During an economic crisis, there's a sneaky way your portfolio could be crippled...

During an economic crisis, there's a sneaky way your portfolio could be crippled...

In late June, UC Berkeley hosted its annual "Fraud Fest" – completely online for the first time. This year, the 200 panelists had a lot to talk about... As one said, "the pandemic is the perfect storm for fraud."

Due to the need for quick action to prop up the economy, the U.S. government was unable to place a clear and rigorous standard on loan distribution.

This means many firms have received funds they might not deserve. For example, Kanye West received a multimillion-dollar Paycheck Protection Program ("PPP") loan.

While lack of oversight is a big problem today, it's a normal issue for the small companies that were supposed to be applying for PPP loans... and for the investors who look to buy their stocks.

Investors in public microcaps are used to that ambiguity. The U.S. Securities and Exchange Commission ("SEC") can't hope to monitor every microcap company the same as it would mega-caps like Apple (AAPL) or Microsoft (MSFT). This means questionable things happen in the space that scare many investors away from microcaps.

We've said it before... the best way to avoid fraud when investing in microcaps (or in general) is to start with investigating the management team. By looking at the people in charge, it's possible to sniff out fraud before even looking at the balance sheet.

For example, management can enact fraud without touching the balance sheet by drumming up artificial press releases to pump up the company's stock.

But most people won't spend the necessary time to thoroughly investigate executives or auditors. They think it's too much work... so they'll just avoid investing in the microcap space all together.

But for the investors who can actually identify potential "torpedoes" – the stocks that can sink an entire portfolio – and pick out the winners from the crowd instead... they have the potential for huge returns.

It's exactly why we launched a brand-new product to guide investors through the microcap world. Using Uniform Accounting and fundamental forensics, we can find the tiny stocks with massive market potential... and avoid the traps.

Our Microcap Confidential service helps you sort out the fraudulent companies from the firms that can make hundreds-of-percent gains, or even more.

We just put together a presentation explaining the full story. In it, we also name one company in the space that's currently playing games with investors and regulators. It's promoting itself in the news and through press releases to try to take advantage of speculators in the midst of the pandemic... and it's essential that you do not buy this stock.

We're ending our charter offer this week, and we don't want you to miss it... Get the details right here.

Forecasting pharmaceutical companies gives investors fits...

Forecasting pharmaceutical companies gives investors fits...

Paradoxically, the pharmaceutical industry is both one of the easiest and one of the hardest to forecast.

The math behind forecasting approved drug demand is straightforward. The formula is simply the number of people with the disease times the percent of the market the drug is targeting. Then, to find profit, you multiply by revenue and subtract cost.

Furthermore, the data are easy to get a hold of for most investors, since numerous sources provide the details. Following a two-step formula then, if an investor knows that a drug will be approved, he can easily model future demand and profit.

That all sounds easy...

But the hard part is knowing whether the drug one of these companies is developing will actually be approved. As we mentioned in the July 15 Altimetry Daily Authority, it's a cycle of boom and bust revenue related to drug development and production.

This process is often impenetrable to the average investor... as during clinical trials, a firm's drugs can be rejected for a wide variety of factors. This is partly why companies that develop these drugs get years of patent protection.

A company's stock can trade at low valuations for some time, since investors are unsure if the product will make it through testing. The stock can swing massively once any incremental datapoint comes out, as the probabilities change for whether a drug is approved or not.

In this way, investing in biotech and pharmaceutical companies becomes binary... which is why even though the stocks in theory are easy to value, many investors throw their hands up and walk away from the industry altogether.

This is part of the reason investors have had a love/hate relationship with Supernus Pharmaceuticals (SUPN) – a company targeting central nervous system disorders. It's already past the hurdle of having its drugs approved by the U.S. Food and Drug Administration ("FDA"), with two major drugs approved and a third in the last stage of approval.

