Welcome back to Cabin Fever Week at Altimetry...

Welcome back to Cabin Fever Week at Altimetry...

As the coronavirus pandemic drags on – along with social distancing regulations, fewer in-person interactions, and more time spent in the house – many folks are struggling with feeling cooped-up indoors.

So this week in Altimetry Daily Authority, we're covering tips from the world-renowned Mayo Clinic to avoid cabin fever. We already discussed prioritizing exercise and going outside... and today's tip is getting some sunlight.

The Mayo Clinic suggests opening your window shades to get as much natural light as possible.

Cabin fever isn't a diagnosable condition... but as we mentioned on Monday, the more extreme symptoms amplified during the winter months can be classified as seasonal affective disorder ("SAD"). This form of depression occurs from late fall through winter and is partially caused by a lack of sunlight.

One of the best ways to fight SAD and stay healthy is to get more direct sunlight outside. Folks can also get more natural light in their lives by opening window shades. By supplementing ceiling lights with the sun, our bodies can fall into a more natural day-and-night cycle.

Another advantage of getting sunlight outside comes from boosting vitamin D levels. Our bodies make vitamin D when the sun's rays convert a chemical in the skin into an active form of the vitamin... so it's another good reason to take a break and get out of the house. However, many folks also take vitamin D supplements to go along with exposure to sunlight.

Taking supplements can become a daily ritual...

Taking supplements can become a daily ritual...

Many people take vitamin supplements each day to boost not only vitamin D levels, but also vitamin B-12, iron, and more. As vitamins are the building blocks of health, taking supplements can often be a vital health move.

The supplement industry is growing, with well-established firms backing the biggest supplement suppliers. Big Pharma firm Bayer owns One A Day, while competitor Pfizer (PFE) produces Centrum and Emergen-C. Meanwhile, consumer goods conglomerate Procter & Gamble (PG) owns New Chapter.

Each of these firms understands the value of supplements, and they're taking initiatives to further their participation in the space.

The potential for growth in supplements has led other companies to join this market as well... including consumer-goods giant Clorox (CLX), which is better known for its portfolio of cleaning products. Supplying vitamins has been a large focus of growth for the company.

Since 2016, Clorox has made two major acquisitions that further its ability to grow in the vitamin market.

The purchase of Nutranext and Renew Life allow the company to compete with the likes of Bayer and Pfizer in this area. Renew Life is a leading digestive supplement maker, with probiotic, digestive enzyme, and fiber products in its lineup. Meanwhile, Nutranext's products include the popular Rainbow Light multivitamin brand – the No. 2 vitamin brand in the natural market segment.

With Global Newswire projecting the supplement market size to grow by almost 70% from now until 2026, investors should be on the lookout for strong companies in the space to take advantage of these tailwinds.

And yet, when looking at the as-reported metrics, these acquisitions seem to have had little effect on profitability...

And yet, when looking at the as-reported metrics, these acquisitions seem to have had little effect on profitability...

In fact, they even appear to be a negative driver for Clorox.

