Regulators want telecom firms to put 5G on airplane mode...

Regulators want telecom firms to put 5G on airplane mode...

AT&T (T) and Verizon (VZ) started the year with a back-and-forth battle with regulators over delaying the rollout of 5G wireless services across the country.

The Federal Aviation Administration ("FAA") and broader Secretary of Transportation asked the two telecom providers to delay their release of expanded 5G wireless services for a few weeks. Officials said widespread 5G services could impact flight safety.

5G can cause interference to aircraft altimeters if it occupies a frequency next to the barometer's frequency.

Without accurate altimeter readings on airplanes, pilots may not calculate their altitude accurately. During these frantic times, the airline industry could do without the additional turbulence to their operations.

Earlier this month, AT&T CEO John Stankey and Verizon CEO Hans Vestberg said in a letter to U.S. transportation officials, "The question of whether 5G operations can safely coexist with aviation has long been settled." The telecom carriers agreed to a two-week delay so older aircraft could be refitted with 5G-compatible altimeters.

But the telecom executives aren't interested in any further delays...

Strong networking isn't just essential in finance...

Strong networking isn't just essential in finance...

Anyone who read Altimetry Daily Authority last April 12 wouldn't be surprised by the resistance of the telecom companies.

As our analysis at the time highlighted, both AT&T and Verizon were spending tens of billions on building out infrastructure for 5G and need to see the returns on those investments as soon as possible.

In April 2021, we highlighted how both companies needed additional debt to fund their 5G investments but were already strapped with obligations. However, Verizon was in a much better place to weather 2021 than AT&T.

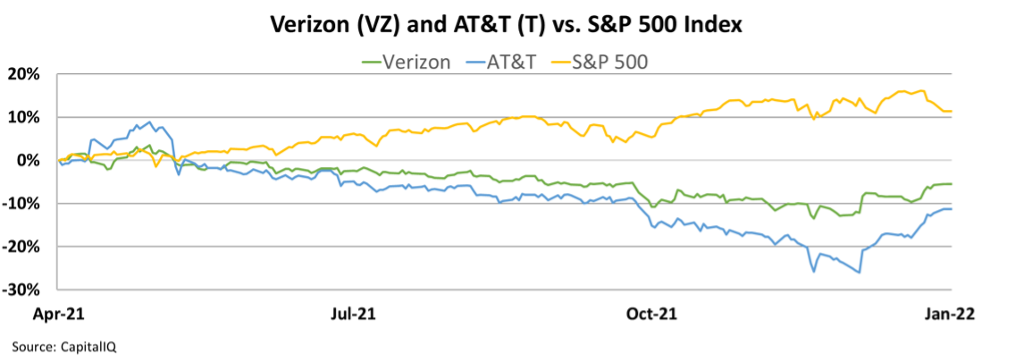

As you can see in the chart below, since we highlighted both names last April, they have underperformed the market, with Verizon performing slightly better than AT&T.

But AT&T has come a long way from the depths of its troubles from a year ago.

The adoption of 5G smartphones has ramped up, and telecom carriers are playing hardball with federal authorities.

A return to core company operations makes this company a more attractive credit...

A return to core company operations makes this company a more attractive credit...

Divestitures in the Time Warner division and other debt-financing activities have improved AT&T's debt schedule to a degree where it has more breathing room than it did before.

Using our Credit Cash Flow Prime ("CCFP") analysis, we can get to the heart of the firm's true credit risk.

In the below chart, the stacked bars represent the firm's obligations each year for the next five years. These obligations are then compared to the firm's cash flow (blue line), as well as the cash on hand at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

With cash flows expected to rise as the 5G network expansion rolls out, AT&T continues to have strong cash flows close to the firm's obligations.

Each year from 2022 to 2027 has meaningful debt maturities, of which 2023 onwards will require the firm to have its cash on hand to cover its obligations. The company will need to trim its maintenance capital expenditures ("capex") to much lower levels than last year to cover its full obligations.

Given the stronger outlook for 5G rollout and a significantly improved debt profile, AT&T is in a much better place going forward.

Continued rollout of its 5G network should see increased cash flows, and recovery in the market should cede better costs for its infrastructure needs.

Recovery in telecom companies, such as AT&T, shows how previously debt-laden companies are primed to refinance their obligations in this low-rate environment and positioned for future success.

Is AT&T a good stock to buy?

Is AT&T a good stock to buy?

AT&T appears to be poised to perform well as it looks to the future of 5G.

But one way for retail investors to simmer down the noise and look at the heart of the company's true financials is through the Altimeter, our service that grades nearly 5,000 U.S.-listed stocks and acts as a "stock truth detector."

Altimeter subscribers can click here to see how AT&T is valued... and if T shares are primed for upside ahead.

If you're not already an Altimeter subscriber, you can take advantage of our risk-free trial offer... and see for yourself how the tool can improve your investment strategy.

But you'll need to act fast. This risk-free trial offer is closing soon...

Click here to learn more.

Regards,

Rob Spivey

January 11, 2022

Regulators want telecom firms to put 5G on airplane mode...

Regulators want telecom firms to put 5G on airplane mode...