Despite a banner earnings season, Wall Street has been disappointed...

Despite a banner earnings season, Wall Street has been disappointed...

As of last week, around 98% of S&P 500 Index companies had reported first-quarter results. This earnings season was a standout, with 85% of names reporting a positive earnings-per-share ("EPS") surprise – the highest level since the metric was tracked in 2008.

Furthermore, earnings growth itself came in at 51.9% relative to the first quarter of 2020, comparable to an expectation of 23.7% in late March.

But despite these barn-burner results, the S&P 500 has increased less than a percentage point since earnings began. Meanwhile, the Nasdaq Composite Index is down 1%.

If this sounds a little familiar to regular Altimetry Daily Authority readers, it's because we've been reporting on this throughout May.

Back at the beginning of the month, we explained how management teams are less bullish about growth than they were in late 2020. We said this wasn't a reason to sell, but we anticipated flat markets.

Later in the month, we also discussed how one metric of investor bullishness, investor credit, showed some concerning signals.

Finally, on May 24, we highlighted exactly why blowout earnings weren't moving the needle on the market.

While companies are seeing incredibly strong performances, these results are already "baked in" to stock prices after the 2020 climb.

Furthermore, at current valuations, the market is pricing in the next business cycle to be the most profitable one in the past 20 years. With a market already priced for perfection, it was inevitable for markets to trend flat to down, even with companies overperforming.

Now, let's expand our scope to get an even better sense of market expectations...

Now, let's expand our scope to get an even better sense of market expectations...

As we've explained numerous times here at the Daily Authority, one of the key ways we try to understand market expectations for the future is to look at expectations for return on assets ("ROA").

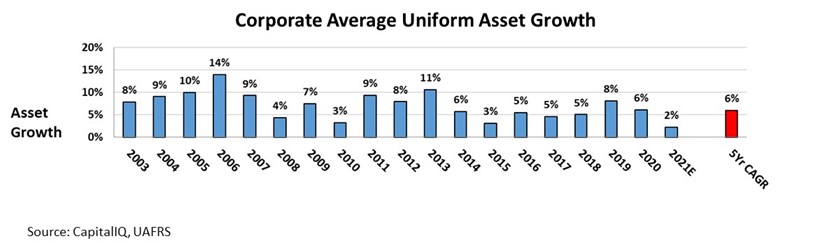

To get a full picture of what the market is pricing in for the future, we can also look at market expectations for company reinvestment – asset growth.

At current valuations, investors aren't just pricing in an all-time high for midcycle ROA... Asset growth is also expected to sit at prior cycle levels.

At first glance, growth in line with prior bull markets seems to be neither bullish nor bearish for expectations. But to understand what this says about investor expectations, we must pull back the curtain on market history.

Over the past three business cycles, asset growth has – on average – steadily declined between each cycle.

After every recession, management teams learn to tighten their belts and become more reserved about investing in new operations. Furthermore, management techniques like "lean" and "six sigma" teach executives to slash costs and operate with less working capital and other investments.

In the 1980s and 1990s, management teams were much more concerned about growth at any cost. Today, board members and investors hold the C-suite more responsible for making sure investments have a better return than the cost of capital for the business.

Overall, this focus on smart investment has benefitted businesses and is part of the reason why returns climb after every recession. It has also meant that each cycle, management teams grow their companies, on average, less.

As a result, an expectation for growth to remain flat this cycle may be optimistic for the next five years.

In the cycle through 2006, average growth was around 11%. In the next cycle, growth was around 8%... And in the most recent cycle from 2015 to 2020, growth was only around 5% to 6%.

With expectations of 6% over the next five years, markets are pricing in a multicycle slowing in investment to stop now. Take a look...

Expectations for future growth may have been a little too optimistic. Additionally, in the short term, if management teams are less confident about their outlook, they may hold off on investing.

As the red bar in the chart above shows, the market isn't pricing in this at all.

Since investors already priced in banner growth in the recent first quarter, the growth didn't push the market higher. If growth is more of a disappointment later this year based on the data that we see now, the market may continue to trade sideways.

Regards,

Joel Litman

June 14, 2021

Despite a banner earnings season, Wall Street has been disappointed...

Despite a banner earnings season, Wall Street has been disappointed...