If you gave credit investors a crystal ball in March 2020 that would enable them to look forward a year, they wouldn't believe the results...

If you gave credit investors a crystal ball in March 2020 that would enable them to look forward a year, they wouldn't believe the results...

Fourteen months ago, few people were prepared for the massive shift that was about to be unleashed on the market and reverberate through the world.

If you had told credit investors back then that the coronavirus pandemic would last for more than a year, they would have foreseen the end of corporate and consumer credit as we knew it.

No credit analyst worth his salt would think credit would be intact after months of no restaurant visits, concerts, sporting events, and more. And yet, not only is corporate credit strong, but ratings agencies are predicting less than 2% default rates for "junk" bonds in the U.S. this year.

This is the lowest rate of default since 2017, and it's after months of strapped cash flows and unprecedented business uncertainty. Again, even if investors last March could have seen the future, they would have been incredulous.

This corporate credit strength is thanks to unprecedented action from governments across the globe...

This corporate credit strength is thanks to unprecedented action from governments across the globe...

As Bloomberg explains, there has been upwards of $12 trillion combined monetary and fiscal stimulus in the U.S. since last February. With the floodgates open, it has been incredibly easy for investment-grade and high-yield companies alike to secure funding.

These names have issues of $1.5 trillion of new debt in credit markets since the pandemic started... And that doesn't even capture lending from banks, the government, and direct investments.

Despite this surge in new debt from the start of the pandemic, the yields on high-risk distressed corporate debt have fallen from 20% to just 8% today.

With rates so cheap, it became easier than ever for higher-risk companies to reevaluate their balance sheets and refinance their debt across multiple years.

As we've said before here at Altimetry Daily Authority, the match that lights the powder keg of any prolonged recession is a credit crisis. Despite the economic chaos, swift government intervention prevented the pandemic from becoming a financial meltdown.

The question now is, did the U.S. simply kick the can down the road?

The question now is, did the U.S. simply kick the can down the road?

While default risk is expected to fall to record lows, this massive stimulus didn't change the way the credit cycle works.

Many investors fear that with such easy credit, the U.S. Federal Reserve might only be amplifying the problem next year by giving unstable companies more debt before they fail. Others fear that this easy access to capital has created soon-to-fail "zombie companies." These firms should have been swept away by competition, but they still exist thanks to government handouts.

Without the numbers to back them up, any forecasts on the future of the economy are just idle speculation. So, to better understand the credit risk, we can turn to our Credit Cash Flow Prime ("CCFP") analysis...

When thinking about the market as a whole, we can aggregate data for publicly traded companies with debt to build an aggregate CCFP and get the same level of insight as we would for an individual company. We can use the data to understand the strength of credit and the foundation of the economy.

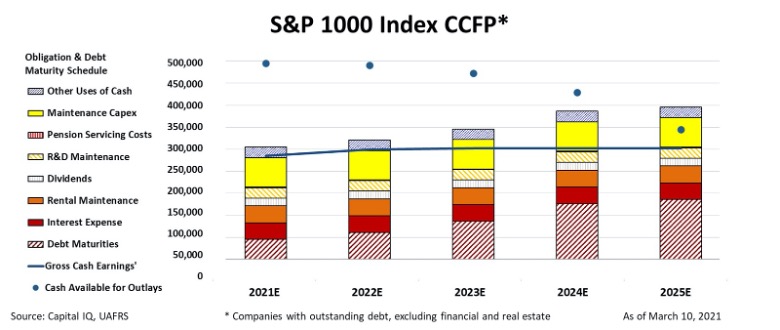

For a more accurate focus, we'll look at the S&P 1000 Index. This is comprised of 1,000 smaller companies than those in the S&P 500. We examine small- and mid-cap companies, as the S&P 500 tends to have businesses that are so safe and liquid that it washes out any insights about credit trends.

In the CCFP chart below, the stacked bars represent the S&P 1000 companies' obligations each year for the next five years. These obligations are then compared to cash flow (blue line), cash on hand at the beginning of each period (blue dots), and undrawn credit revolver (blue triangles).

As you can see, in this riskier segment of the market, cash flows alone still cover all obligations other than potential share buybacks through 2023. And even in 2023, cash flows alone cover almost all capital expenditures ("capex"), along with all other corporate obligations.

Critically, these companies also have cash on hand to cover all obligations – including outstanding debt – through 2024.

By looking at this CCFP for the next few years, we can see that in general, companies will have little issue handling their obligations over the next few years.

In the near term, with unprecedented government intervention, companies are still safe.

Last week, we explained that we may see some short-term volatility over the next few months as the market's expectations begin to outpace reality... But this doesn't mean investors should panic in any pullback.

Thanks to this strong credit position, there's little threat of a protracted recession laying waste to your portfolio. Due to easy credit, the market quickly bounced back in 2020. With credit still strong, any dip is a buying opportunity... not a reason to run for the hills.

This environment is a great time to invest...

This environment is a great time to invest...

And in Altimetry's Hidden Alpha, we've loaded the portfolio with stocks that our Uniform Accounting framework has identified as low-risk, high-upside investment opportunities thanks to big mispricing by the market.

You can learn more about Hidden Alpha – including how to gain access to the full portfolio – right here.

Regards,

Joel Litman

May 10, 2021

If you gave credit investors a crystal ball in March 2020 that would enable them to look forward a year, they wouldn't believe the results...

If you gave credit investors a crystal ball in March 2020 that would enable them to look forward a year, they wouldn't believe the results...