This industry is under attack from all sides...

This industry is under attack from all sides...

The last decade has been the era of the platform and the side-hustle (also known as the "gig economy"). Uber, Lyft, Grubhub, Postmates, TaskRabbit, and other successful "gig" platforms have transformed how consumers interact with the world... and how people think about earning an income.

But if the 2010s were the decade of the gig economy, 2019 was the year many of these businesses started to see serious regulatory and competitive pressure... and 2020 may be the year the market starts to recognize these risks.

As we closed out 2019, one major discussion point was whether gig economy workers were really employees. California passed the AB-5 bill in September, which will reclassify gig economy contractors as employees for companies like Uber. This will dramatically shift the dynamics of these businesses.

As the year ended, Uber and Postmates sued California to block the law. But more and more regulatory overhangs keep emerging for this industry... be they for safety and liability issues like Uber ran into in London when its safety record came under scrutiny... or for employee and contractor questions like those in California.

But it's not just the regulatory overhangs that have squeezed these companies... Competitive pressures are also an issue.

Uber has experienced serious competition from alternatives – like Lyft in the U.S., and Grab and Didi Chuxing internationally, to name a few – ever since the business emerged. Many drivers and riders shop across multiple ride-hailing services, which leads to price competition and weak returns.

Similarly, in food delivery, previous market leader Grubhub competes with Postmates, DoorDash, Caviar, and UberEats, among others. The race for market share limits the profit potential for investors.

And now, Google is entering the food-delivery market in earnest... and that has put all the other food-delivery gig platforms on notice.

Google has a history of entering platform markets and wiping out incumbents. The most recent example was in travel, where its entrance into hotel and airline ticket sales has significantly impacted Expedia and TripAdvisor.

Expect to see more and more of these types of stories in 2020. Investors will continue to be disappointed by these platform companies never getting the dominant market share they'll need to avoid the competitive pressures and manage the regulatory overhangs that have cropped up.

Now that it's a new year, we can finally start getting ahead on everyone's favorite pastime...

Now that it's a new year, we can finally start getting ahead on everyone's favorite pastime...

Paying taxes.

It's becoming easier than ever to get started filing your annual taxes way ahead of the April 15 deadline.

With online tax software continuously improving and adding new features, it's now possible to load your various tax documents as you receive them, rather than having to collect them all together to go through in one night or to send to your accountant.

The convenience factor alone has driven plenty of Americans to online tax programs... And that's not even factoring in the much lower cost compared with a traditional accountant.

In the September 19 Altimetry Daily Authority, we discussed how more and more people have turned to Intuit's (INTU) TurboTax software.

While Intuit is easily the largest provider of online tax software, as you may recall, its stock was not nearly as exciting. In fact, we wrote that to justify stock prices at that time, Intuit would need to file every tax form in the U.S. and then some.

Although the market leader may often be a good investment, there's not always as strong a relationship between being a good company (or a market leader) and having a good stock.

Sometimes investors pay too much attention to the biggest player for this reason. While Intuit may have gotten too popular with investors, the No. 2 in the industry has gotten much less attention... and it looks much more compelling as a result.

H&R Block (HRB) is the second-largest provider of online tax-preparation services in the U.S. Last tax season, it prepared more than 23 million tax returns – the majority of which were from U.S. households.

What's more, unlike Intuit – which makes nearly half its revenues from sources other than personal tax filings – H&R Block is a "pure play" tax preparation firm. The company does nothing else.

As a result, it will benefit roughly twice as much from rising demand for online tax software compared with Intuit.

