One segment of health care is finding a way to buck the industry trend of collapsing demand...

One segment of health care is finding a way to buck the industry trend of collapsing demand...

In the June 3 Altimetry Daily Authority, we explained how Integra LifeSciences (IART) is a vital market player in the elective surgeries sector.

The pandemic has hit this area hard... Hospitals have been canceling these surgeries to keep rooms available for coronavirus treatment. To avoid potential infection, patients are pushing off procedures such as hip replacements. Furthermore, adrenaline junkies are avoiding or unable to perform higher-risk activities such as riding motorcycles or extreme sports.

However, one segment of the elective surgery market has seen a sizable uptick over the past few months: plastic surgery. As clinics have reopened, demand has skyrocketed for folks looking to touch up their looks.

You might have heard of the "Corona 15"... a phrase referring to the extra weight gained from being quarantined in the house for months. However, the desire to cut away a few extra pounds is only one of the catalysts for this abrupt rise in demand...

As U.S. Federal Reserve Chair Jerome Powell has explained, the current economic contraction is an enforced demand constriction. For many wealthier Americans who've spent less in 2020, they're flush with cash... and now they can undergo voluntary procedures to improve their looks. Many in the workforce have also had a reason to think more about their looks now than ever before...

With all the Zoom meetings, professionals are spending more time than ever looking at themselves. Furthermore, with most webcams angled up, many now want work done on their chins – the most visible feature on a digital call.

Finally, as everyone is working from home, patients have been able to recover in the privacy of their own homes, possibly without having to file leave. Common procedures in the plastic surgery practice will leave scabbing that lasts for up to 10 days. However, with limited visits outside and mask wearing, patients can hide these signs of recovery.

On the surface, it might appear this industry would suffer from the pandemic... But plastic surgery is riding a few strong tailwinds to a profitable second half of the year.

The "At-Home Revolution" continues to change consumer spending patterns... so it's important to revisit industries in 2020 to see how the trend continues to unfold.

After our July 28 Daily Authority on how specific sectors have seen pressure and bankruptcies, we received some reader feedback...

After our July 28 Daily Authority on how specific sectors have seen pressure and bankruptcies, we received some reader feedback...

Daily Authority reader Jack highlighted how consumer credit markets may not look as positive as corporate credit.

In his view, looking at metrics such as student debt, auto loan delinquency rates, and underfunded government pension plans all painted a more negative picture...

No debt crisis?? Student debt at $1.5 trillion with a 25% delinquency rate. Corporate debt off the charts from borrowing cheap money to buy back stock. Auto loans delinquent at a rate higher than student loans and most of those are sub-prime. State and corporate employee pension funds going bankrupt because of over-hyped investments returns. Social Security running out of money. The market for government debt is drying up because investors (a) want a return on their money, (b) they doubt the government's ability to pay the debt back and (c) expect hyper-inflation to render the bonds worthless over time.

But, glad to hear there's no debt crisis.

So in today's Daily Authority, let's dig a bit deeper into consumer credit in particular – one of Jack's big areas of concern.

When we cover corporate credit, we regularly talk about the importance of looking past just debt levels. It's necessary to look at the ability companies have to pay off the debt in relation to when this debt will come due. A business with little debt but even less cash can be at a greater risk than one with high debt levels and robust cash flows and cash on hand.

Corporations have taken on more credit over the past 40 years. This is because interest rates have trended steadily downward, from above 20% in the 1980s to less than 3% in recent years. As debt becomes cheaper to obtain, it only makes sense companies would turn more to debt to finance growth. And as we discussed in the June 22 Altimetry Daily Authority, with commercial charge-off rates so low, widespread company defaults haven't appeared... and healthy debt maturity schedules indicate that these are unlikely to crop up.

While understanding the risk of corporate credit default is a key part of macroeconomic analysis, focusing on consumer credit is also crucial. Consumer credit can affect the economy just as much as corporate credit – mass consumer bankruptcies will grind the economy to a halt.

