Ford Motor (F) just threw a curveball at the electric-vehicle industry...

Ford Motor (F) just threw a curveball at the electric-vehicle industry...

The automaker is pausing production on the F-150 Lightning – its flagship electric truck – through the end of the year.

For an industry that has been banking on the electric-vehicle ("EV") wave, this is a huge deal. It has been a brutal year for EVs. Even Tesla (TSLA), the market leader, has had to slash prices just to keep demand up.

When Ford – a legacy brand with a major stake in the EV game – halts production, it raises questions about the sustainability of these ambitious EV plans.

But as we'll break down today, this pause isn't just about demand... It highlights some serious issues with Ford's strategy.

Last year was a win for Ford...

Last year was a win for Ford...

After years of struggle, the automaker's Uniform return on assets ("ROA") hit 12%... its highest level in a decade.

Here's the catch – Ford has poured billions of dollars into EV production, counting on future demand. And people aren't buying cars the way they used to, especially not expensive EVs.

With consumers pulling back on big-ticket purchases, that heavy investment could turn into a heavy burden. While Ford's 2023 returns looked promising, the reality is, those gains could quickly fade.

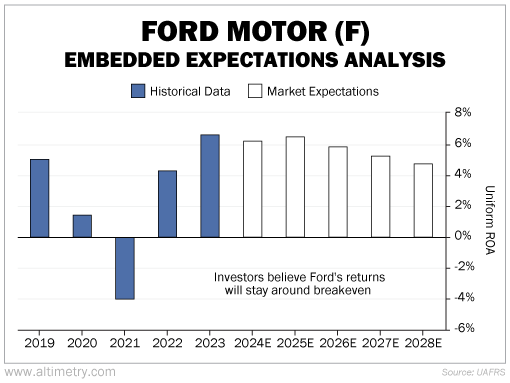

That could be bad news if investors have high hopes for Ford. So let's take a look at what the market thinks using our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Investors are pricing in an expected Uniform ROA of around 5% – a level typical of mid-cycle returns. That's right around the breakeven level.

Take a look...

In short, Ford's market valuation assumes a fairly steady state... but if consumer demand for EVs keeps slipping, shares could take a hit.

Subsidies, tariffs, and incentives only go so far in propping up an industry with shaky demand.

Not to mention, EV demand could fall even further during Donald Trump's next term. He's very likely to cancel existing tax credits.

Ford needs to rethink its EV strategy if it wants to keep investors on board...

Ford needs to rethink its EV strategy if it wants to keep investors on board...

The automaker's EV pivot was supposed to be a game changer. But right now, it's starting to look more like a gamble – and an expensive one at that.

If Ford can't adapt to the slowing EV market, its ambitious plans could become a drain on profitability rather than a source of growth.

Its next moves in this space could make or break its positioning in the market – and determine whether it can truly deliver the returns investors expect.

Regards,

Joel Litman

November 14, 2024

Ford Motor (F) just threw a curveball at the electric-vehicle industry...

Ford Motor (F) just threw a curveball at the electric-vehicle industry...