In the midst of the coronavirus pandemic, Apollo Global Management (APO) has been on a deal-making spree...

In the midst of the coronavirus pandemic, Apollo Global Management (APO) has been on a deal-making spree...

The global alternative-investment manager understands the massive need for liquidity during this crisis. As we've said repeatedly here at Altimetry Daily Authority, stay-at-home orders have crushed demand... so companies are looking to shore up their balance sheets.

Apollo is conducting all this deal-making through its Hybrid Value fund, which the company started in 2019 with $3.3 billion in capital. Rather than taking complete control of businesses using leveraged buyouts (an acquisition of a firm funded by debt), Apollo takes on both debt and equity to purchase minority stakes in distressed publicly traded companies, often at a discount.

These are so-called "PIPE" deals – private investments in public equity. This is different than purchasing shares on a stock exchange, and it's a way for businesses to get direct capital injections.

By providing struggling companies with direct capital, Apollo buys into a favorable share of the business. Many of the top private-equity firms, including Blackstone (BX) and Bain Capital, have pursued similar deals.

These PIPE deals have also become common in conjunction with special purpose acquisition companies ("SPACs"). SPACs are shell companies that go public with the sole purpose of acquiring other firms and taking them public – essentially an alternative method to the traditional initial public offering ("IPO").

These PIPE deals are being used to complement the capital initially raised by a SPAC to inject further liquidity into the underlying company. And right now, PIPE deals have become attractive alternatives for companies like Apollo as private markets have ground to a halt during the crisis.

Internet travel company Expedia (EXPE) is one example of a company that has seen a PIPE investment from Apollo...

Internet travel company Expedia (EXPE) is one example of a company that has seen a PIPE investment from Apollo...

Apollo and private-equity giant Silver Lake Partners purchased a $1.2 billion stake in Expedia in April. This has injected liquidity into Expedia and helped the company avoid many of the credit issues facing the travel industry.

As we said in the August 4 Daily Authority, Expedia utilizes the "illusion of choice" with its wide array of offerings. While customers believe that they're selecting from multiple sites for the best deal, many of those platforms are owned by the major two online travel agencies ("OTAs"), Expedia and Booking Holdings (BKNG).

Expedia is particularly hurting during the pandemic... International travel has been virtually nonexistent, and air travel dropped by as much as 96% at the peak of the crisis. This has meant decreased traffic on all of Expedia's platforms.

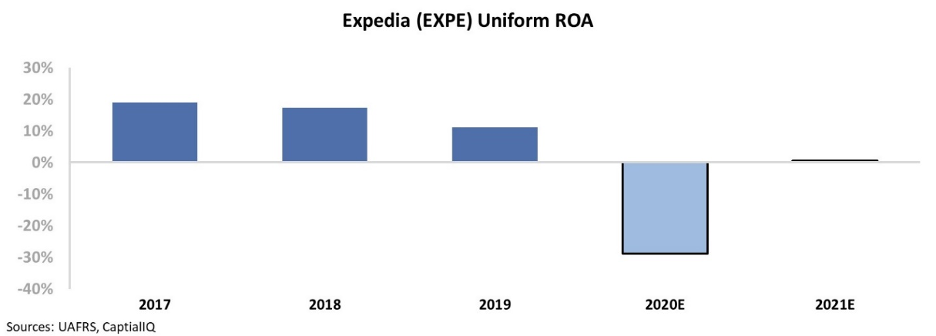

It's no surprise that the company's Uniform return on assets ("ROA") is expected to inflect massively negative this year. People aren't booking vacations, and Expedia still has fixed costs – including leases and interest expenses. The company also takes significant risk in its OTA business – it invests capital to take on hotel and airline inventory, which has sat mostly idle due to the nearly nonexistent demand for travel.

Given these issues, many investors would assume that Expedia is a high credit risk. Ratings agency Moody's (MCO) ranks Expedia as a "Baa3" crossover name, suggesting the company may encounter some credit difficulty should demand for travel take time to bounce back.

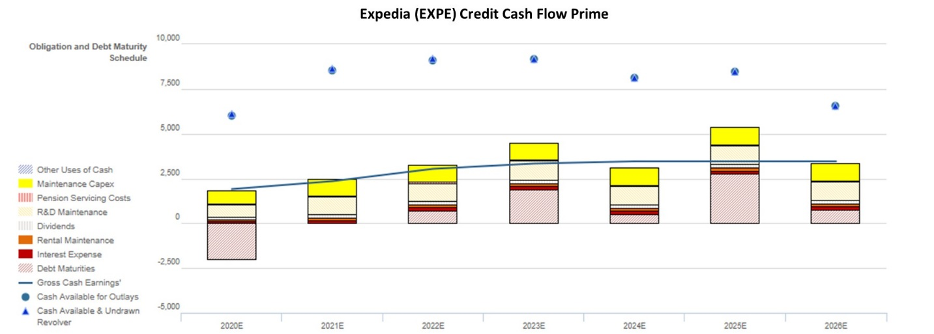

However, if we look at Expedia's Credit Cash Flow Prime ("CCFP"), we can see that the company is much healthier than investors realize...

The chart below explains Expedia's credit risk. It compares the company's obligations (stacked bars) each year for the next seven years against its cash flow (blue line), and cash on hand at the beginning of each period (blue dots).

The bottom bars are the ones that are difficult for Expedia to "push off" – these are costs such as debt maturities and interest expense. The higher bars are more discretionary obligations, such as maintenance capital expenditures ("capex") and share buybacks.

Once we consider liquidity, capex flexibility, and debt maturities, Expedia looks far less risky. The company is estimated to have enough cash on hand to pay off all obligations through 2026.

And a big reason for that is Expedia's tapping of the credit markets... as well as Apollo's PIPE investment earlier this year. This means that Expedia's only significant outstanding debt headwalls aren't due until 2023 and 2025. This gives the company ample runway to improve operations and for travel demand to snap back.

This is why Valens Research – the firm that powers Altimetry – rates Expedia as an "IG3+" credit risk. This is firmly in the investment-grade tier... and five notches above Moody's rating.

When utilizing traditional metrics and simple ratios, Expedia looks like a moderate credit risk to the ratings agencies. However, by looking at the company from a Uniform Accounting perspective, investors can see the real credit data and understand the timing of obligations.

Expedia has a long runway before its debt matures, and it can afford to wait for travel demand to return to pre-pandemic levels. By tapping the credit markets and making an opportune PIPE deal, Expedia has secured liquidity to last through the crisis.

Regards,

Rob Spivey

September 23, 2020

In the midst of the coronavirus pandemic, Apollo Global Management (APO) has been on a deal-making spree...

In the midst of the coronavirus pandemic, Apollo Global Management (APO) has been on a deal-making spree...