Which companies do you want us to cover in Altimetry Daily Authority?

Which companies do you want us to cover in Altimetry Daily Authority?

A few weeks ago, reader Ken responded to our article on conglomerate General Electric (GE) and asked if we'd look at a specific company. We hope it didn't take too long... That business is the one we're covering in today's piece.

Let us know if there's a specific company you'd like us to write about here in Daily Authority. We can't promise we'll get to all of them, but we'll add some of the favorites to our queue of daily reports.

Keep coming back and maybe you'll see us touch on your requested company in a coming issue!

One of the newest movements is socially responsible investing ('SRI')...

One of the newest movements is socially responsible investing ('SRI')...

Put simply, this is a reaction against the shareholder value theory. Pioneered by economist Milton Friedman in 1970, shareholder value theory states that a company's sole responsibility is to their shareholders.

Socially responsible investors propose the idea that a business should also be responsible to all the people the company interacts with, including debt holders, employees, and members of the community.

These investors seek to avoid putting money into companies they see as ethically dubious or environmentally harmful. The market has dubbed these securities "sin stocks."

And that inevitably leads to the question of what the returns are for this kind of investment strategy...

To measure this, we can use the oldest operating SRI fund – the Pax Balanced Fund – as a proxy. For sin stocks, we can use the Vitium Global Fund, also known as the Vice Fund or the Barrier Fund. This one specifically invests in sin stocks.

Comparing the average 10-year returns for both funds, the sin stocks beat out the socially responsible investors – with a 6.83% return for Vitium and a 4.27% return for Pax. However, both funds have performed worse than their respective market benchmarks.

If you're an investor who wishes to avoid morally dubious investments, then it would pay to do your research on which funds to invest in. However, if you're only looking to maximize your returns, you would be better off further diversifying your portfolio than just sticking to saints or sinners.

So as the SRI debate continues, one of the largest sin stocks has been put under the national spotlight this year: tobacco firm Altria (MO).

The company began as Philip Morris in 1847, selling hand-rolled cigarettes out of a single shop in London. However, since its incorporation in 1902, it took off... growing massively in the first half of the 20th century.

Philip Morris even sponsored the hit TV show I Love Lucy, which is why Lucille Ball pitched the company's cigarette so often. However, as the health risks of smoking were discovered in the 1970s, Philip Morris worked to diversify its holdings. As part of its rebranding in 2003, the company changed its name to Altria.

Altria maintains holdings in the Château Ste. Michelle wineries, beer producer Anheuser-Busch InBev (BUD), cannabis grower Cronos (CRON), and e-cigarette maker JUUL Labs. This portfolio would send any socially responsible investor running for the hills. But even adherents of Friedman might have cause for concern...

Over the past two years, the U.S. Centers for Disease Control and Prevention ("CDC") has linked 33 deaths to complications from e-cigarettes. As legislative pressure builds on JUUL to discontinue its flavored products, Altria's stock has fallen from highs of more than $70 per share in early 2018 to current levels near $50...

Using as-reported metrics, investors might be concerned that the company wasn't even operating according to Friedman's shareholder value theory. It would be easy to write off Altria as a business with too much risk for too little return.

