The holiday season is finally upon us...

The holiday season is finally upon us...

However, just like many aspects of life this year, it looks different than usual. Normally, we'd be talking about the strength of Black Friday sales. We'd see videos of consumers camped out in front of retail stores racing to win the best deals.

Additionally, today's Cyber Monday is different from past years. As Forbes recently highlighted, the whole holiday shopping schedule has been altered...

The first big difference is the calendar for shopping. The fourth quarter is the most important quarter for retailers, as the weeks between Thanksgiving and the end of the year make up a large portion of sales. This year, companies pulled the timeline forward.

To improve consumer spending, companies moved Black Friday deals to as early as mid-October.

Additionally, other major shopping events changed dates. E-commerce giant Amazon's (AMZN) Prime Day, one of the largest online shopping days of the year, moved from the summer to October.

The coronavirus pandemic has also forced most shopping online. This could create more shipping delays than usual – causing inconvenience for shoppers across the country.

Finally, spending should be down across the season. Some folks will be spending normal amounts... but for others, it's not financially feasible given the economic downturn.

The last change will be the gifts folks buy. People have had to change how they spend their time during the pandemic, and it has meant a lot more time at home. This may cause buyers to purchase more electronics or online subscriptions for friends and family.

All these changes are making this holiday shopping season a truly unique one.

While consumer spending may be different this year, the underlying importance of consumer spending can't be overstated...

While consumer spending may be different this year, the underlying importance of consumer spending can't be overstated...

Consumer spending makes up roughly 68% of U.S. gross domestic product ("GDP") – it's the backbone of the economy. These transactions have ripple effects on business profits, taxes, and more. A small reduction in consumer spending can greatly alter both GDP and many industries' revenues.

This means that it's critical to keep a pulse on consumer credit. The consumer credit profile can help us understand where the economy is heading.

A strong profile means consumers can return to normal spending faster once the pandemic ends. The less income spent repairing personal balance sheets, the more folks are buying into the economy. However, a weak profile would imply a delay in consumers returning to normal spending levels.

And during the pandemic, consumer credit has been a more frequent topic of conversation. Investors were scared that consumers would default on loans when unemployment rates skyrocketed.

However, as we discussed over the summer, consumer credit was strong and left little to worry about.

Today, it's time to look again...

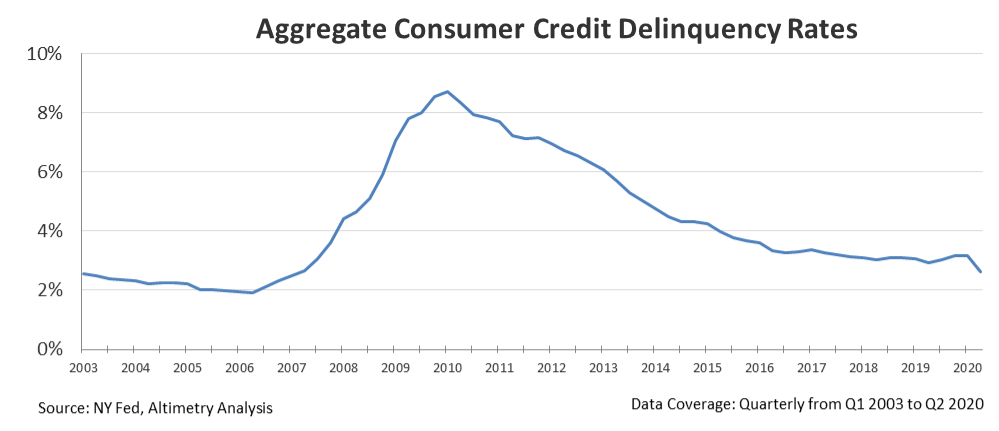

Overall consumer credit delinquency rates are down in 2020. This is the opposite of what most folks would have predicted when the pandemic began, and it's a positive sign for financial markets and the economy.

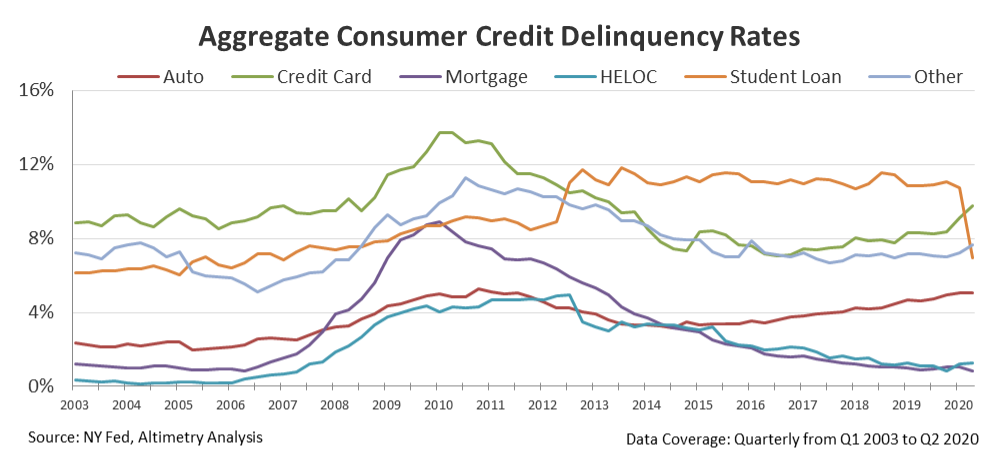

Looking into the data, we can see the fall in delinquency rates hasn't been the same across the board. Student loans, mortgages, and home equity loans and lines of credit ("HELOC") have been the main causes for the improvement.

Mortgage and HELOC defaults have stayed low thanks to low interest rates. Expectations are for interest rates to stay low in the near future, which means the risk of these defaults rising are similarly low.

Student loan defaults have fallen dramatically due to student loan forbearance. The interest rate on many student loans has dropped to 0% and some payments have been suspended. While these protections expire in 2021, they have helped keep delinquency rates low during this unique time.

This has given borrowers time to rebuild balance sheets and income statements, which may limit rises in delinquency rates once things return to normal.

Auto loan delinquencies aren't declining, but they've flattened out. The delinquency rate on auto loans consistently rose from 2014 to 2019... but they've slowed their rise this year.

Credit-card and other loan delinquencies have slightly increased this year. Although they've increased, it's important to note that they're still well below historical highs. Credit-card delinquency rates reached 14% in 2010 and are currently near 10%. This is a far better rate than past recessions.

The overall picture of consumer credit looks positive, with the data showing that aggregate delinquency rates have fallen. This means once society normalizes, consumers should have no problem resuming normal spending habits.

Compared to past recessions, the hangover may not be as bad and drawn-out when considering the strength of consumers' credit profiles. This also means GDP growth could accelerate faster.

For all these reasons, we can still remain bullish on the economy today.

Regards,

Joel Litman

November 30, 2020

The holiday season is finally upon us...

The holiday season is finally upon us...