The stock market welcomed August with both ups and downs...

The stock market welcomed August with both ups and downs...

To start the month, U.S. jobs data for July showed the unemployment rate climbing to 4.3%. That's near a three-year high... and above estimates that called for unemployment to remain at 4.1%.

This trigged the Sahm Rule – a reliable recession indicator – and investors panicked. As we covered, the U.S. market lost more than $1 trillion in a three-day sell-off.

The slaughter ended with another jobs-related data announcement on August 8. Initial jobless claims for the week ending August 3 came in at 234,000 – 2.9% below expectations and 6.4% lower than the previous week's number.

Said another way, fewer people filed for unemployment benefits than expected.

The S&P 500 recovered about 3% following the report, partially offsetting the market's bloodbath in the beginning of the month.

This has left investors confused... Some labor reports seem bad, and some seem good.

Employment data has been the key driver of financial markets lately – more so than inflation statistics.

That's because it's now a more critical indicator of economic health than it has been in recent history...

The answer to 'why now' lies in the consumer...

The answer to 'why now' lies in the consumer...

Regular readers know that consumers are a major force in the U.S. economy, accounting for nearly two-thirds of GDP.

Consumer behavior and spending can either support economic growth... or tip us into a recession.

That's why investors obsess over data that highlights the financial well-being of consumers.

Consumer spending relies on two things: savings and income.

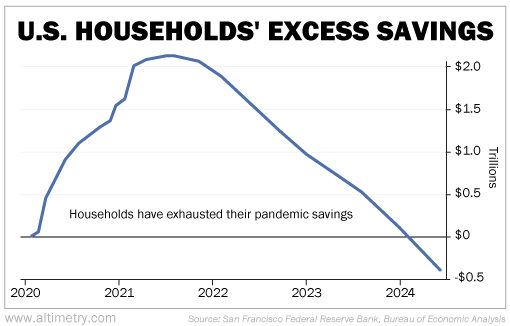

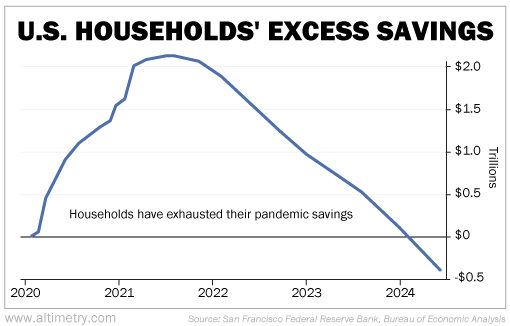

According to the Federal Reserve Bank of San Francisco, aggregate "excess savings" (meaning the extra savings people built up during the pandemic) peaked at $2.1 trillion in August 2021.

However, since then, households have been spending more than they're saving... driving their excess savings down.

By the end of 2023, nearly all pandemic-era savings had been exhausted. Yet that didn't stop people from spending...

Fast-forward to June 2024. American consumers had $372 billion less in savings than they did at the beginning of the pandemic.

Take a look...

Remember, "excess savings" includes all savings that exceed the pre-pandemic trend.

So not only have we exhausted everything saved since 2020... household savings are now in a worse position than they were prior to the pandemic.

The once-strong consumer is fresh out of 'rainy day' money...

The once-strong consumer is fresh out of 'rainy day' money...

Over the past few years, consumers have continued spending despite high inflation and high interest rates.

They had enough savings... and almost everyone who wanted a job had one.

Now, household savings have dried up.

That means income is even more important in determining consumer spending. And income is directly tied to the health of the job market.

It's no wonder why folks are so fixated on newly announced jobs data.

As we said earlier, the labor market has been sending mixed signals. Unemployment is on the rise, though jobless claims haven't yet reached alarming levels.

Keep in mind, though, that on top of depleted savings... households also have a record $17.8 trillion in debt as of the second quarter.

Consumers are struggling to pay big expenses like credit cards and auto loans.

And with their safety cushion of savings gone and huge amounts of debt piling up, they may have to change their spending habits – and fast.

The Federal Reserve has been trying to reduce consumer spending to lower inflation...

The Federal Reserve has been trying to reduce consumer spending to lower inflation...

To a degree, that's what needs to be done.

However, if consumer spending shrinks more than necessary in the process, this might push the economy into a recession.

Right now, consumers only have their income to pay debt and fund their spending.

Any developments in the job market will be more decisive for the macro-outlook. Layoffs and fewer available jobs, for instance, would be devastating news for the economy.

So keep a close eye on jobs data, particularly on weekly jobless claims.

If they start to surpass expectations, it could signal a consumer-led recession is right around the corner.

Regards,

Joel Litman

August 19, 2024

P.S. The market just had both its best and worst days of the year... only two days apart. The economy is a mixed bag of results. Investors and consumers need every advantage they can get in these tumultuous times.

That's why Joel is stepping forward with a way to protect your wealth... and also lock in massive gains.

He's revealing a special type of investing that's creating a new class of millionaire and billionaire "aristocrats" – from former hippies and Cold War code breakers to the owner of the Boston Red Sox. Click here to read all about his shocking discovery.

The stock market welcomed August with both ups and downs...

The stock market welcomed August with both ups and downs...