Editor's note: The markets and our offices are closed on Thursday, June 19 for Juneteenth. So we won't publish our Altimetry Daily Authority e-letter that day. Please look for your next edition on Friday, June 20.

The Department of Government Efficiency ('DOGE') sparked outrage after slashing federal jobs earlier this year...

The Department of Government Efficiency ('DOGE') sparked outrage after slashing federal jobs earlier this year...

But the public uproar and legal battles seem to have faded. And right now, DOGE is thriving.

The department is offering software engineers and AI specialists up to $195,000 a year to build the information-technology ("IT") infrastructure of the future.

Major government agencies are leaning into this mission, too. The new Social Security Administration Commissioner, Frank Bisignano, is embracing DOGE's digital-first vision. He's integrating engineers to streamline identity verification, process claims, and detect fraud.

In short, DOGE is a long-term catalyst for the U.S. government's tech overhaul. And certain companies are already capitalizing on this digital revolution.

Today, we'll explain how one tech player soared after inking a DOGE-related contract... and then stumbled when it couldn't deliver profits. It's a cautionary tale for investors who assume that all companies tied to DOGE's tech agenda will deliver.

IT management company BigBear.ai (BBAI) was a first mover in the DOGE gold rush...

IT management company BigBear.ai (BBAI) was a first mover in the DOGE gold rush...

It secured a $13.2 million contract with the Department of Defense ("DoD") back in March. With that, BigBear became a go-to AI vendor for the Joint Chiefs of Staff, which includes the most senior DoD leaders.

The goal was to upgrade the agency's Orion platform – a mission-critical tool used to visualize global military deployments and simulate crisis responses.

That put the company at the heart of DOGE's tech mission... And investors took notice.

BigBear's stock more than doubled when DOGE first took the reigns in early 2025. Since then, the market has bet big on any firm tied to Elon Musk's AI empire.

But the excitement has fizzled out...

The company fell short in its recent earnings report...

The company fell short in its recent earnings report...

BigBear is weighed down by high research-and-development costs. And it can't easily scale operations. Even its flagship DoD contract couldn't boost the company's latest quarterly results.

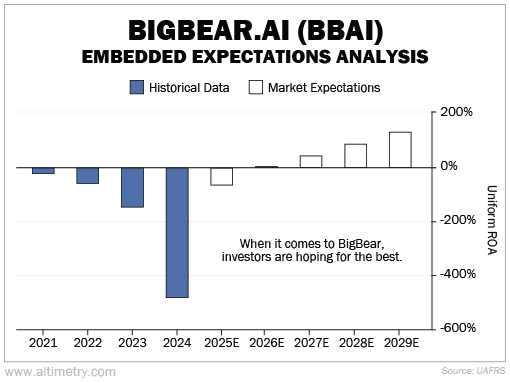

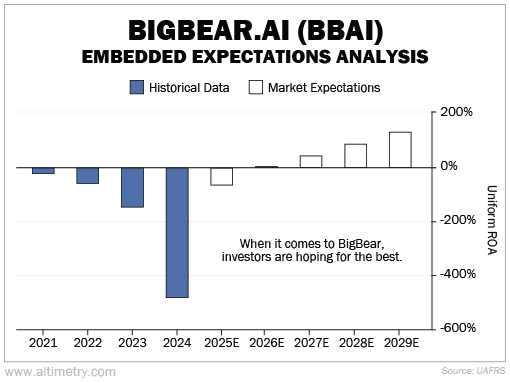

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

BigBear has lost money every year since going public in 2021. And the losses are only getting bigger.

At the same time, investors are pricing in massive profitability over the next four years... They think its Uniform return on assets ("ROA") will surpass 130%. Take a look...

In other words, they see BigBear as a major player in DOGE's digital revolution. That's why investors were so spooked by its recent earnings report.

Back the winners, not the dreamers...

Back the winners, not the dreamers...

The U.S. government is pouring billions of dollars into IT modernization. And it's hiring tech experts faster than ever.

This trend will lift up many companies over the next few years. But not all of them will thrive.

BigBear showed that DOGE-related contracts alone don't guarantee success. We want to see steady profits, not just potential.

Companies like BigBear might become winners in the future. But it's safer to focus on the ones generating real earnings today.

Regards,

Joel Litman

June 18, 2025

P.S. The DOGE momentum is continuing to build, and that means we're ready to profit from the massive, multiyear AI rollout.

This will create trillions of dollars in new wealth for investors... It has already minted 600,000 new millionaires.

And we're certain this trend will continue – despite any tensions between President Donald Trump and Elon Musk... or market volatility.

The biggest U.S. government agencies are already adopting AI... And there's no turning back.

In April, we handpicked our favorite under-the-radar stocks set to lead this tech revolution. Our entire list has soared since then... This could be your last chance to buy in for the biggest gains. Click here for the details (before it's too late).

The Department of Government Efficiency ('DOGE') sparked outrage after slashing federal jobs earlier this year...

The Department of Government Efficiency ('DOGE') sparked outrage after slashing federal jobs earlier this year...