The growth wave is coming...

The growth wave is coming...

Just last week, we talked about how constrained supply chains and old assets mean the economic recovery will include a new wave of capital expenditures ("capex").

Physical assets such as property, plant, and equipment (PP&E) are at their oldest levels in the U.S. and need to be replaced. As a result, companies will be going out to customers and spending cash, fueling a virtuous cycle to boost economic growth over the next few years. Capex spending is already up by 15% on an annual rate.

This wave of spending bucks a trend going back to the early 1980s.

In the June 14 Altimetry Daily Authority, we highlighted how growth rates have trended downward over the past 40 years. After a period of reckless growth in the '80s, a focus on tightening belts, along with the Great Recession, made management teams leery of investment.

Now, management teams are looking to make up for lost time...

Now, management teams are looking to make up for lost time...

With supply chains still tangled by the coronavirus pandemic and differing levels of reopening across the globe, this growth might not come immediately. However, the upcoming capex spending will be spread out into 2022 and beyond, even if it comes at the cost of a slower second half of 2021.

Consider demand for hot-ticket items, such as semiconductors... In this case, silicon mines will be buying dozers, fabricators will be investing in plants and machinery, trucking companies will be ramping up fleets, and shipping providers will be adding capacity.

All told, global tech firms are expected to boost capex by 42% this year relative to 2019. For example, Taiwan Semiconductor Manufacturing (TSM) – the world's largest chipmaker – recently announced it will be investing $100 billion into manufacturing over the next three years.

Additionally, Danish shipping institution Maersk is buying more shipping containers to keep the world connected. The global order book for the container ship fleet has risen from 9% in October to more than 15% in April.

Across the global economy, we can see this spending trend is only accelerating.

Now, let's see how these companies are actually going to pay for this capex...

Now, let's see how these companies are actually going to pay for this capex...

With assets in dire need of replacement and businesses finally willing to spend, management teams need to evaluate how they are going to pay for this planned wave of investment.

The two common ways management teams pay for these types of expansions are through the cash they have on hand or raising capital through issuing debt or equity. As we've highlighted previously, companies taking on debt is a healthy part of the economic cycle.

And yet, despite debt being an important growth mechanism, it's also what causes recessions. Every sustained recession throughout history has been caused by a credit crisis. Furthermore, as management is naturally more reluctant to invest with money it doesn't already have, the more debt needed to meet this upcoming capex cycle, the more subdued it might end up being.

Fortunately for the wider economy, access to capital isn't a problem that most companies are dealing with today.

Thanks to the robust response by central banks to the pandemic, many companies were able to stay afloat. Now, with spending ramping up, firms are finding themselves with more cash and less short-term debt.

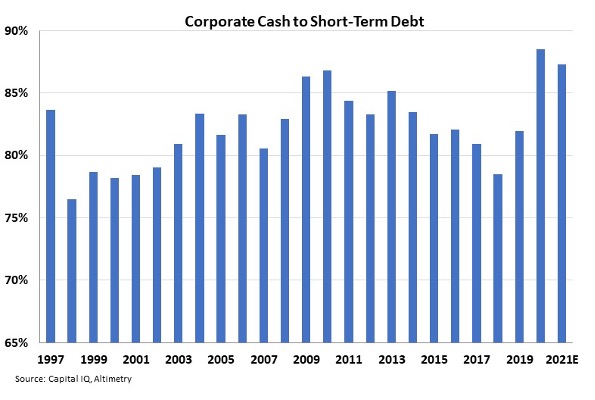

To measure the cash position of the U.S. market, we can compare the ratio between cash on hand and short-term debt over time...

To measure the cash position of the U.S. market, we can compare the ratio between cash on hand and short-term debt over time...

As you can see in the chart below, since 1997, corporations have slowly been holding on to more cash compared to short-term debt, up until a precipitous drop-off after 2015. Then, with the stimulus in response to the pandemic, cash reserves shot up near all-time highs – with an average of 87% of a company's short-term spending power in cash instead of debt.

This strong cash position is a "green light" for the upcoming capex wave.

With such high reserves, management teams don't need to concern themselves with securing new credit to fuel growth. If anything, with historically high cash levels, corporations are finally in a position to safely deploy growth capital.

The pandemic is receding and companies are looking for long-term growth... Combined with large war chests, this means that we can expect large-scale corporate investment ahead.

Regards,

Joel Litman

June 28, 2021

The growth wave is coming...

The growth wave is coming...