average valuation in similar periods has been around 20 times. Take a look...

Said another way, valuations are higher than they should be. That doesn't mean they're about to plunge, though.

If corporate tax rates decline further or earnings growth accelerates, valuations could start coming down without stock prices taking a beating.

Buffett knows this... It's probably why he's holding so much cash.

Buffett knows this... It's probably why he's holding so much cash.

It's not that the "Oracle of Omaha" is waiting for a crash. He almost certainly expects valuations to come down to more reasonable levels, even as they stay elevated.

Then he can pounce on the next great opportunity. positioning Berkshire to act when opportunities arise – whether it's buying undervalued businesses or capitalizing on market dislocations.

By holding so much cash, Buffett will be ready to strike when others can't.

Regards,

Joel Litman

December 9, 2024

Each quarter, Berkshire Hathaway (BRK-B) gives us a glimpse into Warren Buffett's strategies...

Each quarter, Berkshire Hathaway (BRK-B) gives us a glimpse into Warren Buffett's strategies...