Folks Are Panicking Over Inflation, But Don't Hit the 'Sell' Button Yet

Historically, inflation has wreaked havoc on economies across the globe...

Historically, inflation has wreaked havoc on economies across the globe...

In the 16th century, the Spanish Empire brought back so much silver from the New World that the resulting inflation caused its economy to collapse.

Rampant inflation crippled the Weimar Republic in the 1920s – forcing German citizens to spend millions of marks to buy a loaf of bread. More recently, in Zimbabwe and Venezuela, hyperinflation made currencies and investments worthless.

While the U.S. has never seen hyperinflation, we've tackled regular inflation. Prolonged "stagflation" in the 1970s slowed economic growth and depressed stock market valuations.

And coming out of the pandemic, we might be at risk for higher inflation...

With more than $9 trillion committed by Congress and the U.S. Federal Reserve to fight the pandemic and bolster the economy, companies and investors are flush with cash. However, we've seen little comparative spending... Many traditional luxury items such as cruises and vacations are still out of reach.

This is one reason for the recent non-fungible token ("NFT") craze. Investors with cash to spend are looking for somewhere to park it... such as NFT digital collectibles.

Furthermore, the pandemic has disrupted the supply chain for many critical goods...

Furthermore, the pandemic has disrupted the supply chain for many critical goods...

Products like semiconductors are seeing widespread shortages. This means as the world continues to open up, businesses may struggle to match supply to rising demand.

Inflation is caused by more money chasing fewer goods. If a product is in high demand and low supply, the price goes up.

Last month, we talked about how the standard inflation-related "Rule of 18" for valuing the stock market is breaking down. While this rule of thumb is no longer relevant, inflation still has a direct effect on your portfolio.

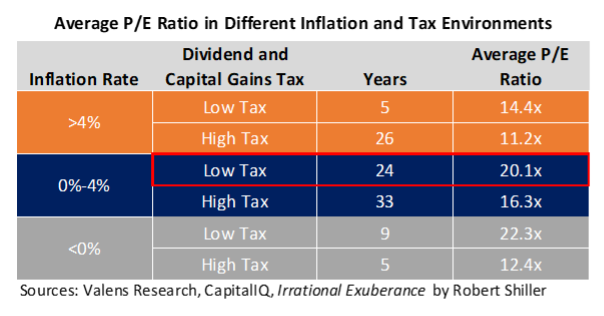

With low inflation, investors keep more money from their investments and can pay a higher price for the same earnings. In other words, the entire market's price-to-earnings (P/E) ratio can be higher. On the other hand, high inflation drags down the stock market.

This is why many investors are fearing the return of inflation.

However, this risk may be overblown...

However, this risk may be overblown...

While we may be at risk for short-term inflation, there's no reason for equity investors to panic.

Right now, the market's P/E ratio is being supported by the low-tax and low-inflation environment. This means the ratio can be around 20 times, with an inflation rate below 4%.

While inflation hawks panic about '70s-style stagflation and double-digit inflation, in the long run, inflation has rarely come above 4% to crash P/E multiples and the market.

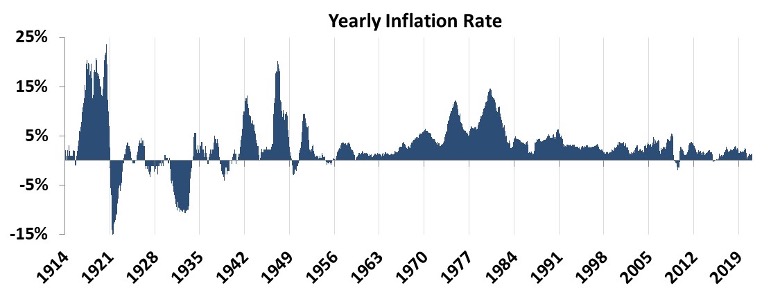

Let's look back at the long-run inflation rate of the U.S. to give context for the inflation of the '70s...

Let's look back at the long-run inflation rate of the U.S. to give context for the inflation of the '70s...

Inflation has historically been at low levels, coming in at an average of around 2% since 1914.

Periods of high inflation are anomalies, not the norm.

The first period of high inflation came between 1914 and 1921, as the U.S. government made record spending efforts during and after World War I. Predictably, the second wave of inflation came during World War II, as the government once again spent record amounts of money.

Finally, the period of prolonged inflation during the '70s was exacerbated by the Fed's poor monetary policy.

Due to an incorrect assumption that inflation was linked to employment, the U.S. was pumping out money instead of cutting back on interest rates. When former Fed chair Paul Volcker declared war on inflation and aggressively raised interest rates, inflation came back to normal levels.

With the Fed now in control of monetary policy and inflation, it has been able to sustain steady inflation rates over the past 40 years. At this point, you might argue that the problem has been the opposite of investor concerns... Inflation has been too low.

With current inflation rates at only 1.7%, investors will have plenty of warning before inflation rates breach 4% and really begin to be a significant headwind to valuations... as opposed to having just a short-term effect, as we've been discussing.

While media headlines may be looking to prey on investor fears, there's little risk of an inflationary spike in the short term.

Regards,

Joel Litman

April 12, 2021

Historically, inflation has wreaked havoc on economies across the globe...

Historically, inflation has wreaked havoc on economies across the globe...