A poker-playing chess devotee has neared 90% gains after a $1.8 billion loss...

A poker-playing chess devotee has neared 90% gains after a $1.8 billion loss...

In 2008, financial-services firm Deutsche Bank (DB) was preparing to spin off a division for its most successful trader. As we mentioned in the March 31 Altimetry Daily Authority, Boaz Weinstein had spent the previous decade making high-powered trades for the bank... with big returns to show for it.

Weinstein became a chess master at age 16, a card-counting blackjack ace at 20, and a managing director at Deutsche Bank at 27. By trading in the credit sphere – especially with credit default swaps ("CDSs") and mortgage-backed securities ("MBSs") – Weinstein was trading in assets with theoretically infinite gains... and theoretically infinite losses as well.

In 2008, the financial markets imploded, with failures across the board of financial instruments. This was centered in the CDS market, which brought the insurance giant AIG to its knees that September.

Due to some thoughtfully designed but too-cute trades, Weinstein cost Deutsche Bank dearly in the implosion. When the dust settled, Weinstein left the firm holding onto a $1.8 billion hole – obliterating the profits he had made over the past two years.

However, that didn't stop the infamous trader...

As we mentioned in March, after leaving Deutsche Bank in 2008, Weinstein set up a hedge fund called Saba Capital Management to trade his volatility strategy in credit. After 11 years of substandard returns, Weinstein's strategy is starting to pay off big.

For investors who had signed up with Saba in 2009, they would have seen a return close to 3% a year. For a fund that executes on complex trades around credit instruments, simply investing in the S&P 500 Index would have yielded a greater return.

However, last week, Bloomberg reported that Saba is up an astonishing 90% since the beginning of the year.

The firm has taken advantage of the market volatility to find trades with large credit mispricing. Initially, it benefited from panic... since Saba has profited by riding the tails of the U.S. Federal Reserve as credit spreads have again shrunk.

Whether Weinstein can continue executing or if his strategy will catch up with him again, he proves during times of upheaval that credit investing is a compelling place to make a killing... if one knows where to look.

We can use our Uniform Accounting analysis to do credit analysis, just like we do for equities each day in the Daily Authority. In fact, this is one of the offerings we give to institutional clients. Are you interested in credit ideas from time to time in the Daily Authority, or would you prefer we stick to equities? Let us know at [email protected].

America loves a good comeback story...

America loves a good comeback story...

It doesn't matter who the story is about – it could be a sports team, a celebrity, or even a country.

Since many Altimetry employees are from the Boston area, we often love to reminisce about the epic 2004 Red Sox comeback in baseball. At that time, it had been 86 years since the Red Sox had last won a world series.

Down three games to zero in the American League Championship Series, the Red Sox became the first team in major U.S. sports to ever come back from a three-game deficit in a seven-game series. From there, the team went on to beat the St. Louis Cardinals in the World Series to become champions.

There's no shortage of comeback stories that people cheer for... The founding fathers beat the most powerful nation in the world in the American Revolution, basketball's Michael Jordan came out of retirement and won three more championships, and Steve Jobs returned to Apple (AAPL) after he was fired.

America is obsessed with these stories. We love people who must fight tooth and nail to achieve their dreams and goals... and we use the stories to help inspire us in our own lives.

The same principal can be found in the stock market. We inherently find ourselves rooting for companies and industries that have been beaten down. And recently, one of the sectors that has been beaten down the most is oil and gas.

The past few years haven't been kind to the struggling industry. Increased regulations, public scrutiny, volatile oil prices, and heavy competition have made it hard to succeed in the sector.

And things have only gotten worse with the coronavirus pandemic. Demand has withered and the price of oil is still low, causing even greater strain on oil and gas companies. However, perhaps the great decline in the industry could set up a great comeback story...

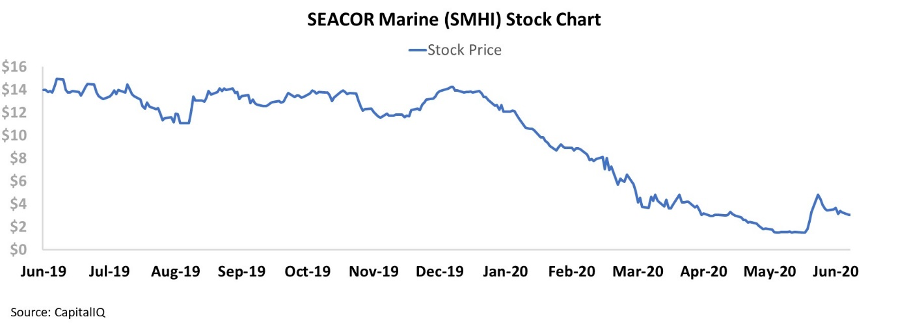

One possible comeback is oil and gas transporter SEACOR Marine (SMHI). The company's stock traded for around $13 per share before the price of oil fell earlier this year. But since early January, SMHI shares have fallen more than 80%... and now sit around $2. The stock at least appears like it could have no direction to go but up, just thanks to how low it is.

