One positive aspect of the quarantine might sour come next winter...

One positive aspect of the quarantine might sour come next winter...

Because social distancing limits opportunities to spread the coronavirus, many health experts are talking about how the common cold, the flu, and other seasonal sicknesses have declined across the globe.

Wearing masks and keeping a safe distance away from each other eliminates some common transmission methods.

For the medical system, it's great news that fewer of these sicknesses are being added onto the heavy caseload created by the coronavirus.

However, when the pandemic starts to wane, these diseases won't be gone forever...

Avoiding of common illnesses now may only kick the can down the road, and there may be even more issues next winter. As the Washington Post reported last month...

As welcome as the absence of these other viruses is during a pandemic, epidemiologists say they see a potentially dangerous consequence after coronavirus cases eventually decline – a rebound that could be frightfully large given the relaxation of social distancing and lowered immunity to other pathogens.

"The best analogy is to a forest fire," said Bryan Grenfell, an epidemiologist and population biologist at Princeton. "For the fire to spread, it needs to have unburned wood. For epidemics to spread, they require people who haven't previously been infected. So if people don't get infected this year by these viruses, they likely will at some point later on."

The natural immunity from being exposed to common diseases will be weaker as life returns to normalcy. Consequently, more people may end up getting sick from illnesses that aren't normally much of an issue. And those who do become sick might become more ill than normal.

As the world opens back up and individuals get their vaccines, we can't completely abandon our vigilance. With such large changes to society over the past year, the potential resurgence of common illnesses is just one of the secondary effects of the quarantine.

If collective immunity for common sicknesses starts to dip, one firm's remedies may become more useful than ever...

If collective immunity for common sicknesses starts to dip, one firm's remedies may become more useful than ever...

If these illnesses become more prevalent and dangerous as the pandemic recedes, it's important to understand how to combat their threat.

Fortunately, we already have many powerful tools to fight these common sicknesses.

Many pharmaceutical companies produce remedies for those in the early stages of contracting the flu.

For example, these companies offer products with vitamin C such as Airborne for those looking for a proactive treatment. They also offer medicine like Tamiflu to lessen the effect of the virus.

After these early stages, antibiotics are the first line of defense when you go to the ER and doctors aren't sure exactly what you have.

If you're diagnosed with an illness such as bronchitis or pneumonia, antibiotics are required to effectively fight back.

One of the most popular antibiotics is Zithromax, or a Z-pak. It's made by Big Pharma firm Pfizer (PFE).

The company has made headlines during the pandemic for its development of a coronavirus vaccine. However, Pfizer has already achieved great success in developing a wide range of treatments from infectious diseases, to cardiovascular and chronic immune disorders, to other issues.

Considering its broad range of treatments, investors might expect Pfizer to have robust returns...

Considering its broad range of treatments, investors might expect Pfizer to have robust returns...

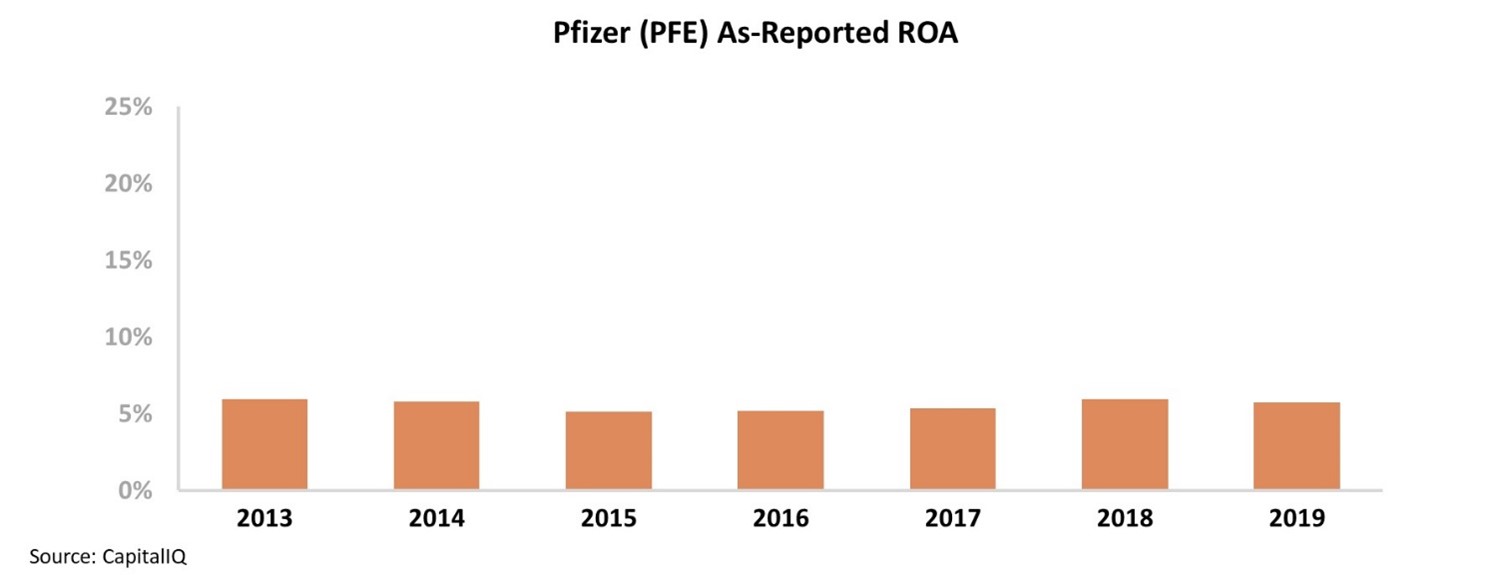

However, Pfizer doesn't look that impressive on an as-reported basis. Due to accounting distortions – including those created by serial write-offs – the company's as-reported return on assets ("ROA") is only 6%.

Based on the GAAP numbers, investors may conclude that Pfizer's returns aren't far from the corporate average.

In reality, this below-average ROA is just "noise" from bad accounting. To see the real story of Pfizer's profitability, we have to remove the distortions in the as-reported numbers...

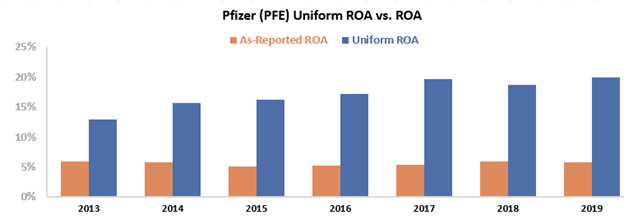

Uniform Accounting paints a clearer picture of the company's true profitability levels. As you can see in the chart below, Pfizer's Uniform ROA stands at 20% – more than triple the as-reported figure. Additionally, thanks to the company's strong bench of new and existing treatments, Uniform ROA has been rising since 2013. Take a look...

Without Uniform Accounting, investors would completely miss Pfizer's above-average performance. Furthermore, they would fail to see how the company has been improving its operations... and how tailwinds after the pandemic recedes could benefit it.

Regards,

Joel Litman

February 9, 2021

One positive aspect of the quarantine might sour come next winter...

One positive aspect of the quarantine might sour come next winter...