The debate is growing as to whether a successful vaccine might have unintended economic consequences...

The debate is growing as to whether a successful vaccine might have unintended economic consequences...

For investors, economists, and average folks who the coronavirus has affected, many are pinning their hope on the introduction of one or several vaccines as the light at the end of a dark tunnel. From a health perspective, it will be a welcome relief for a world waiting for a way to deal with the virus.

However, it may come as a shock to the economy due to the nature of how governments and central banks have leveraged fiscal and monetary policy.

If reduced health risk from the coronavirus vaccine leads to consumers rushing to stores, spending will temporarily spike.

As we discussed in yesterday's Daily Authority, in its July press conference, the Federal Reserve specifically highlighted its focus on full employment and a tight labor market. The Fed's priority right now is not inflation.

However, some have raised the concern that if inflation did start to pick up and become more of a focus, the Fed would be forced to raise rates. That's a "safety valve" to prevent an economy from overheating, which might be necessary after a pent-up population all starts spending at once.

Raising rates will shock bond prices, too. As the historic cutting of rates is reversed, bond appreciation will turn to bond depreciation, as investors will be able to buy new, higher-yielding bonds.

Earlier this month, investment bank Goldman Sachs (GS) warned of this danger. Goldman explained that the introduction of a vaccine could act as a market catalyst to price in rising rates. Rising rates means falling bond prices, and so bond valuations would be in danger of a significant correction.

However, bonds are still an essential part of many portfolios. They allow for shorter-term investing that equity markets can't. When shopping for bonds, investors will need to find ones that are currently attractive buying opportunities.

This is why we asked readers earlier this month if they'd be interested in us writing more about credit ideas going forward. We got a wave of feedback in return and the overwhelming majority of you told us to write more about credit.

Based on that wave of feedback, starting tomorrow, we will be highlighting interesting bond and credit insights, just as we have been highlighting stocks. Knowing which bonds are misrated, which ones are interesting, and which ones to avoid will be a vital skill for any investor as the economy continues to shift through 2020.

Sometimes, knowing how to define a company is just as vital as valuing it...

Sometimes, knowing how to define a company is just as vital as valuing it...

Like many in the investment world, we here at Altimetry use the MSCI global industry classification standard ("GICS"), which is a framework that helps define what industry a company resides in.

Other frameworks exist, but they have questionable groupings, such as grouping biotech and chemicals together.

We think the GICS does the best job of bucketing companies. It has 11 sections, 24 industry groups, 69 industries, and 158 sub-industries. Bucketing companies is vital for investing, because it would be impossible to compare a company against its peers without knowing who those peers are.

That being said, no framework is perfect, especially with rapid technological change occurring. Broad industries like semiconductors include a huge range of companies. Solar firms and memory chip companies get put in the same bucket, despite having entirely different business models and end markets.

Other industries have less dramatic (but still important) differences, like the payment-processing industry. When talking about payments, the two companies that always come to mind are Visa (V) and Mastercard (MA).

Yet an entire ecosystem below them enables the industry to run. This includes companies that handle mobile banking systems, point-of-sale equipment manufacturers, card processing, and e-commerce companies.

Each of these groups has different fundamental trends that affect its businesses. Looking at where each company fits in the broader picture can help shape investing decisions.

Fiserv (FISV) is a great example of this. The company provides financial services technology solutions worldwide. Fiserv's legacy business involves cash transfer including electronic bill payment, account-to-account transfers, and Automated Clearing House ("ACH") transfers.

In essence, Fiserv is a provider of much of the "piping" of the financial market. Historically, its services were mainly geared toward financial institutions, not consumers. But last year, Fiserv acquired First Data and its consumer-facing payment-processing business.

First Data provides merchants with point-of-sale hardware, enabling them to accept electronic and digital payments. With the transaction, Fiserv now has direct interest in seeing consumers use less cash.

Cash has seen a rapid decline in usage, and Fiserv's acquisition will allow the firm to benefit from this. Consumers used cash in 46% of purchases under $20 in 2015, versus just 37% of those purchases in 2019.

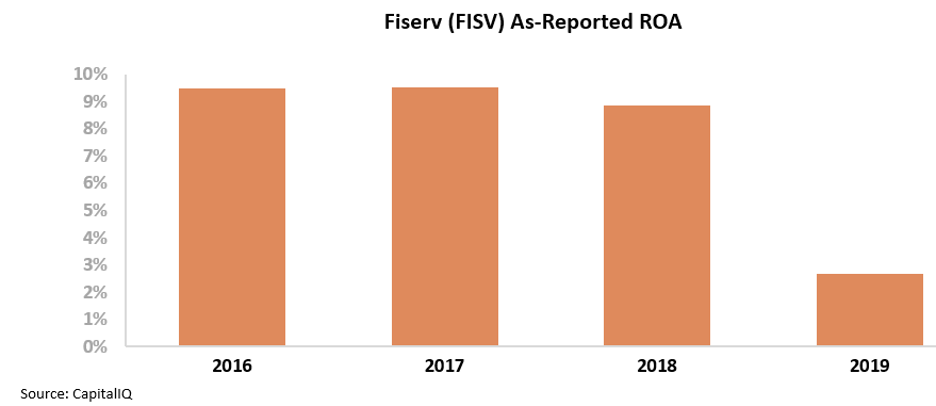

While getting exposure to this market sounds logical, looking at the as-reported numbers, it appears this acquisition wasn't as beneficial as Fiserv anticipated.