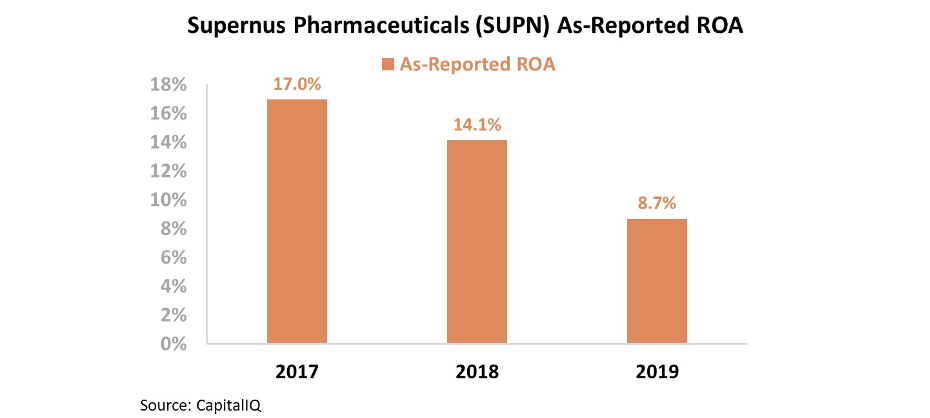

And yet, when looking at Supernus' as-reported returns, it looks as if the company has been unable to turn these approvals into profitability. Over the past three years, its as-reported return on assets ("ROA") has slid from 17% to 9%...

Looking at these numbers, it's no surprise investors have balked at Supernus. A low-return pharmaceutical firm is only a worthwhile gamble for investors if it's because the company is working on pushing a drug through the FDA. If that firm is still losing money after approval, it must be a bad business.

However, investors are scared of shadows, not real metrics...

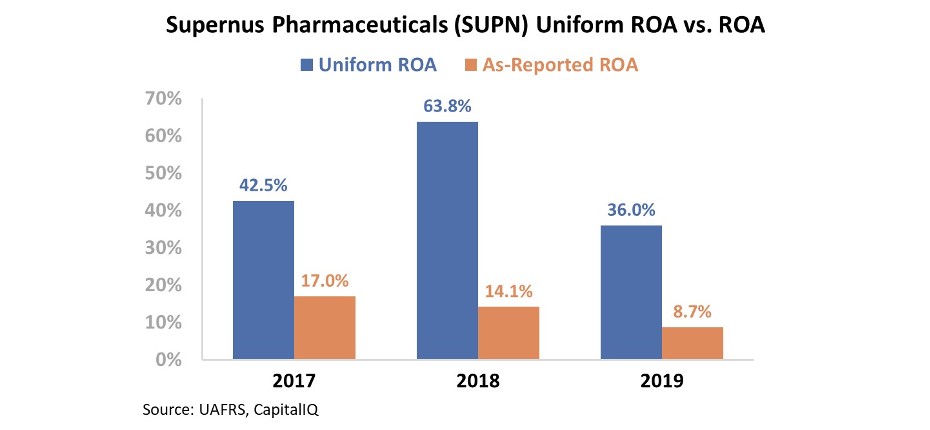

Due to the distorting nature of GAAP accounting, Supernus's asset base has been seriously misstated. After adjusting for research and development (R&D) and long-term investments, a different picture emerges...

In reality, Supernus has seen strong ROAs... in excess of 36% last year! Furthermore, the company has seen real inflections in ROA, but not consistent contraction. Take a look...

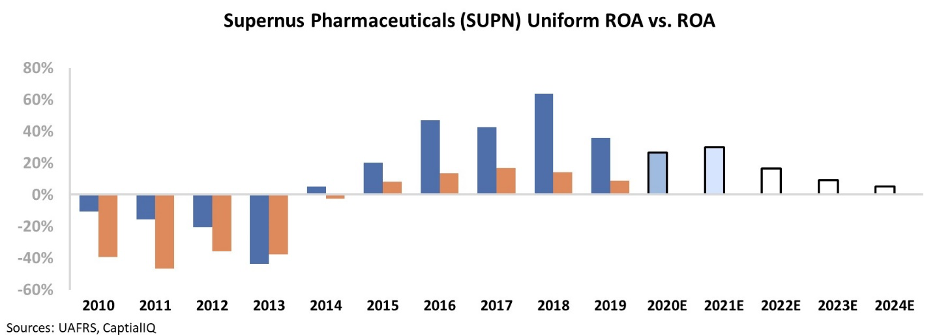

This market distortion has put significant downward pressure on Supernus' stock price. We can understand how depressed valuations are by using our Embedded Expectations framework.

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, market expectations for Supernus are incredibly bearish. The market has priced in Supernus' ROA to fall all the way from 36% in 2019 to 5% in 2023.

Due to the misleading nature of as-reported accounting, the market has missed the boat on Supernus. Investors believe it to be a drug company failing to turn its approved drug into real profits.

However, once we make Uniform adjustments, it's possible to see what the market has missed. Supernus is a high-ROA pharmaceutical company making a profit... but it's priced like it hasn't already started making money. This is yet another example of why so many investors throw up their hands at the space... but you don't have to if you know the right numbers.

Regards,

Rob Spivey

July 21, 2020

During an economic crisis, there's a sneaky way your portfolio could be crippled...

During an economic crisis, there's a sneaky way your portfolio could be crippled...