Inflation is at 40-year highs...

Inflation is at 40-year highs...

As the world reopened and folks felt more confident about safely going out both locally and abroad, demand for goods and services grew in quick succession.

Plus, with bank accounts buoyed by stimulus cash, people were ready to splurge.

From fancy new outfits for the return to the office to the vehicles that would take individuals to their social events, the U.S. was back to making big-ticket purchases.

While the market was busy reaching new heights, some concerns about potential inflation began to surface.

Consumers saw prices increase, sometimes dramatically, for their daily purchases. With concerns already abound about labor and shipping constraints, consumers wondered if those costs would be passed on to them.

As March drew to a close, people eagerly awaited the data to figure out just how bad the damage was.

When the month's inflation numbers finally came out in mid-April, the number was staggering.

The Consumer Price Index ("CPI") increased 8.5% in March, the highest 12-month growth rate since 1981.

After decades of 2% inflation, the public was shocked to see inflation skyrocket so quickly.

Stimulus bills were essential for the economy to recover quickly from the lows in 2020, but one of the consequences came in the form of inflation.

Simultaneously, with Russia's invasion of Ukraine impacting global oil supply, a jump in oil prices was the biggest contributor to inflation.

Fuel oil prices jumped more than 70% and gasoline jumped 48%. Anyone who had to heat their home in March (or for anyone in California like I was filling up their gas tanks for $6 a gallon) can attest to these staggering figures.

There was not a single component on the CPI that dropped in the month, and all of the big-ticket items that saw a surge in demand also saw massive increases.

The cost of used cars, airline fare, utility gas, meat and poultry, new vehicles, and electricity all experienced double-digit growth rates.

With price increases so rampant, it was strange to watch the stock market pop at the same time.

Why did markets rise with so much inflation?

Why did markets rise with so much inflation?

The market rose because for many, these inflation levels felt like a high-water mark for a few reasons...

The biggest contributor to inflation for the month was oil and natural gas prices, which as the fuel for the economy, flowed through many other places.

Since then, the prices of many of the finished products have dropped and oil price surges have tapered off.

However, core inflation didn't see a similar jump. Many took that as a signal that outside of volatile fuel and food prices, things might finally be starting to stabilize.

As we consider the potential stabilization, it's also worth noting when inflation first started to pick up last spring.

Considering the annualization that occurs with inflation calculations, the inflation rate might start to head down naturally. This reversion will likely occur as many of the short-term spikes we've discussed will moderate, as we've highlighted when talking about treasury yields and long-term inflation.

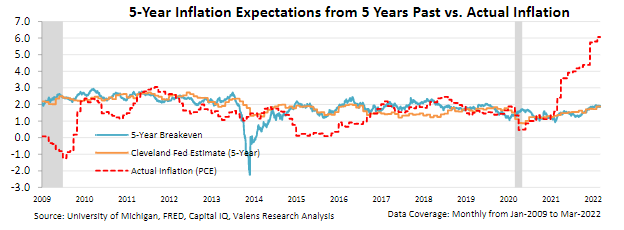

In fact, as we've highlighted previously, long-term inflation expectations demonstrate that the market still expects levels to moderate, just as experts do. While the red dotted line, or actual inflation, has climbed this year, both the five-year breakeven inflation rate and the Federal Reserve estimate are still around 2% for the long term.

Even as inflation levels are higher than they have been in decades, the data shows that smart money is betting on inflation levels calming down.

This is why, despite the scary headlines, the signals still point to this spike in inflation being driven by temporary factors and not setting into the economy. For this reason, you shouldn't let inflationary fears drive you out of a market that is still fundamentally sound.

Best,

Rob Spivey

May 2, 2022

Inflation is at 40-year highs...

Inflation is at 40-year highs...