For years, investors used a simple rule of thumb to determine whether the market was cheap or expensive...

For years, investors used a simple rule of thumb to determine whether the market was cheap or expensive...

It's a matter of adding the price-to-earnings (P/E) ratio of the market to the current inflation rate. If the number was less than or equal to 18, the market was cheap. If the number was greater than 18, the market was getting expensive.

The "Rule of 18" made intuitive sense for many investors and pundits. The P/E ratio is a classic measure of a company's value, which makes it a popular tool for investors studying individual equities. By aggregating the measure, investors had one piece of the puzzle.

However, the rate of inflation also has an effect on stock market valuations, as we discussed in the March 1 Altimetry Daily Authority. At a higher rate of inflation, investors take home less real value by investing in the stock market. In other words, if money is worth less later, why save it instead of use it?

The Rule of 18 was bandied about by U.S. wealth managers and economists for many years during the 20th century. As a quick "dipstick" for measuring how hot the economy was getting, it was a useful tool for explaining valuation.

Then, in the late 2000s and early 2010s, a new rule came out... It was no longer the Rule of 18, but the "Rule of 20."

The market was considered undervalued if the average market P/E ratio and inflation rate equaled 20 or less. With the market showing signs of strength above the rule of 18, investors realized they needed to revise the number.

Then, in the late 2010s, as the market continued to rise, investors were quick to call for a correction, since the combined total went above 20 times. We're hearing some calls for a "Rule of 21."

As stocks keep rising, many investors are wondering if it's a bit too convenient that the needle keeps moving...

Perhaps this simple rule is a little too simple...

Perhaps this simple rule is a little too simple...

The shifting goalposts might seem like a sign that investors always looking to be bullish are just constantly reevaluating the narrative, or that inflation is becoming less important to valuations. In reality, as we discussed back on March 1 and have talked about many times before, inflation is critical to equity valuations.

The goalposts keep moving as a result of other factors alongside inflation that affect market values...

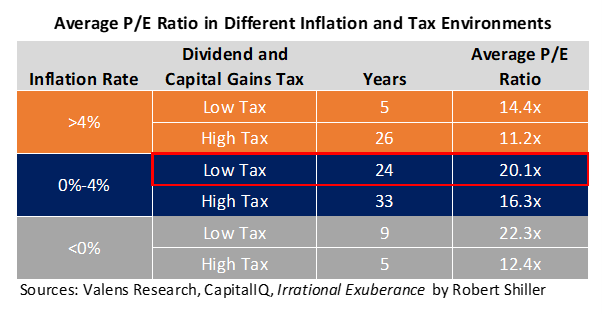

As regular Altimetry Daily Authority readers know, both inflation and taxes have their own effect on the P/E of the market.

Over the past two decades, inflation has been consistently low, thus keeping P/E ratios up. However, the rule has to be adjusted "up" to 21 partly because the simple rule doesn't capture the effect of taxes. Taxes have been in a secular decline for the past 40 years. As taxes drop, more money goes from a company's net income to investors' pockets. This means shareholders get more bang for their earnings dollar, and so are willing to pay a higher premium.

As you can see in the table below, a lower tax rate leads directly to a higher average P/E ratio, no matter the inflationary context...

Additionally, the simple 'P/E ratio plus inflation' relationship of the Rule of 18 (or more) fails to capture the effect of compounding...

Additionally, the simple 'P/E ratio plus inflation' relationship of the Rule of 18 (or more) fails to capture the effect of compounding...

Inflation builds on itself, just as higher compound interest in a savings account leads to exponentially higher returns.

If the U.S. experienced 1% inflation for five years, a dollar in 2026 would be worth $0.95 in 2021. Meanwhile, if the U.S. experienced 5% inflation – a small increase – a 2026 dollar would only be worth $0.78 in 2021. At 10%, the 2026 dollar would be worth just $0.62 today.

Due to the compounding effect of any rate over time, as inflation changes, there isn't a linear relationship with the P/E ratio... but an exponential one.

This means a rule of 18 or 20 or 21 will never hold true over a long period of time. Too many other variables determine how cheap or expensive the market is – including taxes, average returns, credit factors, and more.

This is why, here at Altimetry, we don't just focus on that simple rule, but instead look at things in a broader context. When evaluating market P/Es, we look at both taxes and inflation. When looking at market direction, we also look at credit signals and investor sentiment.

Instead of worrying about what rule of thumb or single metric to use for gauging if the market is undervalued or overvalued, investors should be looking at the right, complete dataset.

Regards,

Joel Litman

March 15, 2021

For years, investors used a simple rule of thumb to determine whether the market was cheap or expensive...

For years, investors used a simple rule of thumb to determine whether the market was cheap or expensive...