Back in September, he explained how he had been seeing full hotels despite the coronavirus pandemic. But instead of the usual international travelers, they were packed with Turkish nationals.

And this isn't just happening in Turkey. For example, last month, Bloomberg shared a story about a New Jersey hotel. The article detailed a couple who bought a distressed hotel in Wildwood, began renovating in 2018, and opened this April. They expected demand to suffer due to the pandemic.

But by September, their hotel was packed. The boom in demand came from the rise of "staycations" – as people weren't traveling long distances, they booked nearby vacations instead.

Big destination spots like Hawaii are suffering from lack of demand. However, regional travel has thrived this year. Restrictions on travel have made it difficult to plan big vacations in advance, so consumers are turning to local venues to relax.

And yet, despite the rise in local vacations, many investors are painting all hotel stocks as bad buys. They're missing the "two-speed market" in travel and other areas affected by the pandemic...

Cheaper regional vacation spots have seen a boom in demand. Meanwhile, larger international areas are still reeling from the hit.

One company benefitting from this two-speed travel market is Choice Hotels (CHH)...

One company benefitting from this two-speed travel market is Choice Hotels (CHH)...

Choice is one of the largest hotel chains in the world. The company boasts more than 7,100 properties across the globe, with nearly 600,000 rooms.

Choice mostly focuses on the lower end of the hotel market, which includes brands like Comfort, Sleep Inn, Mainstay Suites, Econo Lodge, and Rodeway Inn.

The company operates a franchising model. Individual operators run its hotels, and Choice takes a slice of the profits. This model allows for rapid expansion and reduced risk, as Choice isn't fronting the building costs.

Most of these franchises are located along the highway for travelers in the middle of their journey or in traditional vacation spots. And as families go on more road trips closer to home, Choice benefits from its highway locations. Air travel has been slow to recover, and international travel is still out of the question for most folks.

Additionally, since Choice's portfolio consists of lower-cost brands, the company is more recession-resistant. This is important during the pandemic, as cash-conscious families want to vacation without breaking the bank.

We've previously explained how a franchising strategy can lead to higher returns. As franchisees grow, franchisors tend to see increased profitability while royalties grow and costs remain small.

Investors might think a franchising hotel company that has increased its room count by 10% in recent years would see a strong and growing return on assets ("ROA").

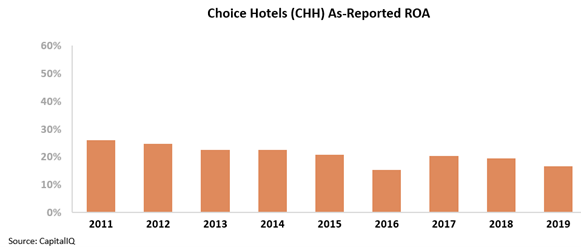

However, this doesn't appear to be the case with Choice. It looks like investors are buying into a declining company that's unable to execute on its franchising strategy. As you can see in the chart below, Choice's ROA has fallen from 26% in 2011 to 17% in 2019. Despite Choice's hotel growth, the company's returns are in a downward spiral.

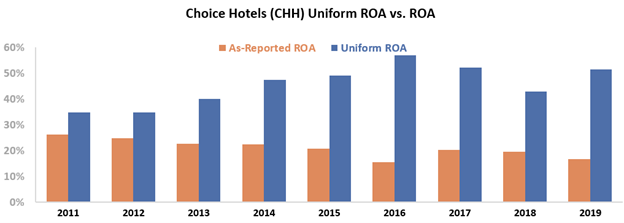

But this picture of Choice's performance isn't accurate... and it's due to distortions in as-reported accounting, including the treatment of interest and stock option expense. Wall Street doesn't see what's really going on with Choice's profitability.

Choice's Uniform returns have been more than double the as-reported numbers since 2014. Last year, the company's Uniform ROA was 51% compared with the 17% as-reported figure. Additionally, Choice's Uniform ROA has risen from 35% in 2011 to 51% in 2019. Over the same time frame, as-reported metrics show a steady decline of 26% to 17%.

Choice has effectively used the franchising strategy to generate growing returns. Investors who believe the company was declining even before the pandemic are looking at bad data.

Choice's returns were strong before the pandemic, and its franchising strategy has allowed profitability to climb at a rapid rate.

But without Uniform Accounting, investors would miss the real story here. They might see Choice as a company with declining returns instead of robust and growing profitability.

Additionally, they might not see that Choice is well-positioned to benefit from shifting travel trends during the pandemic. Its highway strategy and low costs make the company's brands ideal for families looking for a road trip.

Ultimately, Choice is one of the winners of the travel industry before and throughout the pandemic.

Regards,

Rob Spivey

November 11, 2020

As regular Altimetry Daily Authority readers might remember,

As regular Altimetry Daily Authority readers might remember,