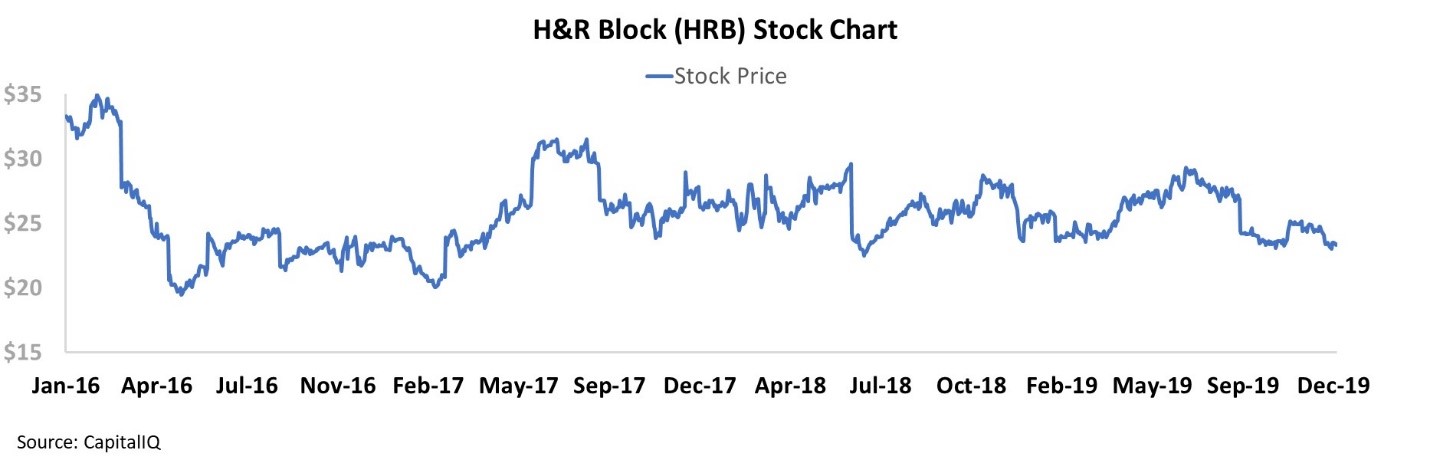

However, H&R Block's stock has fared considerably worse over the last several years. HRB shares have fallen from $35 at the beginning of 2016 to around $25 today...

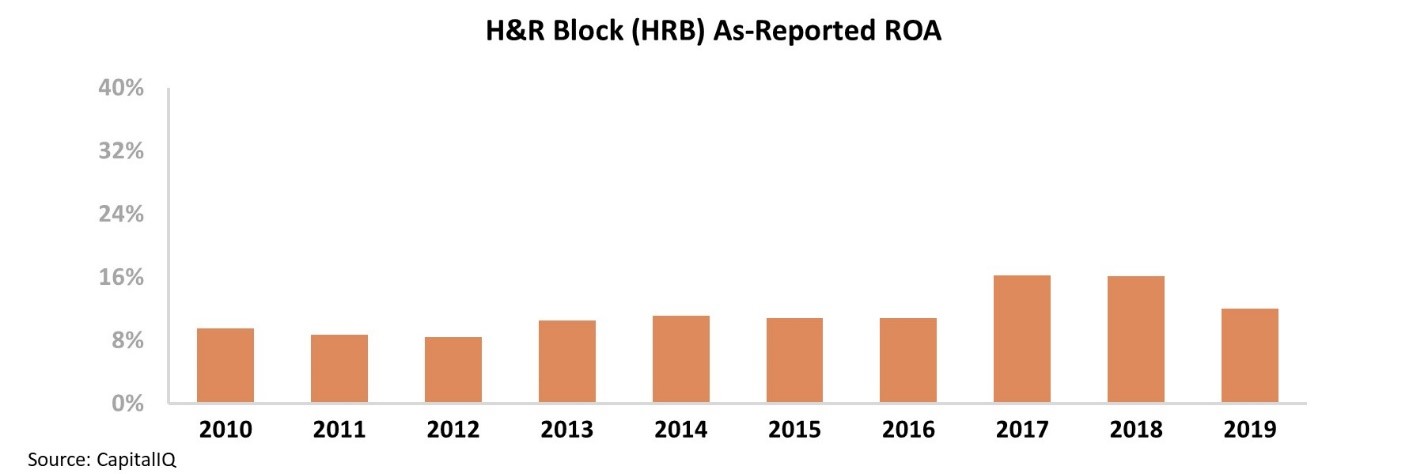

When looking at H&R Block's as-reported profitability, this seems justifiable. The company has had just average return on assets ("ROA") for most of the past decade, mainly in the 9% to 10% range. While it briefly expanded to 16% in 2017 and 2018, H&R Block's ROA has fallen back to average levels, which is a disappointing signal for investors.