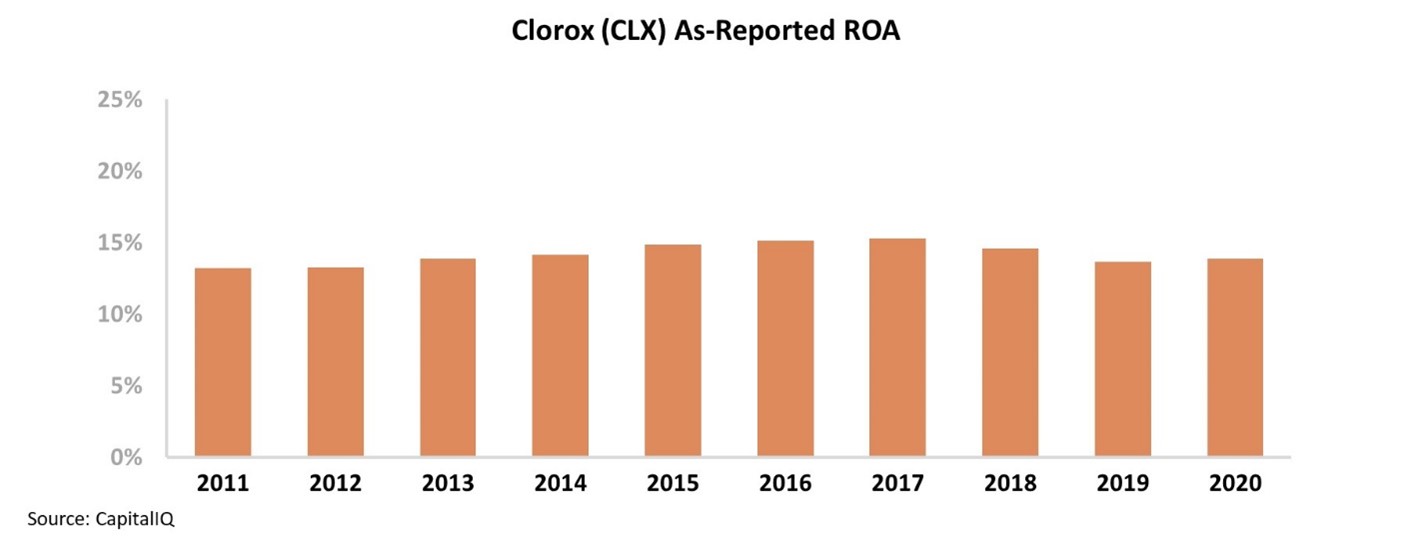

The company's as-reported return on assets ("ROA") has slowly faded from 15% in 2015 to 14% in 2020. Investors using as-reported accounting must assume Clorox has been eroding value through expanding into supplements.

But in reality, though, this decline in as-reported ROA is just "noise" from bad accounting. GAAP metrics understate how powerful Clorox's acquisitions have been.

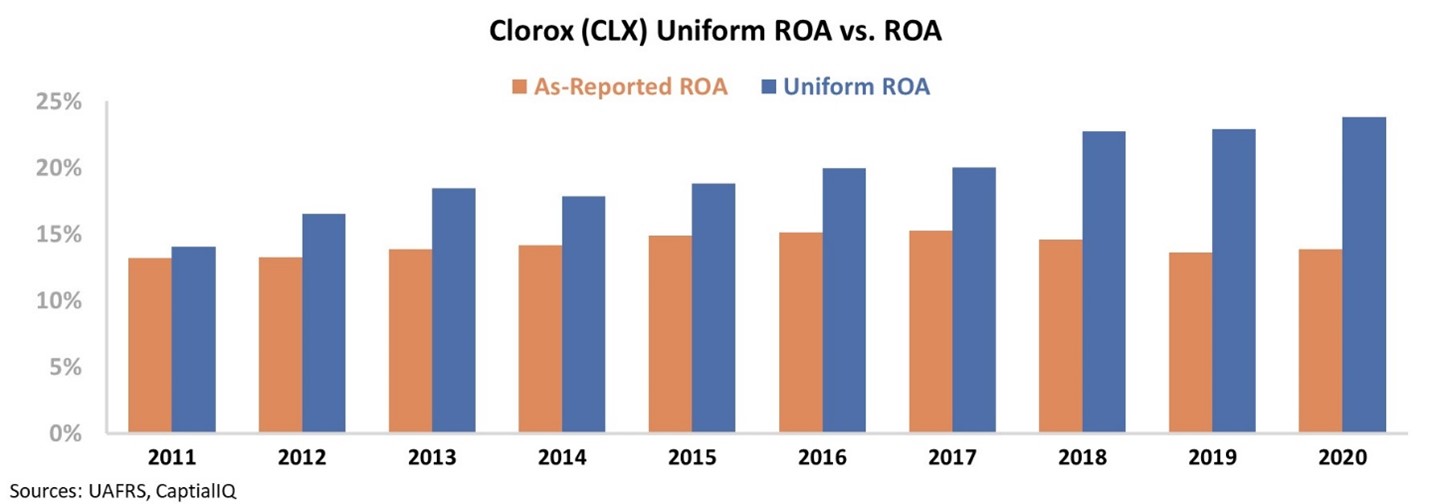

When looking through a Uniform Accounting lens, it becomes clear that the company's profitability levels have been steadily improving.

As you can see in the chart below, Clorox's Uniform ROA has actually risen from 19% in 2015 to 24% last year. This profitability expansion shows the value that Clorox has unlocked from its move into the supplement business.

But by relying on as-reported metrics, investors would completely miss this improving performance... They would see stagnant returns instead of the sharp jump higher since 2016.

Without understanding the real profitability trends that Uniform Accounting shows, investors are forced to guess at the outcome of Clorox's strategy to diversify the business.

Regards,

Joel Litman

January 27, 2021

Welcome back to Cabin Fever Week at Altimetry...

Welcome back to Cabin Fever Week at Altimetry...