Software is the world of kings and queens...

Software is the world of kings and queens...

At least, that's what my old colleague at Credit Suisse used to say.

Once a software company takes the top spot, it's about as hard to knock it off its pedestal as it is to depose a monarch. If users are comfortable with a software, they're not eager to turn to something new.

Companies also tend to integrate their software into every part of their operations... creating a lofty barrier for the competition.

If software is the nobility of tech, semiconductors are the serfs. Chips have long been viewed as a commodity business. Companies fight it out for market share, with little profit to go around.

But although it's tough to break out of this hierarchy, it's not impossible. Today, we'll discuss one company that has "changed its stars" in the technological feudal system.

This business has gone from an industry serf to a market king... and the secret lies in competitive advantages.

The way a company makes money says a lot about how long it'll be able to make big profits...

The way a company makes money says a lot about how long it'll be able to make big profits...

Take retail giant Walmart (WMT), for example. Walmart and your local grocer both sell groceries. But their business models are polar opposites...

Walmart makes money by running a top-of-the-line distribution machine. It squeezes every dollar of costs out of its business to offer low prices. And as customers flock to those low prices, it can drop them even further.

Your local grocer probably connects with you on a more personal level. Maybe it stocks your favorite cookies after you ask for them. It might offer produce from nearby distributors. And it's physically close enough to be convenient.

Said another way, Walmart competes by having a better distribution network. Your local grocer competes based on "search cost." It's easier for you to go there than somewhere farther away... so that's what you do.

Great software companies compete based on 'switching costs'...

Great software companies compete based on 'switching costs'...

The kings and queens of tech make it really hard for you to switch from their software to a competitor's.

Software giant Microsoft (MSFT) doesn't necessarily have the best office suite technology. It might be easier to collaborate using Google Sheets than Excel.

And yet, people still fall back on Excel... because switching all their spreadsheets to a new format would just be too much of a burden.

The same is true of many Adobe (ADBE) design tools. Much of the design world is built around Adobe. Competitors don't stand a chance against it.

Switching costs offer one of the most powerful competitive advantages. Once you become the industry standard, it's next to impossible to be dethroned. That's why software companies become kings and queens.

Meanwhile, semiconductors compete on intellectual property ("IP"). One semiconductor firm's profits and stock might take off for a half a year... because it came up with a new chip that's light-years ahead of the competition.

It takes a few quarters for competitors to catch up – or even leapfrog it with a new technology. The first company reaps the rewards in the interim.

And then its profits come crashing down as competitors roll out their solutions.

It's a race to the bottom... because your IP is only the best until someone comes out with something better. Your customers have no reason to stay unless you offer a cheaper price.

That brings us to market darling – and former microchip serf – Nvidia (NVDA)...

That brings us to market darling – and former microchip serf – Nvidia (NVDA)...

Nvidia's profits exploded as it broke out of its semiconductor mindset. It's not competing on IP anymore. Instead, it has gotten almost every AI-focused company to use CUDA... its state-of-the-art software platform.

CUDA makes programming on Nvidia's graphics processing units more streamlined and unlocks their power for complex calculations. Essentially, it's now the language AI programming talks in.

Nvidia has locked its customers into its chips and its ecosystem. And in doing so, it has moved from an IP competitive advantage to a switching-cost competitive advantage. It's now king of the AI ecosystem.

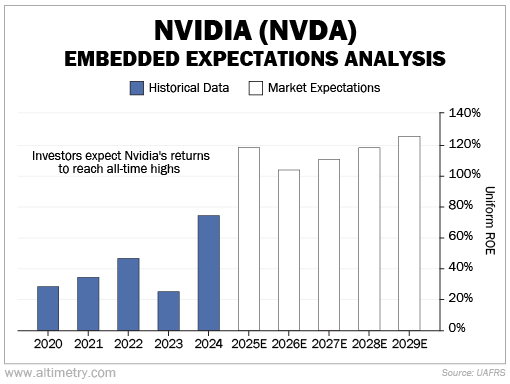

The market believes Nvidia will keep its advantage for the foreseeable future. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Investors expect Nvidia to continue its massive growth as it capitalizes on the AI explosion. They project returns will reach an all-time high of 125% by 2029.

Take a look...

Put simply, folks realize Nvidia's competitive advantage is changing... and getting stronger. They've priced in most of the upside already. It's easy to see why.

Even if you missed the boat on Nvidia, some of the best opportunities come from other companies taking a similar approach. Look for business-model changes the market hasn't caught on to yet.

These strategy shifts can unlock enormous upside potential. When investors realize what's going on, shares can explode higher... transforming your portfolio in the process.

Regards,

Rob Spivey

June 14, 2024

Software is the world of kings and queens...

Software is the world of kings and queens...