The 'At-Home Revolution' also means entertaining yourself close to home...

The 'At-Home Revolution' also means entertaining yourself close to home...

One big question for many folks during these uncertain times is when they will be able to travel again (and do so safely). Many people are not certain if they're going to be able to go on their normal summer trips to other states or internationally.

For instance, on the East Coast, Maine is still technically closed to tourists, and people from the U.S. aren't allowed to cross into Canada. Scotland and Ireland aren't accepting visitors yet. For each of these, it's unclear when borders will open again.

One way people are getting outside and staying active is by hitting the links. And considering the demographic of your average golfer, many of the people who might otherwise be traveling to some of the places listed above are the exact demographic that's planning to spend a lot more time on the local golf course.

And that sets up an interesting opportunity for one company in particular that's likely to see discretionary spending come its way as more people play golf rather than traveling this summer. Last week, we published an article on Forbes talking about this company, which is benefiting from the same tailwinds as our other favorite At-Home Revolution stocks.

To learn more about the At-Home Revolution, click here.

The banks have finally spoken…

The banks have finally spoken…

So far through the pandemic, we've collected a lot of data on the markets, some of which offer conflicting viewpoints.

In the May 4 Altimetry Daily Authority, we called out that market valuations were pricing in long-term declines in profitability and stifled growth, which appeared overly bearish.

We also pointed out in the May 18 essay that we're not in the clear just yet.

The markets are going to be volatile over the next several months, with increased sensitivity to news and events.

But just because the data we look at says the market is likely to pull back doesn't mean the economy is in danger. To understand that, we need to look at the credit markets...

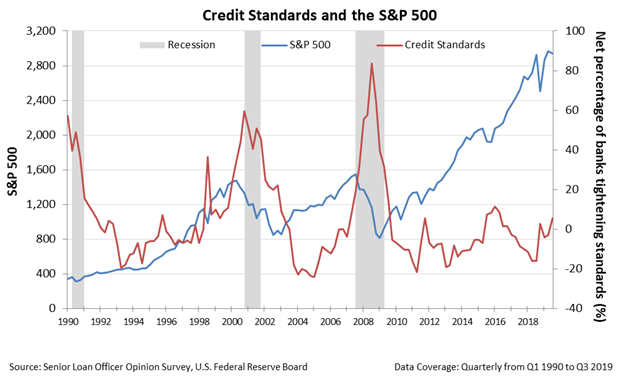

Back on January 13, we discussed the importance of monitoring lending standards to understand credit health and to help predict corporate growth.

At the time, we had data through the third quarter of 2019 which indicated banks were starting to (minimally) tighten their lending standards.

As a reminder, the red line is a "rate of change." Following the Great Recession, banks were generally relaxing their lending standards, which are a signal for a growing economy and a bullish equity market.

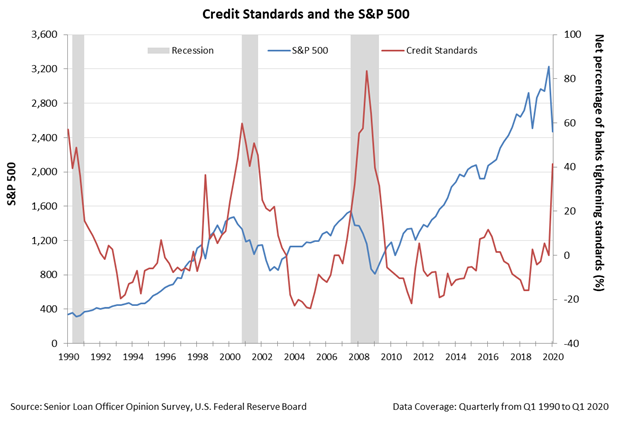

Recently, though, we saw the Senior Loan Officer Opinion Survey ("SLOOS") for the first quarter, which contained an important update for investors.

According to the April 2020 survey, 41.5% of banks reported tighter lending standards, an uptick we haven't seen since the Great Recession.

On the surface, that looks like a concerning figure. While it's already obvious that we're in a recession because of the shutdown, we should certainly be concerned about credit standards getting so tight that they freeze the market.

But before we react, we have to understand what it really means for companies and investors. And to do that, we need to remember the first rule of lending: Lenders like to give money to people who don't need it, and hesitate to give it to those who do.

As we highlighted in the April 27 Altimetry Daily Authority, U.S. corporations don't have material debt maturities in the near term. U.S. corporates don't need to borrow money. It's why even with credit standards tightening, U.S. corporate debt issuances have been at their highest levels in history.

So far this year, we've seen $1 trillion in corporate investment-grade debt get issued. High-yield debt issuances in April and May were also at all-time highs. Access to credit is plentiful in the credit markets, even with tighter lending standards.

And companies have borrowed so much to navigate the coronavirus shutdown that tightening standards have become immaterial. In other words, although credit standards are quickly tightening, U.S. corporations don't immediately need to refinance.

The Federal Reserve has supported this and has aggressively provided easy credit and liquidity to the markets.

Second, as we mentioned earlier, the red line is a rate of change, not an absolute level. Over the last decade or so, banks had largely been easing their standards, meaning most borrowers likely began this pullback with substantial credit availability.

That being said, should lending standards continue tightening after the pandemic recedes, it could stifle growth coming out of the pandemic. That would slow economic growth... and considering how much money companies have borrowed to navigate the crisis, it could create problems down the road. But you shouldn't invest today based on what could happen in three or more years.

With that in mind, we'll keep a close eye on lending standards in the coming months. If standards continue to tighten, the economic recovery may take longer... And that may spell issues further down the line.

Regards,

Joel Litman

June 8, 2020

The 'At-Home Revolution' also means entertaining yourself close to home...

The 'At-Home Revolution' also means entertaining yourself close to home...