Could working in the office become a status symbol?

Could working in the office become a status symbol?

Here at Altimetry, we've said it time and time again... the coronavirus pandemic has kicked off an "At-Home Revolution."

Across the globe, the virus has changed our lives. And the biggest change is in how people work.

We recently came across a CNBC piece published earlier this year in the depths of the lockdown that discussed the ways the pandemic could change work forever.

One major idea is that as fewer people actually work at an office on a regular basis, the fact that a company even has a dedicated office in a large city where people are working full-time could become a status symbol.

It may mean that a business is more influential – or more secure – and may become a draw for potential hires. The act of not having a co-working location or floating desks may give employees more confidence in a business versus its peers.

It's certainly an interesting perspective, whether or not it's likely to be true.

Some of the other possible changes the article predicted were:

- Business travel will end as we know it as people increasingly embrace the idea of "telemeetings" using platforms like Zoom, Webex, GoToMeeting, and Google Hangouts

- Offices could become more conference room buildings than actual offices, as people only come in for face-to-face meetings

- Co-workers could become closer if they move back into a physical office, as they might increasingly walk around and visit each other in person on days when they're back in the building instead of taking seeing each other for granted

- Those 9-to-5 office hours could become a thing of the past as the lines between work and home become more fluid as more employees work remotely... People could work when it's more convenient for them, as opposed to during a rigid schedule

- Home office stipends could become a regular perk that people look for when searching for jobs

- More workplace equality for women, since there would be less of a need for women to leave the workforce to care for children as they can work from home with more fluid hours, and have assistance from their partners in childcare

- Further thinning out the layers of middle management as more direct management becomes seamless with more communication using chat platforms, and telemeeting collaboration means flatter structures

- More automation

It's a lot to consider, and we may not agree with all these potential outcomes...

The death of business travel in particular is something that we've heard before during economic slowdowns, and it hasn't happened yet. The reality is that in-person meetings build a different relationship to deliver a sale, a partnership, or collaboration.

While business travel is unlikely to go away, these are some interesting thoughts on the permanent changes that'll come from the At-Home Revolution.

As society adapts, certain businesses will be poised to take advantage of those changes... and that means delivering big gains for their shareholders in the months and years ahead.

In our Altimetry's Hidden Alpha newsletter, we've identified the companies that are likely to benefit the most from people spending more time working from home, playing at home, supplying their home, and protecting their home. You can find out how to gain access right here.

Banks were in a good place before this pandemic...

Banks were in a good place before this pandemic...

Heading into 2020, they were about as safe as they've been in modern history.

As we said in the June 8 Altimetry Daily Authority, banks were steadily loosening or holding their lending standards almost every quarter since the end of the Great Recession. This meant that they were comfortable with the amount of risk they were taking when issuing loans.

Not only that, banks were seeing good results with their lending practices. In the February 3 Daily Authority, we explained that banks were seeing limited defaults on their loans.