The firm's as-reported return on assets ("ROA") dropped from its already-low 9% all the way to 3% after the acquisition. Investors seeing this would reasonably assume Fiserv's move away from its legacy business as a negative to the firm's performance.

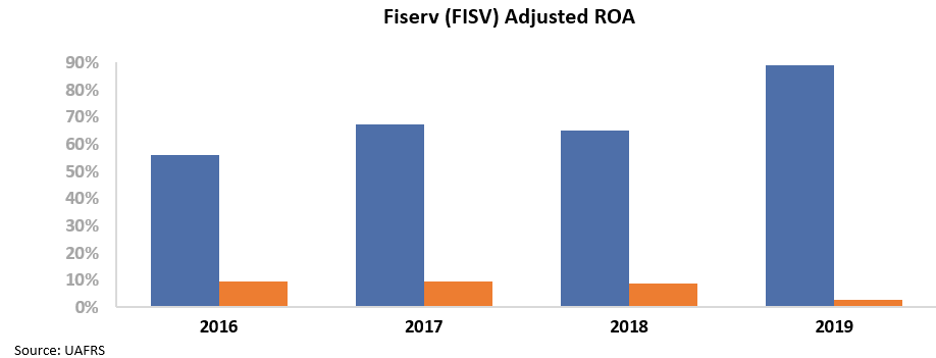

However, this picture of Fiserv's performance is inaccurate due to distortions in as-reported accounting. Due to the GAAP treatment of goodwill, among other distortions, the market has missed the mark on the success of the combined firm.

Fiserv's acquisition of First Data has allowed it to become an end-to-end player in the payments space.

The Uniform ROA following the acquisition for FISV was in fact more than 30 times higher than the as-reported numbers. In addition, while as-reported ROAs have steadily dropped, Uniform ROAs continue to expand...

The First Data merger hasn't destroyed value. In fact, it caused Fiserv's profitability to skyrocket.

Understanding how the company has done isn't enough to decide whether the stock is still compelling, though.

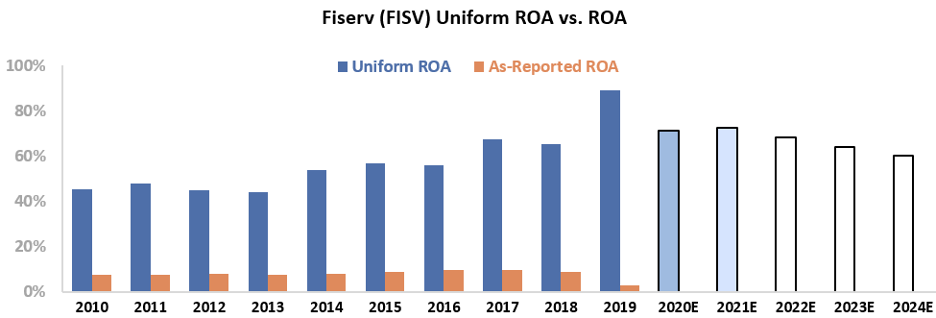

To determine whether it can continue to create value for shareholders, we can use the Embedded Expectations Framework to easily understand market valuations.

The chart below compares the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, both analysts and the market expect returns to fall well below current levels. Expectations are for ROAs to contract to 60% by 2024, levels not seen since 2016.

Despite Fiserv's expansion into the consumer-payment space and the tailwinds for growth, the market is seeing the short-term disruptions in consumer point-of-sale demand from the pandemic, and is pricing it in perpetuity going forward...

Ultimately, Uniform Accounting shows the true strength of Fiserv's business and the market's bearish outlook for the company.

Fiserv now has an end-to-end presence in the payment processing space. It is set to take advantage of the continued migration toward a cashless society. Additionally, the First Data acquisition gives it tailwinds from the electronic-payments space.

Without Uniform Accounting, investors would miss a high-return company providing essential services across the payments space. Fiserv looks set up to take advantage of growth in the consumer-facing payments space and continue to improve returns going forward. As the market slowly catches on, the stock is primed to move higher.

Regards,

Joel Litman

August 25, 2020

The debate is growing as to whether a successful vaccine might have unintended economic consequences...

The debate is growing as to whether a successful vaccine might have unintended economic consequences...