President Donald Trump isn't the only person who's able to get in a tweet battle...

President Donald Trump isn't the only person who's able to get in a tweet battle...

Nassim Taleb is best known for:

- Coining the phrase "Black Swan,"

- Writing a book about the phenomenon and how humans struggle to model low-probability events,

- Being one of the few traders to come out of Black Monday in 1987 as a winner because of his strategy's bets on rare instances, and

- Generally needing to sound like the smartest person on Twitter.

But last week, Taleb ran into someone else who's also known for being exceptionally bright...

He and Cliff Asness, the founder of the quant-fund juggernaut AQR, had a Twitter spat that was both unproductive and enlightening (you can wade through the entire discussion here).

The debate started after the sharp decline in the market in March led to a killing for strategies based on Taleb's philosophy. These involve buying deeply "out of the money" options for cheap and then waiting for the once-every-10-year move that will lead to a payoff for this type of hedge... while the rest of a portfolio is down.

As Bloomberg explains, AQR published a report earlier this month highlighting that the cost/benefit of those strategies may not be as compelling as investors might think... especially in the wake of the sell-off, when portfolio protection is at its most expensive.

Taleb disagreed with AQR's premise, explaining that the type of strategies that AQR is explaining have nothing to do with the type of strategies his fund, Universa Investments, advocates.

At least the tweet storm was entertaining, and it did at times help show both sides of the debate... even though the discussion was a bit technical.

'Diversification is key'...

'Diversification is key'...

That's what any good financial advisor should tell you.

Without diversifying your investment portfolio, you're exposing yourself to unnecessary risk and potentially limiting your upside.

University endowments are a great example of the type of diversification money managers suggest their clients keep.

In addition to a portfolio of stocks, bonds, and some cash, these endowments invest in "real," hard assets like real estate, natural resources, and other non-correlated investment classes.

As several of our employees who've worked at Harvard University's endowment like to point out, that's how these type of big-name universities invest their money – in addition to their multibillion-dollar public market accounts, each school owns several more billions of dollars in commercial real estate, timberland, and oil reserves.

It's a great model for schools who have massive funding to begin with and a multi-generation time orientation.

However, despite what a money manager would suggest, individuals and billion-dollar schools don't need to take on the same level of capital at risk to achieve great diversification and returns.

In the November 7 Altimetry Daily Authority, we explained why real estate isn't always the great investment many people believe it is. Unless you have the time and capital to develop and maintain a portfolio of high-quality real estate, this type of investing can be inefficient.

The same is true with these other endowment-favored asset classes. Unless you have access to a special-purpose vehicle ("SPV") for investing in timberland, it's unrealistic that you'd be able to diversify like Harvard by buying hard assets.

That said, you can get that same type of diversification using the stock market.

You see, this way, you have the ability to diversify away virtually all of the market's risk by investing in companies from a wide range of industries.

Even the S&P 500 Index includes many of the same types of alternative investments that the endowments buy into.

You can buy stock in gold mining companies, real estate portfolios, and even some of the more esoteric assets, like timberland.

Weyerhaeuser (WY) is one of the country's largest timberland owners, and its stock provides investors the opportunity to own a piece.

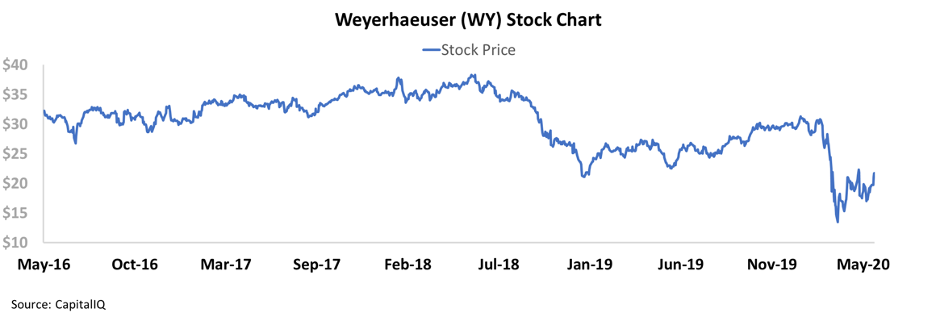

During the last several years of the bull market, Weyerhaeuser significantly underperformed the market. Even prior to this March, the company's stock was roughly flat since 2016...

