For more than a century, Coca-Cola (KO) has been known for one thing...

For more than a century, Coca-Cola (KO) has been known for one thing...

And that's soda.

But now, the company is expanding beyond its iconic soft-drink lineup... It's looking to milk as its next big growth driver.

In 2012, Coca-Cola partnered with dairy farmers to develop Fairlife – a premium milk brand that promised higher protein and lower sugar than traditional dairy products.

This may seem like an odd pairing. Yet, over the years, Fairlife has gained significant traction... It's now a breakout success, surpassing $1 billion in sales.

Fairlife is tapping into the growing demand for healthier beverages – especially as GLP-1 weight-loss drugs (like Ozempic) push consumers toward low-sugar, protein-heavy diets.

Investors see this as a game changer... If Coca-Cola can pivot from falling soda sales and capture a new market, it could breathe new life into the company.

But one bright spot isn't enough to change the bigger picture. Today, we'll explain why Coca-Cola is struggling to shed its soda-dominant image... and why investors need to be cautious.

CEO James Quincey has pushed to make Coca-Cola a 'total beverage' company, yet the numbers tell a different story...

CEO James Quincey has pushed to make Coca-Cola a 'total beverage' company, yet the numbers tell a different story...

Coca-Cola still derives the majority of its profits from traditional sugary drinks... Out of about $47 billion in annual revenue, 60% comes from soda and other concentrates.

Now, Fairlife's sales did surge more than 20% in 2023, making it Coca-Cola's fastest-growing U.S. brand. But that's just a fraction of Coca-Cola's empire.

Another problem involves the GLP-1 drugs we mentioned earlier. Although they've fueled Fairlife's growth, they're also threatening Coca-Cola's core business...

Weight-conscious consumers are cutting out sugar, and that means fewer soda sales. In the past few quarters, most of Coca-Cola’s revenue growth has come from price increases rather than beverage-case volume.

Analysts estimate that GLP-1 drug adoption could reduce soft-drink consumption by up to 7% annually. That would be a major headwind for Coca-Cola's core products.

Yet the market isn't pricing in this risk...

Yet the market isn't pricing in this risk...

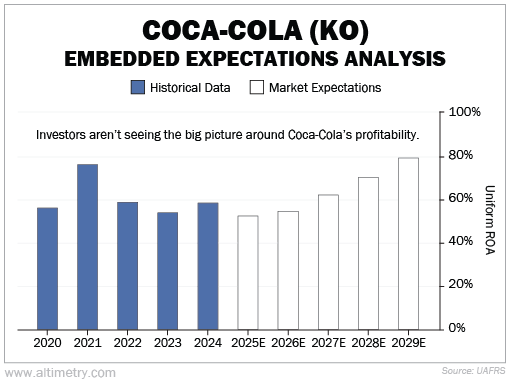

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Right now, investors expect Coca-Cola's Uniform return on assets ("ROA") to soar from 58% in 2024 to 79% by 2029. That would be an all-time high for the business. Take a look...

We think this projection is far too optimistic. GLP-1 weight-loss drugs are a real threat to the broader business, yet the market doesn't seem fazed.

This could be a big problem for investors down the road because, ultimately...

Fairlife's success won't be able to save Coca-Cola...

Fairlife's success won't be able to save Coca-Cola...

The company's investment in Fairlife was well-timed. It capitalized on the shift toward healthier beverages. And this helped Fairlife dominate all of Coca-Cola's other U.S. brands.

But a single product is unlikely to change Coca-Cola's fundamental profile... The numbers show it's still very much a soda company.

Yet investors are focused solely on Fairlife's impressive growth. What they should be thinking about is whether the company can hold up to changing consumer behavior.

Right now, the KO stock looks overvalued relative to future profitability, so the risks outweigh potential rewards. That's why Coca-Cola is a name we'd keep our distance from.

Regards,

Joel Litman

March 20, 2025

For more than a century, Coca-Cola (KO) has been known for one thing...

For more than a century, Coca-Cola (KO) has been known for one thing...