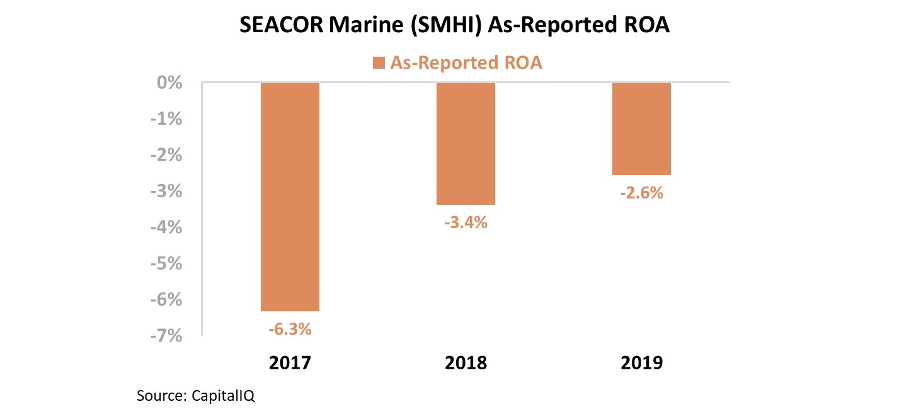

Based on as-reported accounting, it looks as though the comeback has already begun. Over the past three years, SEACOR Marine's return on assets ("ROA") has risen from negative 6% to negative 3%, giving investors hope that the company can soon see positive returns.

A firm about to turn a profit is an exciting prospect... When the electric-car maker Tesla (TSLA) saw its as-reported returns turn positive in late 2019, TSLA shares began their huge rally from $400 to current levels near $1,480.

However, while SEACOR Marine's as-reported profitability has improved, its stock has only continued to plummet. This means there must be something else keeping SMHI shares so low.

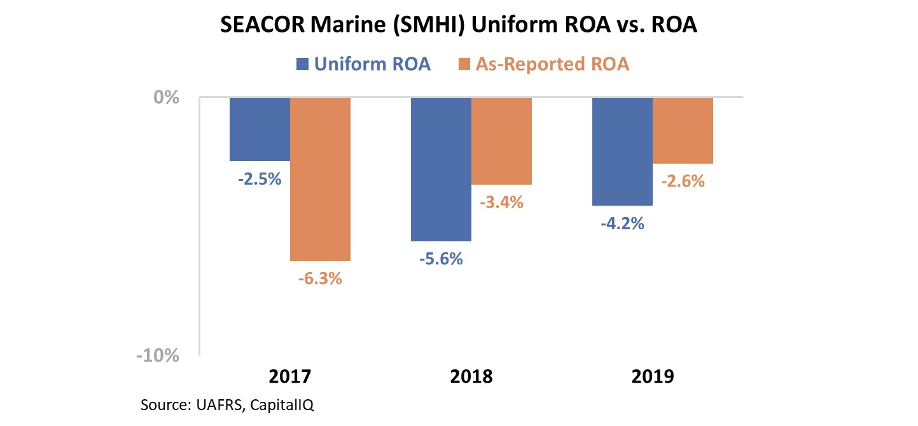

The culprit is GAAP accounting's inability to reveal the entire story. Looking at Uniform numbers reveals what's really going on...

Large distortions related to property, plant, and equipment (PP&E) and other issues have been able to artificially increase SEACOR Marine's profitability and decrease the firm's asset base. This has had the dual effect of making SEACOR Marine appear to be more profitable and asset efficient than it truly is.

When we remove the accounting "noise" and look at the real Uniform returns, we can see SEACOR Marine hasn't been able to improve its profitability. In fact, since 2017, SEACOR Marine's Uniform ROA has slid from negative 3% in 2017 to negative 4%.

It's hard to root against the comeback story, but SEACOR Marine has yet to show investors that the company is able to turn itself around. The comeback story is going to have to wait for now.

By only using as-reported accounting, it would be easy to assume that SEACOR Marine is an improving company that the market hasn't noticed yet. However, its best days are still far in the past... and Uniform accounting is able to warn investors of the truth.

Regards,

Joel Litman

August 7, 2020

A poker-playing chess devotee has neared 90% gains after a $1.8 billion loss...

A poker-playing chess devotee has neared 90% gains after a $1.8 billion loss...