Editor's note: The markets and our offices are closed on Monday, June 19, for Juneteenth. Because of this, we won't be publishing Altimetry Daily Authority. Please look for your next edition on Tuesday, June 20.

Communication issues don't surface all at once...

Communication issues don't surface all at once...

They happen over time.

When everything's going well for a company, executives trip over themselves to make that clear. Their earnings calls tend to be longer, more precise, and with plenty of time for Q&A.

But not all companies respond well to pressure... When earnings take a turn for the worse, some management teams start speaking with what we call fact-deficient, obfuscating generalities ("FOG").

If you're a brand-new investor listening to your first quarterly earnings call, you won't know that the team isn't speaking openly. You have nothing to compare it with.

Worse yet, some companies don't even bother communicating with shareholders consistently. Electric-vehicle company Tesla (TSLA) and investment bank Goldman Sachs (GS) went years without investor days... until their stocks started to plummet at the beginning of the year.

That's why it's important to build your "trust account" with management teams before investing in their stocks. Today, I'll share a simple exercise you can do to make sure you aren't blindsided down the road.

Trust and communication go hand in hand...

Trust and communication go hand in hand...

If you trust someone, you don't have to second-guess everything they say. That's why it's so important to build trust with the people running the companies you invest in.

Author Stephen Covey wrote about trust and communication in his book, The 7 Habits of Highly Effective People. While the book has a lot of fantastic advice about work and life in general, one quote has always stood out to me...

When the trust account is high, communication is easy, instant, and effective.

Covey wrote this with business and personal communication in mind. But as it turns out, it's awfully helpful for investing, too.

One investor day doesn't make up for years of poor communication. It takes repetition for investors to build that trust account with a management team. And it's much harder to gain investor trust than it is to lose it.

Both Tesla and Goldman realized they have to communicate more. They held investor days this year to try to ease shareholder concerns. Only time will tell if it's enough to win back the market.

General Electric (GE) is an even better example of management trust – or a lack thereof...

General Electric (GE) is an even better example of management trust – or a lack thereof...

GE was in its glory days under former CEO Jack Welch. He ruled during the last part of the 20th century.

The conglomerate built up a strong reputation for growing into new industries, backed up by strong management. It owned diverse businesses like financial services, home appliances, and energy infrastructure. It even owned entertainment giant NBCUniversal.

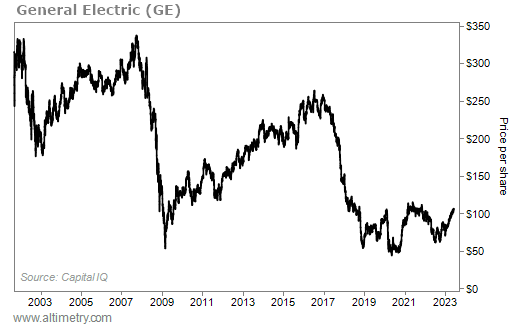

GE was wildly successful as it expanded... At its peak, the stock rose more than 4,000% under Welch's watch.

Simply put, investors trusted Welch when it came to decision-making and knowing what was best for the business. (Although, as we wrote in April, they shouldn't have.)

But it all changed during the 2000s. The company began to unravel in the face of a new CEO, Jeff Immelt, and the Great Recession.

Management couldn't juggle GE's many interests. Investors became impatient. They weren't getting answers during earnings calls... and they lost trust in the company.

During one such call in 2008, analysts asked if GE needed strategic changes to stimulate better performance. They were frustrated with the company and believed that management continued to make promises and not deliver.

Rather than being honest with analysts, management gave vague answers about driving revenue growth, earnings growth, returns, and cash flow. It didn't provide any facts or data.

As Al Meyers, a manager of a fund that owned GE, stated, "You either believe management or you don't."

Most investors didn't... and still don't today. The stock fell and hasn't recovered. It's down about 60% since Welch retired in September 2001.

Take a look...

When investors lose trust in a company, it's hard to earn it back. More than 20 years later, GE is only now starting to turn things around.

It doesn't take expensive analysis or an advanced degree to trust the companies you invest in...

It doesn't take expensive analysis or an advanced degree to trust the companies you invest in...

All you need is a little time.

One of the best ways to build a trust account is to listen to at least a year's worth of earnings calls.

Note that we didn't say to read the transcripts... You get a lot more out of it by listening. That way, you can hear management's tone.

The more quarters you listen to, the more you'll start recognizing patterns. You'll start to pick up on when management is dodging questions that the team used to answer. Or you might notice information that used to be at the top of the slide deck has gone missing.

You can only pick up on these nonverbal cues over time. It's all about getting a feel for the flow of the presentations. When you do, you can make sure your "trust account" is high before buying any stocks.

Regards,

Rob Spivey

June 16, 2023

Communication issues don't surface all at once...

Communication issues don't surface all at once...