Wall Street parties are back...

Wall Street parties are back...

When people think about Wall Street, the mantra of "work hard, play hard" comes to mind.

While equity traders and investment bankers may put in 120-hour workweeks, they tend to do so in fashion when they get a chance to cut loose.

Of course, by fashion, we mean fancy suits, expensive wines, and elegant dinner parties filled with caviar and Alaskan crab legs…

The coronavirus pandemic may have put these soirees on hold for a while, but Wall Street's bankers are back at it once again, congregating in extravagant dinner halls in large numbers for the first time since the crisis began.

The head of the investment banking boutique BDA Partners recently held a dinner party to celebrate the firm's 25th anniversary. The event hosted people across the industry in a soiree reminiscent of those that helped fuel Wall Street dealmaking and networking for decades before the pandemic hit.

One reason there has been so much rebellion among Wall Street's entry-level associates over the past 19 months has been because of the lack of downtime and the significant stress loads.

Those at the analyst level haven't just seen long days of work but "full" days as well. They've been cooped up with managing directors constantly helicoptering over them with new projects, instead of supervisors playing golf or mulling over filet mignon with clients.

But now that opportunities to cut loose have returned, so too has time to recharge and recoup, potentially a sign of corporate strength on Wall Street going forward.

There's also an economic reason those on Wall Street are ready to celebrate again…

There's also an economic reason those on Wall Street are ready to celebrate again…

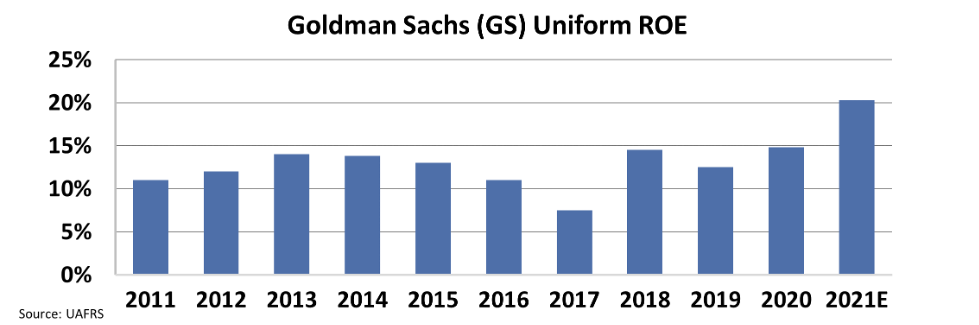

Goldman Sachs' (GS) performance, one of the world's largest and most renowned investment banks, helps to highlight just how good things are looking for Wall Street.

When analyzing the financial sector, or bank stocks, we can't use Uniform Accounting in the same way we do for other nonfinancial companies, as return on assets ("ROA") is a less relevant metric.

A traditional company, such as a manufacturing firm, uses assets like machinery and raw materials to create products. Therefore, we measure what that company's return is, compared to the tools it owns.

A bank makes money on its liabilities. So, it turns those liabilities into assets.

A bank's liabilities are the money it takes in from depositors along with any corporate debt. This is an obligation in which the bank owes and pays interest on. To make a profit, banks take that money and then lend the cash on their balance sheets back out, hopefully at a higher rate than they pay depositors and other creditors.

In other words, a return on equity ("ROE") instead of assets.

Looking at the Uniform ROE for Goldman Sachs, we see that the company never really took a big hit from the pandemic. In fact, 2020 was the highest level of ROE the company has generated over the past 10 years.

Last year's success pales in comparison when looking at the investment banking giant's outlook for 2021. Uniform ROE is forecasted to rise from 15% to 20%, levels not seen once over the past decade.

It's no wonder the bankers on Wall Street want to celebrate... as the initial public offerings ("IPOs"), mergers, and complex financial deals have all lead to larger profits and higher returns.

With a market cap of more than $139 billion, Goldman Sachs shares are unlikely to double over the next 12 months...

With a market cap of more than $139 billion, Goldman Sachs shares are unlikely to double over the next 12 months...

But we recently found a tiny tech company whose stock could soar as much as 380% by the end of the year.

Scores of other major companies, like PayPal (PYPL) and Mastercard (MA), are lining up around the corner to use this little-known company's services.

This microcap stock is still flying under the radar, and most investors don't know about it yet... But maybe not for long. That's why I'd urge you to check out my brand-new video presentation where I share everything you need to know. Watch it here.

Regards,

Joel Litman

October 26, 2021

Wall Street parties are back...

Wall Street parties are back...