The market is about to be in for a rude awakening on second-quarter earnings...

The market is about to be in for a rude awakening on second-quarter earnings...

Earnings season is just about in the bag, with more than 90% of the S&P 500 Index providing first-quarter 2020 as-reported earnings. Earnings per share ("EPS") for the index looks like it's going to come in at $12.56, down from $35.53 in the fourth quarter of 2018 and $35.02 in the first quarter of 2019.

That's a staggering 64% decline in earnings. Fortunately, second-quarter 2020 EPS is forecast to rise to $21.18... That's still down from 2019 figures, but it's a strong recovery. That should be a good sign for the stock market, right?

Actually, as Joel wrote about in Forbes yesterday, it should have investors spooked.

Where earnings lead, the market follows... And earnings are about to take a step down. Any sensible investor should look at that $21.18 EPS number with a raised eyebrow.

We only started to really shut down the U.S. economy in mid-March, so most of the first quarter was a "normal" earnings season. But the world was basically shut down for all of April, and much of May too.

Operating earnings should be lower in the second quarter than in the first.

But perhaps "special item charges" were exceptionally high in the first quarter as companies tried to take restructuring charges?

Impairment of goodwill spiked in the quarter, but when companies started prepping earnings, many still didn't think this shutdown would last for long. Restructuring charges were actually down in the first quarter of 2020 for the S&P 500 versus the fourth quarter of last year!

Now companies are going to have to make tough decisions and start to build these reserves.

As Joel highlighted in Forbes, this is reminiscent of the Great Recession. While everyone remembers September 15, 2008 and the collapse of financial-services firm Lehman Brothers, that year's fourth-quarter earnings were much worse than the third quarter.

Frankly, we're surprised more people aren't talking about this. We didn't even need Uniform Accounting to see the ticking time bomb.

But as Joel said, there's a positive to this...

The earnings walkdown is likely to lead to stocks rolling over again. But once companies build these restructuring charge reserves and take the "big bath" for earnings, it's likely we'll have seen the low point for corporate earnings.

And as we mentioned above, where earnings lead, the market follows. So as long as we don't start seeing credit signals that change our current outlook, this will likely start to help us build a floor for the market... so we can move higher.

Most people don't know much about the specifics of the most famous gold rush in history...

Most people don't know much about the specifics of the most famous gold rush in history...

Beyond knowing what the term means, many folks have heard of the California Gold Rush.

Fewer know that it began in 1848 and lasted roughly seven years. The term "49ers" (hence, the name of the NFL's San Francisco 49ers) comes from the year of peak migration in 1849... not the year it all started.

Even fewer still know the name of the man who caused the California Gold Rush... a carpenter named James W. Marshall. On January 24, 1848, Marshall saw a shiny metal in a water channel below a sawmill. Tests proved it to be gold, and the word spread like wildfire.

That said, there's one aspect of the gold rush most people have heard of, whether they know it or not...

The rush caused the biggest migration in U.S. history and helped put California on the map. While we don't hear much about the lucky few who actually struck gold, we often hear stories about the people who made the most money during the rush.

There's an old saying that ties into this: you're better off being the "picks and shovels" salesman during a gold rush than a prospector.

In other words, it's more profitable to supply a growing, booming industry than to participate when the risk is high.

Would-be prospectors flocked to California for the rush (approximately 300,000 people), and most never ended up finding gold. But everybody who wanted to try needed a pickaxe and a shovel... More generally, they needed supplies.

By supplying the gold rush, savvy entrepreneurs could simultaneously limit their downside risk and rapidly grow a business.

As we said earlier, most people have likely heard of one aspect of the gold rush, but probably don't realize it... It was the main supplier for prospectors.

In fact, it's still a company today... and it just went public last year.

Levi Strauss (LEVI) got its start in San Francisco in 1853 to take advantage of the massive influx of new people hoping to find gold in California.

While the story that the company's namesake sold the first denim pants to gold miners isn't exactly correct, it has the right spirit...

German-born immigrant Levi Strauss and his brother-in-law David Stern sold a number of textiles like sewing materials and ready-made canvas pants, which were in high demand for gold miners.

Levi Strauss is the shining example of what it means to be a picks-and-shovels salesman.

And today, many companies carry the same spirit...

For example, in the May 19 Altimetry Daily Authority, we discussed Universal Display (OLED), which sells technology to the digital display industry. The company's focus on selling the tech and patents rather than competing for market share with products has led to sustainable, outsized returns.

The same can't be said for another firm in the same industry – it's chasing after valuable market share rather than benefiting from the market itself.

Corning (GLW) makes glass products – specifically for technology end markets – including those that go into panel tech for high-end TVs, computer screens, and smartphones. The company is known for its signature Gorilla Glass – a damage-resistant, light, thin glass.

But instead of licensing its glass technologies, Corning decided it was going to use its superior technology to dominate the market.

After Corning froze competitors out of the technology, peers developed close equivalents with names like Dragontrail and Xensation. Corning went from a potential picks-and-shovels seller of the glassmaking world to a reality of being in a battle for who could collect the most gold from smartphone makers, competing with companies like AGC and Schott.

