The economy's 'medicine' doesn't taste good going down...

The economy's 'medicine' doesn't taste good going down...

As we've written in recent weeks, many of the issues our economy is facing today are the result of a massive demand spike following the COVID-19 pandemic.

In short, consumer demand for goods has reached historic levels. And supply-chain deficiencies mean the market can't satisfy this demand. That's what has led to the sky-high inflation we're currently seeing.

The Federal Reserve is trying to control that inflation. And historically speaking, the best tool in its arsenal is interest rates.

The Fed controls the rate commercial banks pay to borrow money overnight – called the federal-funds rate. This is effectively the lowest interest rate in the economy.

Raising the federal-funds rate slows down borrowing because banks must increase their own rates to pay for borrowing money. In turn, that means loans across the economy become more expensive.

We've explained before that we think the U.S. is in the early stages of a supply-chain supercycle. Investment in the supply chain will eventually improve the inflation picture. But it will take time for these changes to take shape.

In the meantime, the Fed is hoping that curtailing demand through higher rates will be a quick inflation fix. But while this solution might make us feel better in the long run, it likely won't be painless...

Declining demand will lead to slower revenue growth for companies. Additionally, manufacturing costs will stay high even as demand tapers. This hurts earnings since companies can't make the same profits they recorded in 2019.

Both Morgan Stanley (MS) and Goldman Sachs (GS) project corporate profit margins will decline in the second half of 2022 as a result of the Fed's actions.

We may even be on the verge of an "earnings recession" on an as-reported basis. In simple terms, that's two or more consecutive quarters of declining earnings.

Uniform Accounting backs up this theory...

Uniform Accounting backs up this theory...

Our aggregate return on assets ("ROA") data, which measures returns for all companies in the Altimeter, agrees with Morgan Stanley and Goldman Sachs. In recent analyses for our paid clients, we've warned that an earnings recession is on the horizon.

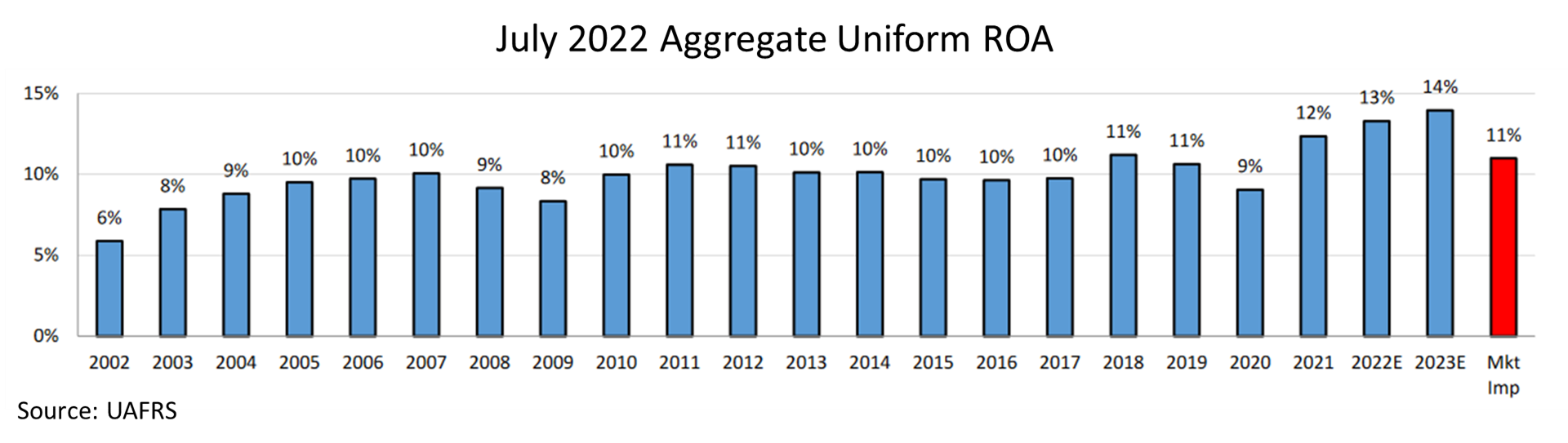

In July, ROA was projected to rise in 2022 thanks to strong earnings in the first half of the year. Take a look...

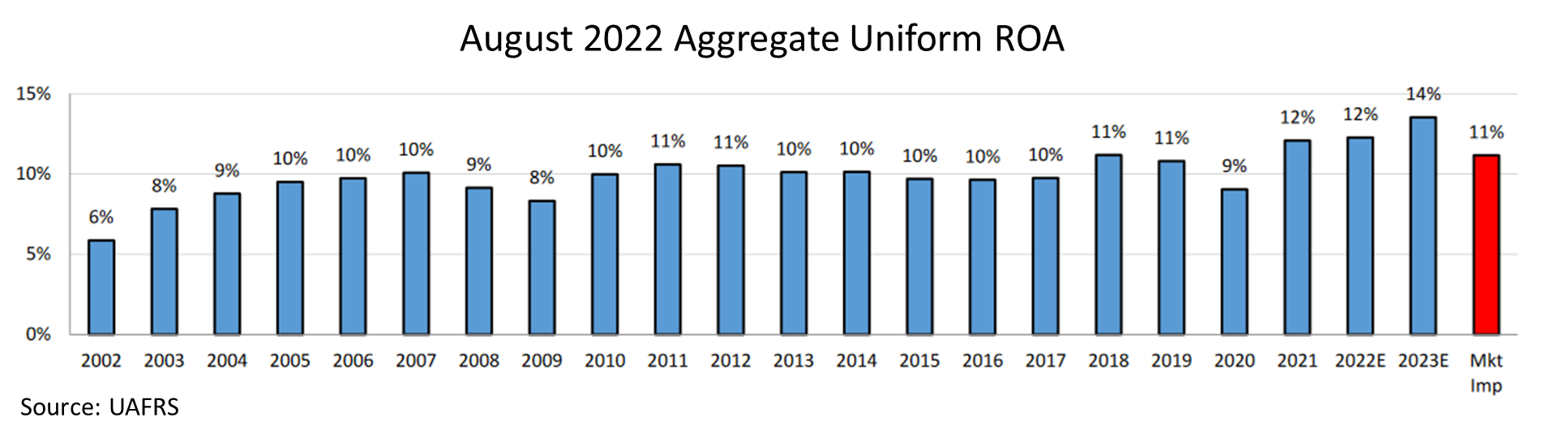

But today, things have changed. The aggregate ROA chart now shows that earnings will remain flat in 2022 thanks to a weaker second half of the year.

If ROA remains flat and company investments don't grow, we could really end up in an earnings recession.

But that doesn't necessarily spell doom and gloom for the economy...

But that doesn't necessarily spell doom and gloom for the economy...

In fact, things have been playing out just as the Fed hoped. Credit markets are tightening and earnings growth is slowing down. This is a sign that the Fed is putting the brakes on inflation. And it will be able to lower rates during the next recession.

Plus, expectations for 2023 ROA remain at an all-time high of 14%. So while high rates might stunt near-term earnings and economic growth, things should start to heal in 2023. Interest-rate hikes will help stabilize the economy in the long run.

We aren't out of the inflationary woods yet... But the Fed is taking the right steps toward navigating it.

Regards,

Joel Litman

September 12, 2022

The economy's 'medicine' doesn't taste good going down...

The economy's 'medicine' doesn't taste good going down...