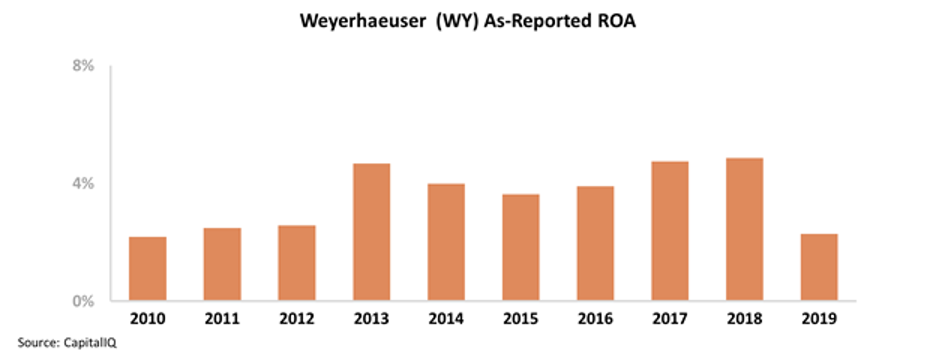

Weyerhaeuser's weak stock performance has likely been driven by its poor – and recently declining – profitability.

Weyerhaeuser's as-reported return on assets ("ROA") has been below long-term corporate averages for the past decade, only reaching a peak of 5% in 2018 before cratering back to 2% in 2019.

Investors may have seen these subpar returns, and were likely further concerned by Weyerhaeuser's recent dividend cut – this could explain the stock's weak performance.

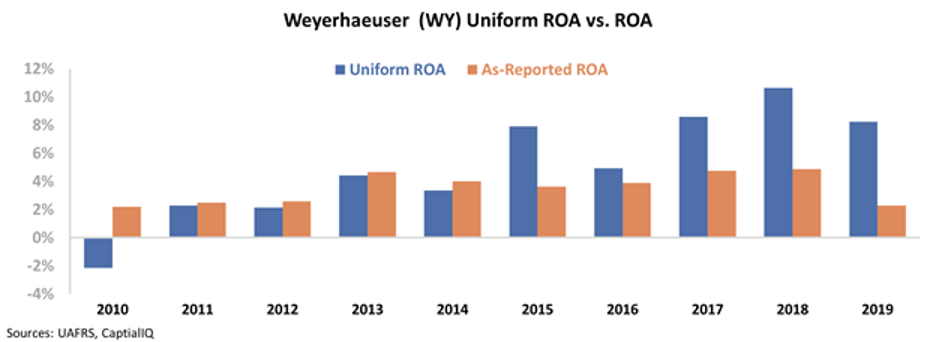

However, the as-reported numbers couldn't be further from the truth, and it's only a matter of time before the stock market realizes it...

After applying our Uniform Accounting metrics – which adjust for misleading line items like pension service adjustments, depreciation, and operating leases – we can see that Weyerhaeuser's profitability is actually improving.

While the company's Uniform ROA was negative coming out of the Great Recession, it has since past long-term corporate averages – reaching a peak of 11% in 2018 before pulling back slightly to 8% last year.

In reality, Weyerhaeuser cut its dividend as a smart cash preservation strategy during uncertain times. Even still, the company's profitability is trending upward.

Once the world calms down, and Weyerhaeuser is able to reinstate its dividend, this is a name with significant upside potential when the market sees its real returns.

Regards,

Joel Litman

May 29, 2020

President Donald Trump isn't the only person who's able to get in a tweet battle...

President Donald Trump isn't the only person who's able to get in a tweet battle...