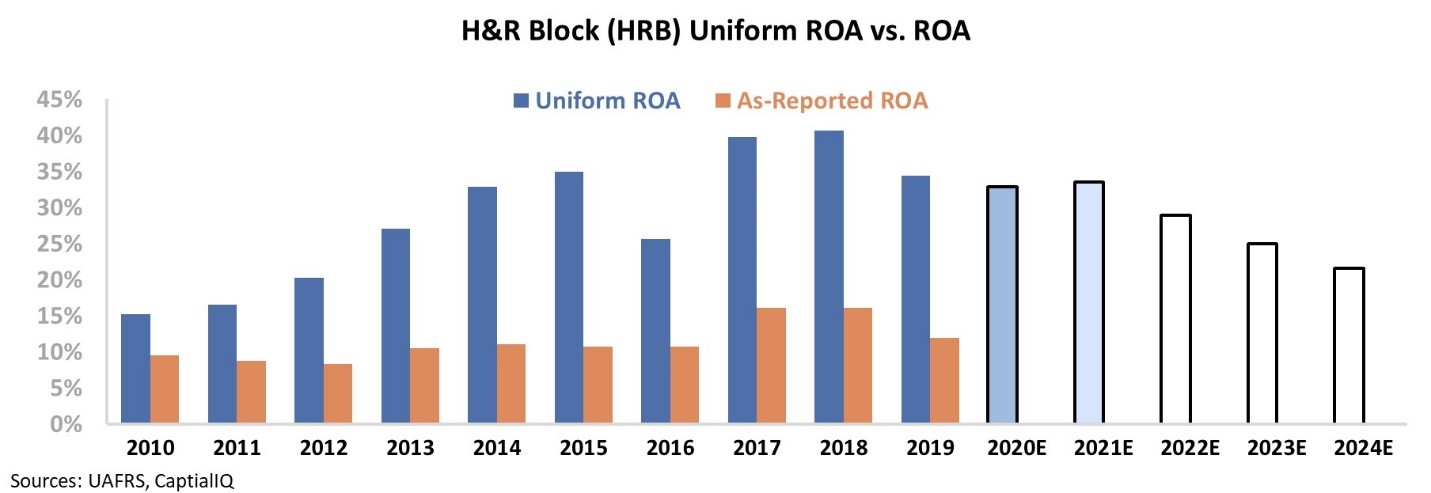

However, this isn't indicative of the company's actual returns. Once we apply our Uniform Accounting framework – adjusting for inconsistencies on traditional financial statements such as the treatment of excess cash, goodwill, and capitalizing versus expensing operating leases – we can see how H&R Block's returns have actually reacted to America's shift toward online tax software.

The chart below highlights H&R Block's historical corporate performance levels in terms of ROA and asset growth (dark blue bars) versus what sell-side analysts think the company is going to do over the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Not only is the company far more profitable than as-reported metrics would suggest, but the difference between its as-reported ROA and Uniform ROA has been growing over time – in line with the increasing popularity of online tax software...

While sell-side analysts project H&R Block's ROA to remain strong and stable around current 35% levels, at present stock prices, the market expects the company's ROA to fall to 22%. This is a level not seen since 2012... while the number of electronically filed tax returns has grown 23% since that year.

Clearly, the market has paid too much attention to the No. 1 online tax filer, while almost completely ignoring what the second-largest player has been able to accomplish. This – combined with H&R Block's potential upside – isn't evident unless you look at the right numbers.

Regards,

Rob Spivey

January 3, 2020