Investors have gotten used to high bond yields...

Investors have gotten used to high bond yields...

Yet, some are beginning to wonder if their luck is running out.

When the Federal Reserve began raising interest rates last fall, corporate bond yields surged. This provided unusually attractive returns for fixed-income investors.

Now, with more rate cuts on the horizon, those high yields are expected to gradually decline.

Simply put, the Fed's recent policy shift has left some investors scrambling for new ways to lock in big returns.

This is where structured finance comes into play... It packages various assets and revenue streams to offer higher-return securities while mitigating risk.

Last month, we discussed how some companies are using Nvidia (NVDA) chips as collateral to secure loans. But it doesn't stop there.

Banks are now finalizing debt deals backed by truly unconventional assets... like chicken wings.

As we'll explore today, this creative debt financing has sparked concerns. Yet, these worries may be exaggerated in today's economy.

Structured finance deals are on the rise, and the credit market is still in play...

Structured finance deals are on the rise, and the credit market is still in play...

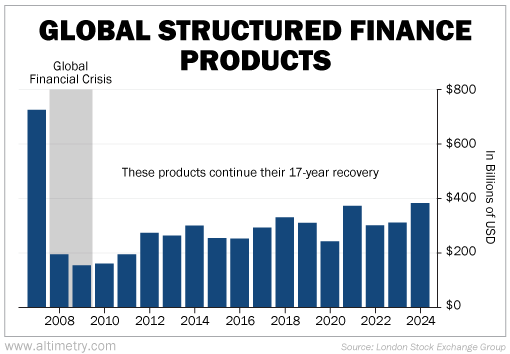

Globally, these transactions reached $380 billion in 2024. They've increased more than 20% from 2023 – the highest amount since the Great Recession.

The biggest driver has been unconventional deals... They package revenues generated by things like oil wells, solar panels, music catalogs, and specific foods.

And they'll probably get more inventive over time.

This area of structured finance surged to $63 billion in 2024, which is 50% higher than the 2023 volume.

Despite this trend, there's good reason to stay level-headed. And the recent Senior Loan Officer Opinion Survey ("SLOOS") shows us why...

SLOOS is a quarterly survey conducted by the Fed... It asks loan officers if their lending standards have tightened, loosened, or stayed the same in the past three months.

As we wrote on December 3, SLOOS has started trending in the right direction... Banks have stopped tightening lending standards for the first time in the past two and a half years.

That should open up the traditional credit market to companies... and, with that, satisfy investor demand for high-yield assets.

That's the opportunity many have been looking for as structured finance surges.

We haven't hit crisis levels yet...

We haven't hit crisis levels yet...

The structured finance sector is now sitting at a 17-year high.

Yet, the product volume is nowhere near 2007 levels, which marked the start of the Great Recession.

Back then, structured finance deals were almost double what they are today. Take a look...

Between 2007 and 2009, the finance world was rocked by reckless lending practices and lack of oversight.

There's another key difference... While creative packages ramp up, most structured deals still rely on consumer credit like auto and credit-card loans.

And although default rates have risen with higher borrowing costs, they remain within normal ranges.

As a result, the current growth rate of structured products has been slower and steadier.

That tells us the credit market is acting as it should...

That tells us the credit market is acting as it should...

Although structured finance saw huge growth in 2024, that's no reason to panic.

As we noted, this sector is still far smaller than it was during the Great Recession... And its growth has been slow and consistent.

Now, with banks more willing to lend, structured debt deals are unlikely to spiral out of control.

In short, credit market hasn't entered a risky zone... Instead, it's in a steady recovery phase.

And that means the current economic rally is poised to continue.

Regards,

Joel Litman

January 21, 2025

Investors have gotten used to high bond yields...

Investors have gotten used to high bond yields...