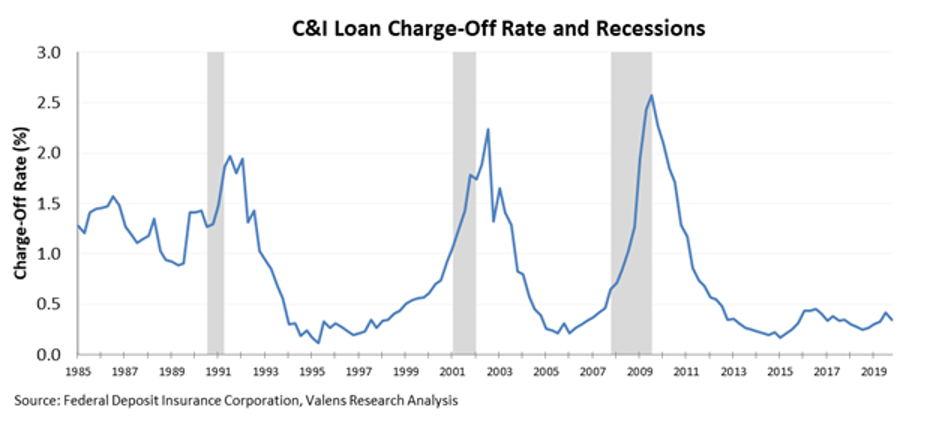

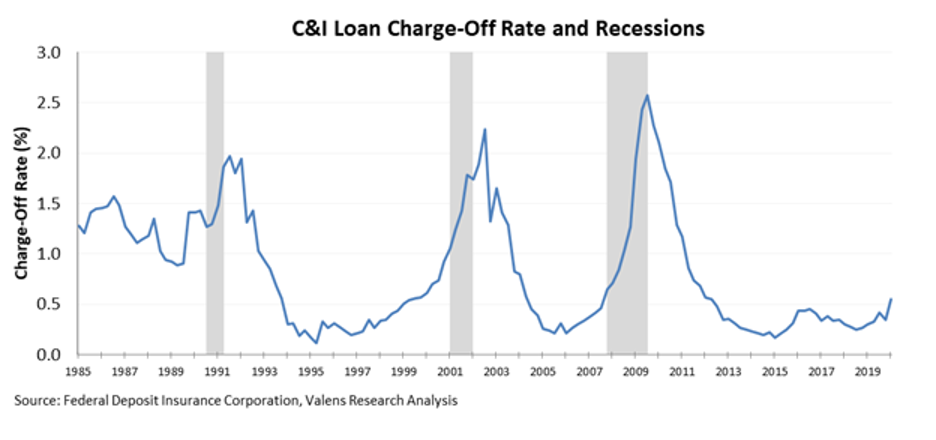

This includes Commercial and Industrial (C&I) loans, which are specifically issued to businesses. C&I loans are a good litmus test for corporate credit trends, and therefore can be analyzed like the corporate credit market.

Every quarter, the Federal Deposit Insurance Corporation ("FDIC") – the same organization that offers insurance on bank accounts – monitors C&I loan charge-offs. This is when a bank writes off a defaulted loan or a loan it expects it won't collect on.

Through the end of 2019, C&I charge-offs remained near historically low levels. The FDIC has C&I charge-off data as far back as 1985, spanning three recessions.

In each case, charge-off rates accelerated rapidly and reached 2% levels or higher – often ramping up ahead of a recession. Since 2012, C&I charge-offs have remained less than 0.5%, which is a great sign for banks and corporate credit health.

And then the coronavirus pandemic shut off many companies' cash flows completely...

Beginning in mid-March, when cities and states across the country began issuing shutdown orders, businesses were forced to shift to remote work if possible. For those that couldn't, they had to figure out how to manage costs while keeping the lights on.

For many businesses, paying rent, salaries, and loans wasn't realistic.

It's no surprise investors expected bank loan charge-offs to start rising, which could potentially cause a shockwave through the banking industry.

As of the first quarter of this year, C&I charge-off rates exceeded 0.5% for the first time in nearly eight years... but barely. At just 0.6%, charge-offs still remained fairly low during the quarter.

Based on the current environment, a spike in charge-offs is expected.

And yet, such a low rate shows how unique this recession is. Unlike each of the past three recessions, we're not in a credit-driven market.

That said, banks have already started reacting to the uptick. As we said on June 8, 41.5% of banks reported that they tightened their lending standards in the April 2020 survey.

As usual, banks are trying to avoid as many losses as they can by getting ahead of the curve.

Remember that the economy was only shut down for the last few weeks of the first quarter. The second quarter was shut down for much longer, so it shouldn't be surprising that second-quarter charge-offs will likely be higher than during the first quarter.

But that doesn't mean it's time to panic.

As we've said many times, the effect of the coronavirus pandemic is likely to be rapid and intense... yet short term. Most states are already starting to open back up as the second-quarter comes to a close, and many businesses are finding ways to offset or adapt to their current challenges.

Furthermore, as we discussed in the April 27 Daily Authority, most corporations were able to refinance prior to the start of the recession... which signals that many companies don't have large maturities coming due in the near future.

All things considered, even though the second quarter is likely to show worse results with C&I charge-offs potentially jumping much higher, they should start improving as soon as the end of this year.

Additionally, banks have been proactive about changing their lending standards to try to get ahead of the effect of the second-quarter charge-offs. Not only that, but the government's business assistance programs are helping many companies bridge their short-term gaps... This is something that hasn't happened during the past few recessions.

Considering how proactive banks and the government have been, rising charge-off rates aren't likely to sustain past the next few quarters... nor are they likely to signal worse-than-expected credit issues.

And that means that if any sell-off happens, it's not a reason to panic about heading into a deeper, credit-driven bear market.

Regards,

Joel Litman

June 22, 2020

Could working in the office become a status symbol?

Could working in the office become a status symbol?