Here at Altimetry, each week, we host an all-hands internal call...

Here at Altimetry, each week, we host an all-hands internal call...

More than 100 people across the globe work behind the scenes to power our analysis, in-house databases, client-facing software, and reports that go out to the world of investors every day.

With so many teams and so many different projects and initiatives, it can be difficult to keep up with all the activity.

So every week, we make sure all of our employees join in for one call. It gives each team the opportunity to highlight how they've been contributing to the operation as a whole.

Our goal is to foster collaboration and innovation. These conversations also serve to set the big picture, so that everyone can hear about the direction and initiatives that we're taking.

At the end of each call, I deliver a coaching comment – some words of advice that ideally will help everyone to get the most out of their day (and hopefully folks can apply it to everyday life beyond just increasing productivity). Altimetry Director of Research Rob Spivey also occasionally steps in to provide coaching comments of his own.

We thought you might enjoy hearing each week's coaching comment, as they apply much more to everyday life than simply how to increase productivity. So, we thought Friday might be the right day to start your weekend, and maybe our readers might appreciate hearing what we're sharing with our people inside the firm.

This recent week's coaching comment had to do with the saying, "Money is the root of all evil."

I frequently hear this phrase bandied about. And working in a firm that lives and breathes analyzing and reporting on monetary vehicles all day, I felt it might benefit some of our staff to address the real phrase – properly quoted and attributed.

As written above, "money is the root of all evil" is terribly misquoted, and the real meaning is lost. As cited in the Bible, its full translation is, "For the love of money is the root of all evil."

Some translations of this sentence directly from the Aramaic and Greek texts even state that it's "avarice" or "covetousness" that are the roots of evil.

In other words, money itself isn't the problem. Society can't function without a means of storing and exchanging value. When working well, money is a stable, divisible, and easily verifiable medium of exchange. It's not just brilliant... It's an absolute necessity to a well-functioning society.

Money has enabled specialization, lower transaction costs, and a seamless method of paying for goods and services. Money has made it easier to trade the benefits of labor for a diverse set of services and goods.

Falling in love with the medium of exchange or becoming overly focused on it is the real problem. The evil comes from people lusting for money and doing anything to attain it. Those that focus solely on accumulating wealth and are never satisfied with their current level can make decisions that hurt others in their pursuit of money.

We ought to be happy analyzing and reporting on money and all the vehicles for it, as that information about exchanges of these vehicles benefits society as well.

Now, as far as cryptocurrency goes... I'm not yet sure how the saints would weigh in on that one.

The misrepresentation of money as the root of all evil has led to some negative societal views towards the credit-card business...

The misrepresentation of money as the root of all evil has led to some negative societal views towards the credit-card business...

At face value – particularly during economic downturns – it's viewed as an avenue for people to load up on debt they can't afford so they can pay for the newest fashion brands or goods.

In reality, credit-card companies provide the piping throughout the economy and help make the markets robust. Credit cards encourage spending and thus increase activity across all stages of the economy.

These sentiments, along with increased competition in the space, have led to the view that companies involved in the industry could even be considered "vice" businesses. One company in particular that fits the bill is Global Payments (GPN).

It provides payment-processing services to merchants, which allows them to accept credit and debit cards for payment. In return, Global Payments receives a small fraction of each transaction.

In recent years, Global Payments has focused on expanding from just providing the typical merchant relationship to embedding itself deeper in its customers' operations. This includes other value-added services such as inventory management, data analytics, and other customer interaction tools.

While some people might see those offerings as essential to the economy's existence, others might think that Global Payments looks more like a utility company. It offers essential things, but not necessarily significantly differentiated.

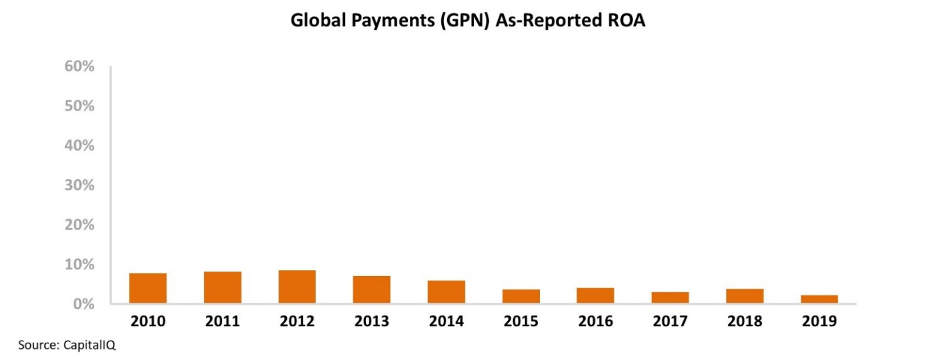

And looking at the as-reported metrics, Global Payments' low profitability seems more like a utility company as well. The company's returns have been under pressure in recent years... Its as-reported return on assets ("ROA") has fallen from 9% in 2012 to 2% last year.

