First-quarter earnings season is drawing to a close...

First-quarter earnings season is drawing to a close...

With most of the S&P 500 Index's component companies having reported numbers, we can begin to look at how Corporate America has matched up to analyst forecasts coming out the coronavirus pandemic.

So far, a strong 85% of reporting companies have beat their analysts' expectations. On average, 74% of companies have beaten quarterly estimates over the past five years. The economy appears to be accelerating faster than expected coming out of the pandemic.

If earnings continue at this rate, the first quarter of 2021 may set a record for the earnings season with the most positive surprises since the third quarter of 2013. That quarter saw a beat rate of 83%, putting 2021 on track for a new record.

The highest rate of analysts under-guessing performance has been in the Financial sector, where a staggering 92% of companies beat analyst expectations.

Thanks to the U.S. and international governments coming in with strong stimulus packages, there have been fewer defaults than expected over the past year, thus shoring up these Financial names.

Even the weakest industries have done better than expected this quarter. Real estate has been upset dramatically over the past year by the societal changes of the "At-Home Revolution," and commercial real estate weakness has pulled down returns. Despite this weakness, 66% of companies in the Real Estate sector still beat analyst expectations.

After such an impressive showing this earnings season, investors logically assumed the stock market would be rocketing higher. However, this hasn't been the case...

Since financial-services giant JPMorgan Chase (JPM) unofficially kicked off the earnings season on April 14, the market is practically flat. This is in stark contrast to the 11% gain from January first to the start of earnings season.

To understand this disconnect, we have to peel back the GAAP numbers...

To understand this disconnect, we have to peel back the GAAP numbers...

As regular Altimetry Daily Authority readers know, we put little stock in the as-reported financial metrics that companies use during earnings calls.

While understanding revenue and forward-looking projections is crucial, a company's earning power is distorted by GAAP standards. These as-reported metrics fail to show the real profitability of a business.

But by removing the financial distortions through Uniform Accounting, we can compare historical returns across different industries on an apples-to-apples basis.

By aggregating the companies that make up the stock market, we can see the historical trend for return on assets ("ROA") and what the market is expecting for the future at current market valuations.

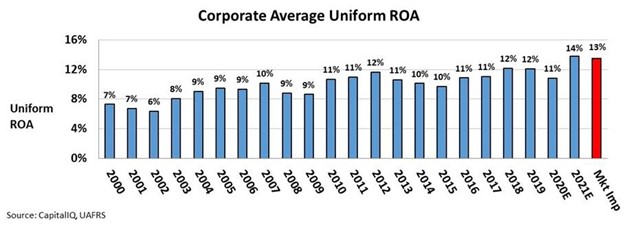

Over the past two decades, Uniform ROA has been cyclically, yet steadily, improving. While returns fall during recessions, most notably in 2008 and 2009, huge macroeconomic tailwinds have served to drive up returns across this time frame.

The U.S. market has focused more on higher-return intellectual property- and service-based businesses rather than manufacturing, thus leading profits to expand.

Furthermore, a constant focus on improving working capital efficiency, taking costs out of the system, and being smart around investing in new ventures have also pulled returns higher.

Unsurprisingly, 2020 put a pause on this steady increase, with returns falling for the first time in five years.

Now that we have context as to the historical profitability of the market, we can look at what analysts and investors are expecting. As you can see in the chart below, analysts are pricing in a record year for 2021, with returns to reach an average of 14%.

Meanwhile, the red bar is what the market is pricing in for "mid-cycle" returns. As this is a long-term price target, this means the market expects average returns of 13% over the next business cycle.

In other words, the market is already pricing in the next cycle to be the most profitable one in the past 20 years.

So it's no wonder that even after companies and management teams reported on barn-burner quarters, the market hardly budged. If record-breaking earnings calls are already being priced into the current market, then it's hard to beat perfection.

As we said earlier this month, a longer-term pullback is unlikely... But the corporate ROA picture is more support for a bumpy market over the next few months.

Regards,

Joel Litman

May 24, 2021

First-quarter earnings season is drawing to a close...

First-quarter earnings season is drawing to a close...