Jerome Powell currently has one indicator on his mind...

Jerome Powell currently has one indicator on his mind...

In late February, the head of the U.S. Federal Reserve testified before Congress. As the sitting chair of the central bank, it's part of Powell's regular duty to report on monetary policy to the Senate and House and Representatives.

In recent testimonies, Powell discussed all manner of economic policy, from employment to tax cuts to stimulus spending.

These events are a chance for senators and representatives to show their constituents they're making sure the Fed is watching out for them, so a Fed chair usually gets questions about how the central bank's policies will directly affect the concerns of the voters.

So it was interesting that this time up on Capitol Hill, Powell was asked about little other than inflation.

Powell stated inflation remains well below the Fed's target level of 2%. He also said the Fed is "committed to using our full range of tools... to help ensure the recovery from this difficult period will be as robust as possible."

Powell explicitly talked about how inflation was still "soft," and the Fed would be sure to avoid a situation like the 1970s. (Back in 2019, we talked about how double-digit inflation in the '70s suppressed stock values.)

These concepts still ring true today. High inflation means investors lose out on returns, and folks everywhere lose buying power.

However, Powell's assurances come at a time of low inflation. Over most of the past seven years, inflation has been below 2%. It even approached zero during the worst part of the coronavirus pandemic.

This messaging might have you scratching your heads... After all, it would seem that a plethora of other economic problems should be higher on the Fed's radar. However, this comes back to an indicator we discussed recently...

The yield curve is just one signal that warns of inflationary pressure...

The yield curve is just one signal that warns of inflationary pressure...

As we explained in the February 22 Altimetry Daily Authority, many pundits view the sharp rise in 10-year U.S. Treasurys as a sign that the markets are hunkering down for high inflation. However, it's not just the yield curve that warns about this possibility...

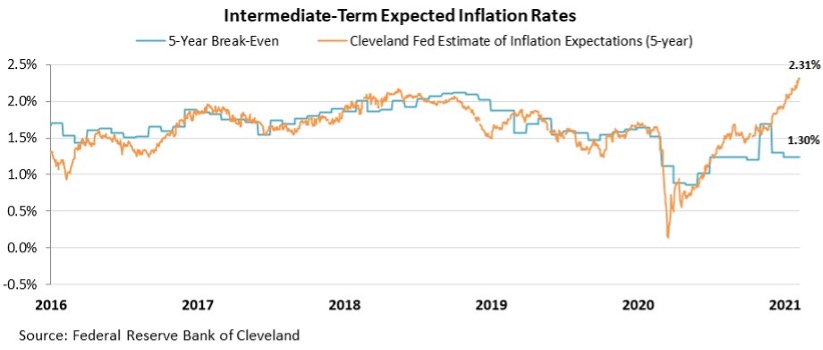

The Cleveland branch of the Federal Reserve tracks an expected inflation rate over different time periods using a variety of inflationary signals.

At the beginning of 2020, the Cleveland Fed put inflation expectations on the low end of five-year levels. However, by February of 2021, inflation expectations have reached five-year highs. Take a look...

Right now, a confluence of factors are leading to this expectation for rapidly increasing inflation...

Right now, a confluence of factors are leading to this expectation for rapidly increasing inflation...

The first is the Fed opening the monetary floodgates, along with the government's prior and future stimulus plans involving literally sending money to taxpayers. Policy makers are clearly prioritizing keeping employment high rather than taming inflation.

Furthermore, while the economy has been hampered from the pandemic, the promise of easing quarantine restrictions promises to boost spending.

With so many folks saving their cash for vacations, spa trips, or just dining out after the coronavirus is under control, more cash chasing the same goods threatens inflation. Meanwhile, as supply chain disruptions become unsnarled, supply constraints could drive prices even higher.

Taken together, these factors lead to a probability of higher inflation going forward.

And yet, it's important to keep in mind that this inflation isn't going to strangle the economy like it did in the '70s. It is starting from multi-decade lows.

Most likely, the rate will rise from the 1.5% to 2% levels of the past five to seven years to around 2% to 2.5%. If the Fed were to really allow things to heat up to ensure an economic recovery, inflation rates may even hit 3%.

This is leagues below the Senate's fears of a return to '70s inflation levels of 15% or greater.

However, any amount of inflation may still affect your portfolio...

However, any amount of inflation may still affect your portfolio...

No matter what the inflation rate is, investors should always keep an ear to the ground to understand how it can affect stock prices.

Inflation distorts the discount rate for any asset. For example, inflation reached 15% in 1980. While the Dow Jones Industrial Average was up 15% that year, investors only took home a "real" (meaning inflation-adjusted) return of 3%, as their money lost its worth from inflation.

If investors take home less during a period of high inflation, they aren't willing to pay as much for cash flows out in the future. This in turn crushes valuations.

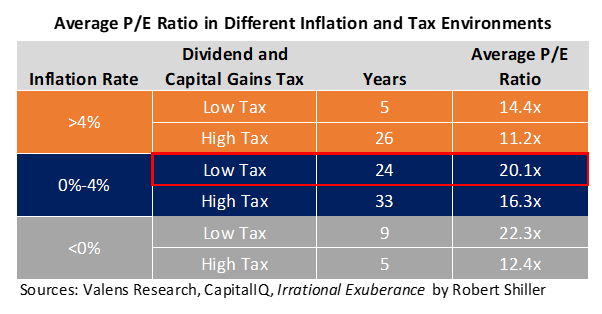

In the table below, we can see how low and high inflation environments change valuations. In times when inflation is greater than 4%, average price-to-earnings (P/E) ratios are between 11.2 and 14.4... and during periods with moderate inflation, these ratios range between 16.3 and 20.1.

This trend is exacerbated for growth companies, as most of the value of these businesses is tied up in cash flows that are coming in future years. As that cash flow becomes less valuable today, it can lead to big swings in valuations like we saw over the past two weeks.

So it's no surprise that as Powell was giving his presentation to the Senate, high-growth tech and biotech stocks came under selling pressure.

With changing expectations for inflation, it's critical to have a plan in mind...

With changing expectations for inflation, it's critical to have a plan in mind...

We highlighted this inflation insight and more in a new feature we added for Altimeter subscribers.

Once a month in our Altimeter Weekly report, we distill our macro insights into a single framework called the Timetable Investor to dispense actionable advice, such as when to aggressively invest in equities or when to pull back before market volatility.

It takes the insights that we discuss pieces of each Monday here in the Daily Authority and consolidates them into an entire "mosaic" for how to think about the market outlook.

We just released the latest edition on Thursday. To learn how to gain immediate access, click here.

Regards,

Joel Litman

March 1, 2021

Jerome Powell currently has one indicator on his mind...

Jerome Powell currently has one indicator on his mind...