These days, you can't talk about health care without talking about GLP-1s...

These days, you can't talk about health care without talking about GLP-1s...

The breakthrough weight-loss drugs continue to dominate the conversation in the health care industry. Eli Lilly's (LLY) Zepbound and Novo Nordisk's (NVO) Ozempic have become household names.

With expectations for their adoption and efficacy soaring, 2025 is set to be an even bigger year for GLP-1s. Employer-sponsored health insurance premiums are projected to rise by 9% in 2025. GLP-1s are the single largest driver of this increase, responsible for 1% by themselves.

That's a huge amount of spending on weight-loss drugs.

Regular readers know Zepbound in particular has impressed us... creating a $730 billion opportunity for Eli Lilly. While investors expect some growth in the business, they're still underestimating its full potential.

And as we'll discuss today, GLP-1s haven't only had a profound impact on Eli Lilly's stock and valuations... They're supporting the entire health care sector.

Zepbound has led to a huge boost for Eli Lilly...

Zepbound has led to a huge boost for Eli Lilly...

Shares of the biopharma giant rose 32% in 2024, outperforming the S&P 500's 23% upside. A big part of that was due to Zepbound, which raked in more than $3 billion in the nine months ended September 30.

And that strong performance is bolstering the rest of the industry...

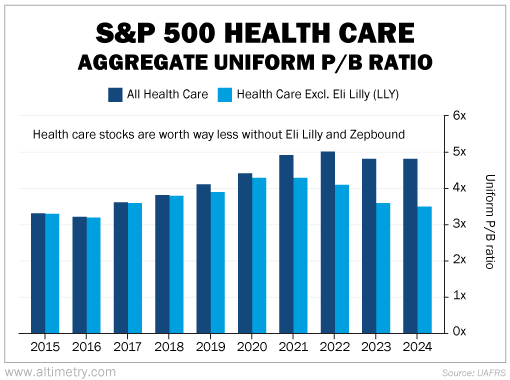

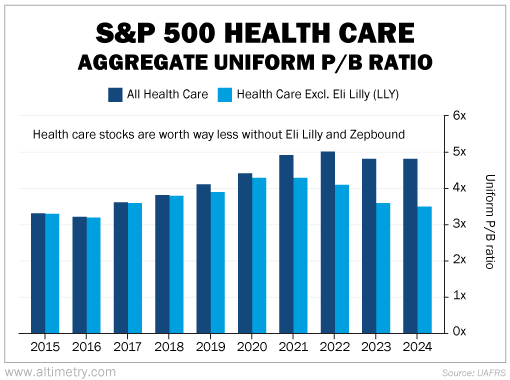

We can see this by looking at the aggregate Uniform price-to-book (P/B) ratio of the S&P 500 health care space.

The Uniform P/B ratio compares a company's total value with the value of the assets on its balance sheet (or "book"). The higher the P/B ratio, the more investors are willing to pay for its assets.

Said another way, it measures how valuable investors think the company's assets are. In this case, we're looking at all health care companies within the S&P 500. That includes pharma businesses, hospital operators, health insurers, medical equipment providers, and more.

This sector's Uniform P/B ratio rose from 3.3 times in 2015 to 5 times in 2022, the year Zepbound was approved for diabetes under the name Mounjaro. It's currently near an all-time high valuation of 4.8 times.

But when you remove Eli Lilly from the equation, something interesting happens. The ratio's peak shifts to 2020 and 2021... It has been falling ever since.

Take a look...

As you can see, without Eli Lilly, the industry aggregate Uniform P/B ratio plummets from 4.3 times in 2021 to 3.5 times in 2024.

This is a more accurate representation of the challenges health care faced after COVID-19... like staff shortages, rising costs, and regulatory uncertainty.

Through Zepbound, Eli Lilly has scooped up a huge share of the sector's value...

Through Zepbound, Eli Lilly has scooped up a huge share of the sector's value...

Meanwhile, many other companies are left trading at discounts.

This gap highlights just how much GLP-1s are reshaping the health care story. They're making waves that extend to both individual companies and the entire industry.

As these groundbreaking drugs keep changing the game, they'll continue to influence future valuations and investment opportunities.

Investors should keep an eye on GLP-1s... and the companies that make them.

Regards,

Joel Litman

January 15, 2025

These days, you can't talk about health care without talking about GLP-1s...

These days, you can't talk about health care without talking about GLP-1s...