The economy is starting to slow down...

The economy is starting to slow down...

Unless you've been living in a cave, this probably isn't news. For months, the mainstream media has been expressing concerns about a potential recession.

We've enjoyed a decade of strong growth. Now, things have changed. The largest economies around the world have been facing rising inflation. Pandemic-related supply-chain delays are still hurting businesses.

And the Russian invasion of Ukraine has disrupted trade... and caused an energy crisis in parts of Europe.

Even some of the biggest international agencies are getting on board.

The International Monetary Fund ("IMF") and World Bank have both warned about a worsening global outlook.

They believe we'll see slowing economic growth in 2023 as the risk of a recession grows.

Regular readers know we also believe we're on course for a recession. However, that doesn't mean the economy is headed for catastrophe.

As I'll explain today, the numbers tell us to expect a sideways market for the foreseeable future.

The overall market outlook has gotten worse...

The overall market outlook has gotten worse...

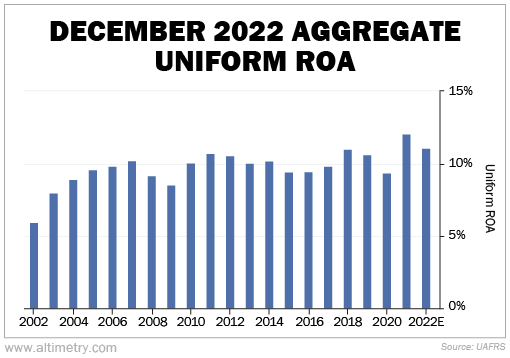

Every month, our team at Altimetry updates what we call our U.S. aggregate return on assets ("ROA") model. It averages the Uniform ROAs of all public U.S. corporations.

Aggregate Uniform ROA was forecast to drop 100 basis points ("bps") – or 1% – in 2022. Take a look...

Now, there are a few important points to keep in mind here...

A 1% move might not seem like a lot. However, when you look at it in terms of the whole U.S. economy, it's pretty significant. It corresponds to about a $100 billion drop in profits for 2022.

Uniform ROA was forecast to be flat (if not slightly up) for the year as recently as August. The picture has gotten worse since then.

Plus, Uniform ROA expectations for 2023 have come down. Previously, that number was expected to approach 14%... Now it's looking to be closer to 13%.

That's still an improvement from 2022, although the improvement is getting smaller.

On top of that, earnings may also fall. Uniform earnings for 2022 were previously projected to rise 5%. Now, they're expected to have shrunk by 3%.

Earnings growth drives the stock market higher. That's why last year, the S&P 500 slid 19%.

Inflation has pushed costs to historic highs. Both companies and consumers are having trouble keeping up.

In an effort to battle inflation and slow down the economy, the Federal Reserve has aggressively raised interest rates.

This has resulted in the decline of economic growth that we're seeing today and expecting to see for the rest of 2023.

So right now, we're getting mixed messages between ROA and earnings expectations. These data points look like they'll be better in 2023 than 2022.

That being said, as long as expectations are falling, the market won't climb much higher. The hope that folks had for the new year is already starting to fade.

Falling expectations will put a cap on stock performance this year...

Falling expectations will put a cap on stock performance this year...

This is another reason why we expect a continued sideways market in 2023.

We've been calling for a deceleration of the economy and a recession on the horizon for months. The data reaffirms our beliefs.

That means as an investor, you need to be tactical this year. In a sideways market, some industries will perform much better than others.

There will still be moneymaking opportunities. However, this isn't a "buy and hold" type of environment.

You won't earn strong returns by treating today's market like the 13-year bull run that followed the Great Recession.

Regards,

Joel Litman

January 9, 2023

The economy is starting to slow down...

The economy is starting to slow down...