This concern is only exacerbated with climbing unemployment. Right now, the unemployment rate is 11%, and has the potential to deteriorate further. With talks of unemployment benefits and eviction protections expiring, some economists fear mass personal bankruptcies could follow.

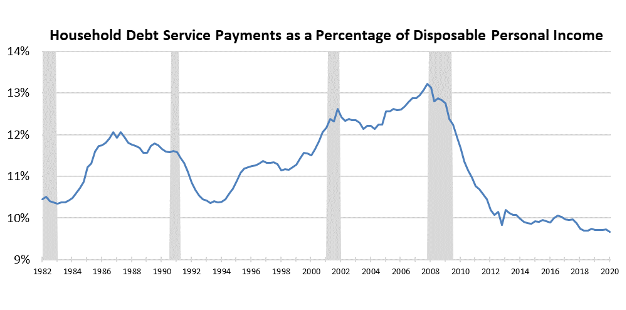

To keep a pulse on the consumer, we can look at two indicators to show the risk of mass defaults. The chart below shows household debt service payments as a percentage of disposable income. This ratio tells us how much each household must spend to pay off any outstanding debt.

As you can see below, the ratio reached short-term peaks prior to the past two recessions. In these instances, households took on too much debt, which had adverse consequences on the economy as a whole.

The current state of household debt service payments as a percentage of disposable income shows much different, positive signals. It's currently at its lowest levels since at least 1982. Take a look...

This shows U.S. consumers have flexibility to service their debt obligations. This also points to a safety valve of available credit going forward.

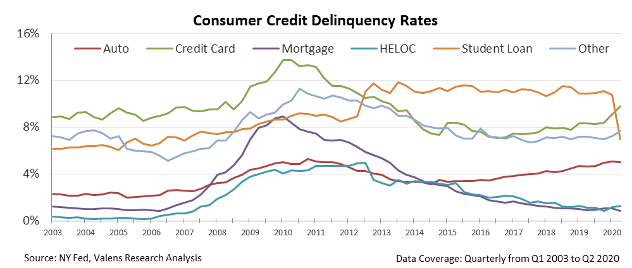

The second indicator we can look at is the different kinds of consumer credit delinquency rates. The data come directly from the New York Federal Reserve, and fill in the nuances of the current debt Americans are struggling with.

To address Jack's concern, student delinquency rates are elevated. However, student loan debt has also been at this elevated level for nearly a decade. There isn't a new warning signal to trigger the recession getting worse.

We can also see from the below chart that credit-card and auto loan delinquencies are rising. However, they are rising from relatively low levels. On top of that, auto and credit card debt only make up roughly 15% of outstanding household debt.

The final takeaway from the data relates to mortgage debt, which makes up roughly 68% of household debt. Mortgage debt has been steadily falling since the housing bubble burst more than a decade ago and is currently nearing all-time lows. This is a positive sign... and also important for all the other debt drivers.

With only two of the six major types of household debt rising, there's no glaring fear of a collapse in the consumer credit markets. Overall, delinquency rates were significantly higher in 2009 and 2010 during the last recession. Furthermore, in 2007, every type of consumer credit was rising... but what we see today is much less ominous.

Those two charts also show that consumer credit markets were largely healthy when the pandemic began. This helps give us confidence that the pandemic's adverse effects may not be as strong as many people fear.

It's hard to look past the "noise" of consistently negative news headlines. Record unemployment numbers and rising debt levels are sad to see, and rightfully scare investors. However, it's necessary to look past the noise and discover that consumers on aggregate have further headroom to service their debts. As such, the fundamentals show no impending consumer credit problems.

Regards,

Joel Litman

August 17, 2020

P.S. What are your thoughts? Do you think Jack has it right and we're off base... or that our macro data are guiding us (and Daily Authority readers) in the right direction through the current environment? Send an e-mail to at [email protected].

One segment of health care is finding a way to buck the industry trend of collapsing demand...

One segment of health care is finding a way to buck the industry trend of collapsing demand...