Global Payments' 2019 merger with another big player in the industry, Total System Services, has only appeared to put more pressure on returns. Furthermore, Global Payments appears to be suffering from increased competition, with innovators such as Square (SQ) and competitors like Fiserv (FISV) taking market share.

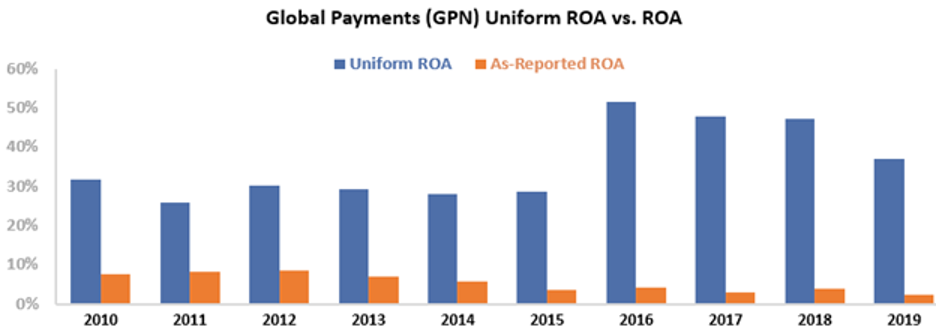

However, this picture of Global Payments' performance isn't accurate... and it's due to distortions in as-reported accounting, including the GAAP treatment of goodwill. The market doesn't see the strength of the company's returns and the shifting strategy to become more entrenched in merchants' operations.

In reality, Global Payments' ROAs have been between 26% and 52% from 2010 and 2019. While the company's as-reported profitability has dropped below cost-of-capital levels, the Uniform returns show a much more robust operation.

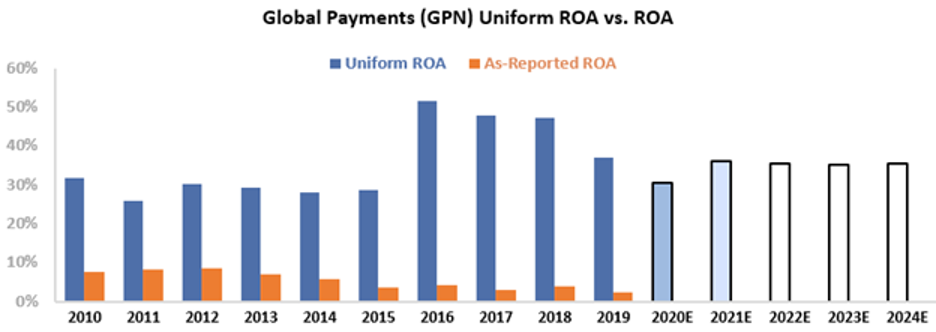

However, to determine if Global Payments can continue to create value for shareholders, we need to turn to the Embedded Expectations Framework to easily understand market valuations...

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Both analysts and the market expect Global Payments' returns to remain in the mid-30s. The market is pricing in the company's ROA to stop the recent downward trajectory as Global Payments restructures its business and integrates Total System Services.

The market appears to perceive the coronavirus pandemic's effect in accelerating the move away from cash and toward increased digital transactions – providing a possible tailwind for Global Payments.

If the company can benefit from more consumers utilizing credit and debit cards, market expectations for returns to remain flat may actually be overly bearish.

Without Uniform Accounting, investors wouldn't see Global Payments' robust profitability. They might see a company with near-zero returns as it gets squeezed out of a competitive market... but that's not the case.

In addition, flat market expectations may be underestimating potential tailwinds from the shift to card payments even after the pandemic recedes. If Global Payments can execute on its transformation and capitalize on secular tailwinds, the company's stock has significant upside ahead.

Regards,

Joel Litman

October 9, 2020

Here at Altimetry, each week, we host an all-hands internal call...

Here at Altimetry, each week, we host an all-hands internal call...