Electric-car maker Tesla (TSLA) has been having a hard time lately...

Electric-car maker Tesla (TSLA) has been having a hard time lately...

The company's stock is down 54% since the start of the year.

That's bad... no matter how you slice it. The S&P 500 is down 16%. Tesla's automotive peers, like Ford Motor (F) and General Motors (GM), are down about 35% each.

And if you think of Tesla as a tech company, not a car company, the Technology Select Sector SPDR Fund (XLK) is down 22%.

Between inflation and the risk of a recession, people are panicking. They're saving more, so demand for Tesla's expensive cars is slowing. Now, the company is taking drastic measures to slow the bleeding.

Tesla recently cut prices and offered incentives in China to boost demand in the region. That hasn't improved much.

Demand is still low. And thanks to global economic concerns, the company's hope for an increase in the short term looks unlikely.

Tesla also plans to trim production by about 20% at its Shanghai plant. That's the first time it has voluntarily slowed its production rate.

Part of the issue may be rising competition. Local Chinese automakers like NIO (NIO), XPeng (XPEV), and Li Auto (LI) are giving the company a run for its money.

So Tesla is facing two main issues... Competition is rising and demand is slowing. Plus, CEO Elon Musk is focused elsewhere.

Since closing the deal to buy Twitter, Musk has been busy.

Investors seem worried that he might be too caught up in his new business – and that he won't be able to commit to Tesla as he did before.

On Monday, Gary Black tweeted, "There is no TSLA CEO today." Black is a managing partner at the Future Fund, a hedge fund that owns about $50 million worth of Tesla stock according to the Wall Street Journal.

Since the Twitter deal closed on October 27, the S&P 500 is up about 6%. Tesla is down about 28%.

Tesla has traditionally been a retail-investor favorite...

Tesla has traditionally been a retail-investor favorite...

These folks tend to gravitate to specific stocks. Through good news and bad, they've helped prop up shares of Tesla. It's up more than 470% since the beginning of 2020.

It seemed like Tesla was on a one-way trip higher... until this year. For the first time in a while, the stock seems as mortal as can be. Elon even briefly lost his title as world's richest person because his equity value fell so much.

These folks don't give up easily, though. Longtime retail investors want to see Tesla's stock get back to all-time highs. And since its stock has been so high before, many think it can get there again.

Of course, stocks rise and fall for irrational reasons all the time. So it is possible that Tesla's stock will rebound.

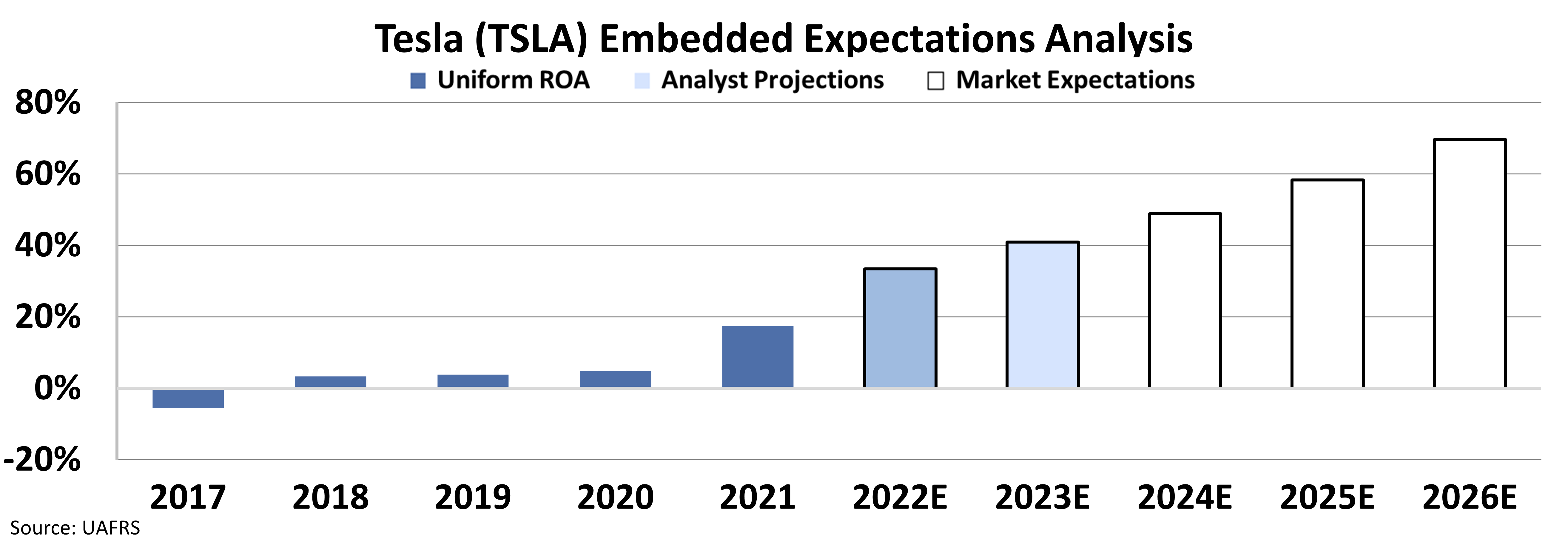

That said, fundamentally speaking, the company is still worth far more than it should be. We can see this through our Embedded Expectations Analysis ("EEA") framework.

Stock valuations are typically determined using what's called a discounted cash flow model. It makes assumptions about the future and produces the "intrinsic value" of the stock.

We know models that use distorted as-reported metrics only come out as garbage. So our EEA framework uses the current stock price to determine what the market expects.

Tesla's Uniform return on assets ("ROA") was 18% in 2021. At its current share price, investors think that number will skyrocket to 70% by 2026.

Take a look...

It's important to put these numbers into context...

It's important to put these numbers into context...

In the past 15 years, Ford's best Uniform ROA was 15%. General Motors' got as high as 11%.

So if you think of Tesla as a car company, these expectations are unimaginable. And even if you believe it's a tech company, the odds are stacked against Tesla...

Right now, only 10 tech companies in the U.S. have Uniform ROAs above 70%. That means the market is already acting like Tesla is a top 10 tech company.

And these unrealistic valuations are after the stock fell more than 50%. It was even worse before. And it's still not a good buy today.

Valuations are a critical piece of data for investors. Even now, Tesla's valuations don't make any fundamental sense. Time will tell whether the market comes around to what we see... or if investors keep their blind faith in Elon Musk.

In any case, Tesla is a stock to stay away from.

Regards,

Joel Litman

December 15, 2022

Electric-car maker Tesla (TSLA) has been having a hard time lately...

Electric-car maker Tesla (TSLA) has been having a hard time lately...