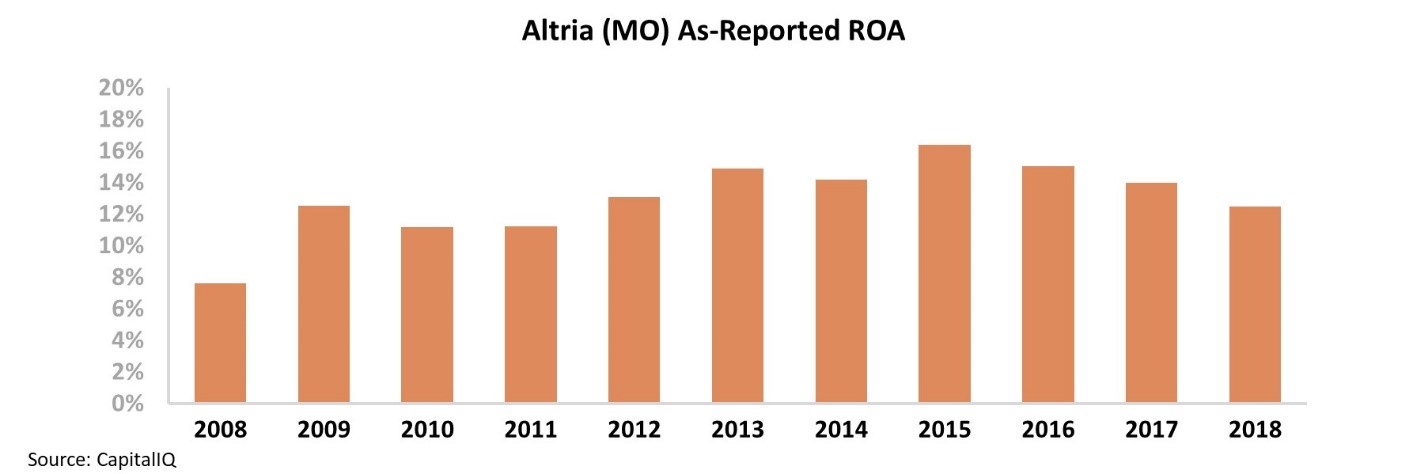

For investors to keep their money in Altria, they would want to see improving returns to compensate them for increased regulatory pressures. Instead, Altria's as-reported return on assets ("ROA") has fallen from 16% in 2015 to 12% last year...

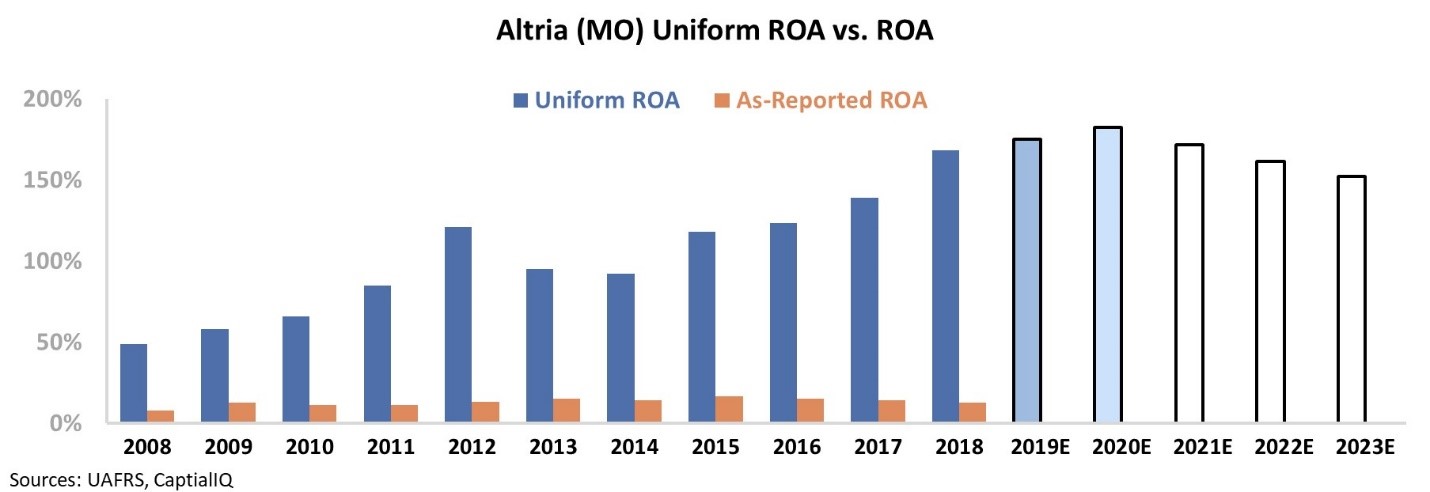

However, our Uniform Accounting removes the noise inherent in GAAP and IFRS reporting. While as-reported metrics have decreased, by removing accounting distortions around goodwill due to Altria's numerous acquisitions, we are able to see a much different picture...

The chart below explains the company's Uniform historical corporate performance levels in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars). Take a look...

Under Uniform Accounting, Altria has seen its ROA improve massively from 49% in 2008 to more than 168% in 2018. The company's organic and acquisitive growth investments and pricing power mean this sin stock has been steadily increasing its return to shareholders.

Furthermore, as the white bars show, the market expects that returns for Altria will collapse over the next few years. While the profitability of JUUL has been significantly impacted, the market appears to already be pricing in this risk.

If the company can keep on creating more value, the market will have to realize it... sin stock or not.

Regards,

Rob Spivey

December 3, 2019

Which companies do you want us to cover in Altimetry Daily Authority?

Which companies do you want us to cover in Altimetry Daily Authority?