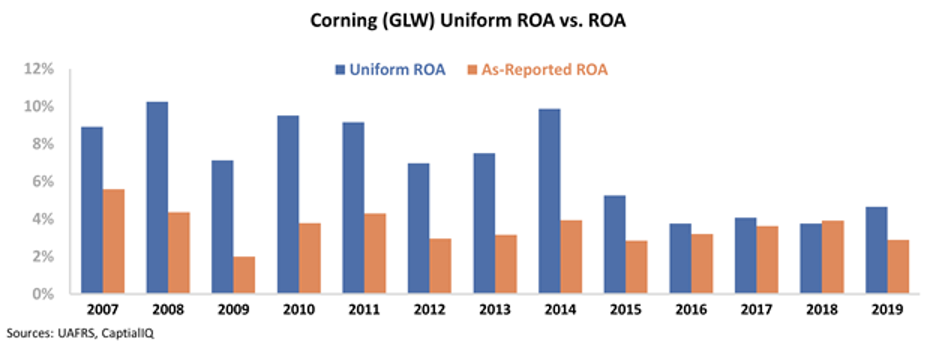

On either an as-reported or a Uniform Accounting basis, Corning's returns have clearly struggled as it has had to compete for market share. Since the start of the Great Recession, the company's return on assets ("ROA") has come under pressure... and is currently below long-term corporate averages.

The trend is much more pronounced when looking at Corning's Uniform ROA, though it also exists for the as-reported data...

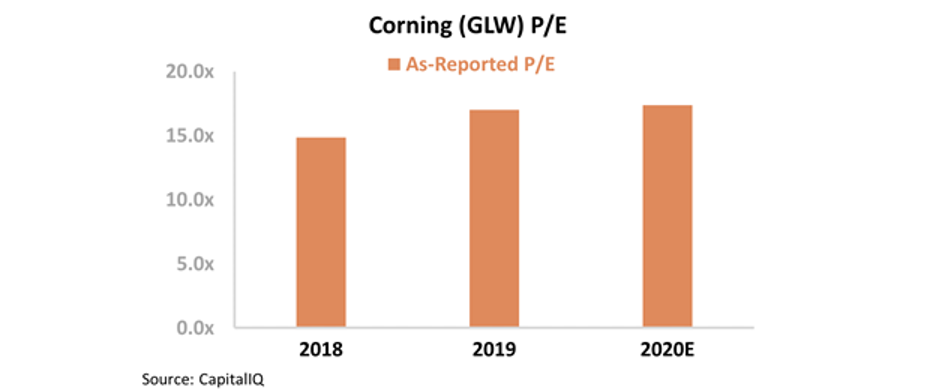

Unsurprisingly for a company that has come under elevated competitive pressures, Corning's as-reported price-to-earnings (P/E) ratio looks cheap compared to the market. Today, it's at 18 times... compared to a market average of 20 times.

At these levels, it looks as though Corning could see some equity upside if it improved profitability back to pre-recession levels.

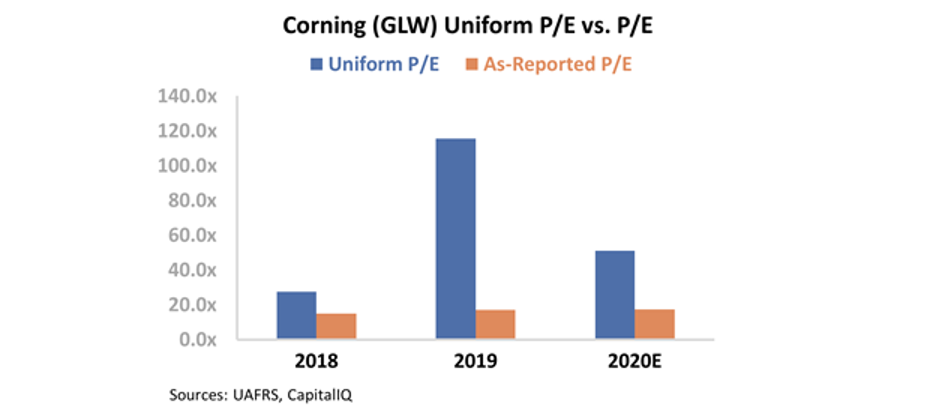

But the reality is, after adjusting to Uniform Accounting metrics, we can see that at current valuations, Corning is actually more expensive than as-reported metrics reflect.

Once we remove distortions from as-reported financials – such as the effect of research and development (R&D), goodwill, and interest expense – Corning's Uniform P/E ratio is actually 53. That's more than double the market average. Take a look...

The market is treating Corning like it's a picks-and-shovels seller that will win as long as the demand for phones and other products with screens rises. In reality, the company is in a trench-fight for share in those markets.

While Corning looks like a potentially undervalued stock using traditional accounting metrics, Uniform Accounting reveals that this a name investors might be better off avoiding. The competitive pressures from trying to be a market participant are just too strong.

Regards,

Rob Spivey

May 28, 2020

The market is about to be in for a rude awakening on second-quarter earnings...

The market is about to be in for a rude awakening on second-quarter earnings...