This certainly isn't the first pandemic to strike the world...

This certainly isn't the first pandemic to strike the world...

Throughout history, massive disease outbreaks have dramatically changed how people lived afterwards.

Here at Altimetry Daily Authority, we've spoken several times over the past week about how the coronavirus has changed how we're likely to live going forward – in particular, how the shift to working from home ("WFH") will become more widespread.

But I came across an interesting article from The Economist late last week that put these changes in perspective. It discussed how the most recent pandemic might change cities much less than prior epidemics have in the past.

The article highlighted how prior epidemics – like the Black Plague, as well as cholera and tuberculosis outbreaks – have all dramatically affected how cities were designed and how officials dealt with disease.

Over the years, many people have talked about the beauty and grandeur of Paris' redesign in the mid-19th century during the reign of Emperor Napoleon III, and how it opened the city up. But that massive renovation was as much to solve issues with cholera outbreaks as it was to show off the power of the Second French Empire.

Similarly, part of the reason that New York prioritized the building of the subway system was to help push people out of Manhattan and into the outer boroughs, where they wouldn't be living so packed in. The goal was to help improve conditions in Manhattan's tenements that were causing rampant issues with tuberculosis.

In terms of how cities are designed, coronavirus isn't likely to change things as much. But as the saying goes, "those who don't learn from history are likely to repeat it"... and it's foolish to assume that the coronavirus pandemic isn't going to change how we live our lives long after the disease has receded.

And we've identified the companies that are poised to profit.

In this month's issue of our Altimetry's Hidden Alpha newsletter, we'll share all the details. It's publishing this evening after market close... and you won't want to miss it.

Learn more about a Hidden Alpha subscription – and ensure you have access to our list of stocks to play the "at-home revolution" – right here.

Another year of data is finally in the books...

Another year of data is finally in the books...

As we find ourselves in the midst of first-quarter earnings season, one of the most important projects we've largely completed is updating the Uniform Accounting macro data we collect for the prior fiscal year.

Companies have had enough time to publish their fourth-quarter 2019 results, including the industries that file late to fully capture the holiday sales season. And our analysts have had time to review the financials and correct them using our Uniform Accounting framework to remove distortions.

With 2019 data in the books, we can revisit our analysis from mid-September when we looked at trends in aggregate U.S. corporate profitability.

It was a record year for U.S. companies in 2018, with Uniform return on assets ("ROA") expanding to an all-time high. Not only that, but average U.S. corporate profitability officially reached an ROA of 12% – twice the long-term average of 6%.

It was a good time to be a U.S. company (or an investor in one).

Not only did they generate record returns, but companies also managed to grow at a significant clip. These are compounding trends... More dollars generated by your assets on a larger asset base means that returns accelerate.

That's why the following year – 2019 – was such a great year for investors, even with concerns continuing to pop up about trade disputes and national politics.

The market was riding on fundamental momentum, and 2019 was promising to be an equally strong year.

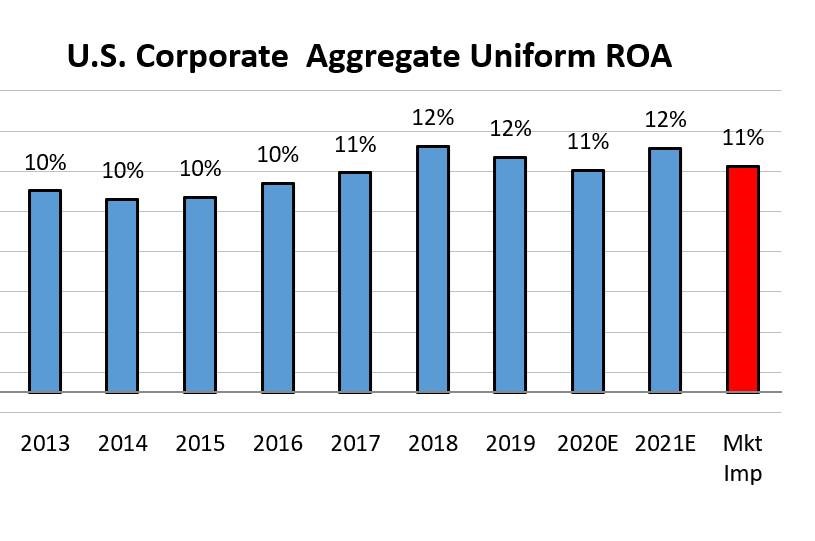

Despite all the talk that the market was getting expensive, our essay in September showed that fundamental expectations didn't seem overly bullish. Investors expected long-term ROA around 11%, which seemed easily attainable. They also expected subdued growth.

If companies could beat those expectations, there was significant fundamental upside potential.

Today, it's a vastly different market – and we've added a new year of data – let's see what's changed...

First, U.S. corporates saw nearly as high returns in 2019 as they did in 2018.

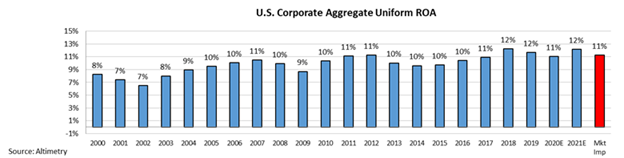

The chart below highlights U.S. Corporate Aggregate Uniform ROA since 2000, including what the market is pricing in at current valuations. As you can see, ROA was nearly in line with 2018 levels – still around historic highs.

Unsurprisingly, estimates from 2020 have already started coming down. Even still, we're expected to see ROA remain around 11% in 2020, before returning to 12% as soon as 2021.

This will all be dependent on how quickly we're able to recover from the current economic slowdown.

More important – while there's no doubt we're poised for a down year – at current valuations, the markets expect 2020 to be the new normal for corporate profitability. They're pricing in the expectation that U.S. corporate profitability won't ever recover from this slowdown.

Furthermore, and possibly more telling for how bearish market expectations are right now, investors appear pessimistic about growth not just for 2020... but for the next five-plus years.

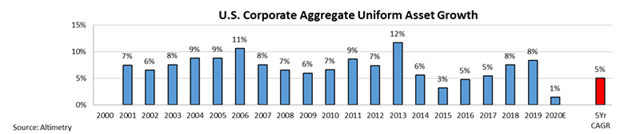

Looking back at 2018 and 2019 again, the average U.S. corporation didn't just have historically high profitability... it also grew robustly. It grew by about 8% in 2018... and did it again in 2019.

As we mentioned above, high returns and high reinvestment means high earnings growth – which contributed to the strong rally in 2019.

U.S. corporate growth was still accelerating through 2019, but 2020 looks like it will be an outlier. Current expectations are for growth to slow down to 1% in 2020 – a 20-year low.

Clearly these are exceptional times, but the market seems to be pricing it like a new normal. Not only do investors expect corporate profitability to permanently decline, but they expect just 5% growth annually over the next five years.

For context, since 2000, U.S. corporates have grown by more than 5% in all but just three years. Even through the worst of the Great Recession, corporations were growing by an average of 6% to 7%.

To justify current valuations, investors seem to be expecting current economic slowdowns to persist indefinitely.

Given all the other bullish macro signals we continue to highlight, this helps explain why we still think this market is undervalued, even with the disruptions from coronavirus.

Regards,

Rob Spivey

May 4, 2020

This certainly isn't the first pandemic to strike the world...

This certainly isn't the first pandemic to strike the world...