Companies are getting more selective with their cash...

Companies are getting more selective with their cash...

High inflation and rising interest rates tend to put pressure on businesses. That's exactly what we're seeing today. And it has forced those businesses to reconsider where they put their money.

That's why spending on buybacks is slowing... down more than 10% year over year in the third quarter. Corporations are choosing to hold on to cash rather than return it to shareholders.

However, not all spending has decreased. In the third quarter, spending actually rose for one specific category... capital investment.

Regular readers know my team and I have been "pounding the table" on the supply-chain supercycle for more than a year. It refers to a huge wave of spending on things like construction, factories, and infrastructure in the U.S.

Corporations took the supply-chain supercycle a step further back in August. That's when they started to invest in hard assets for the first time in more than a decade.

And this new data only confirms that the trend is underway. Capital investment grew more than 20% year over year in the third quarter.

Companies are still improving their facilities and supply chains despite higher interest rates. They know that even in the face of rampant inflation, consumer demand is still strong. They have to improve their own businesses in order to take advantage of it.

One sector in particular will benefit from more capital investment...

One sector in particular will benefit from more capital investment...

I'm talking about industrials.

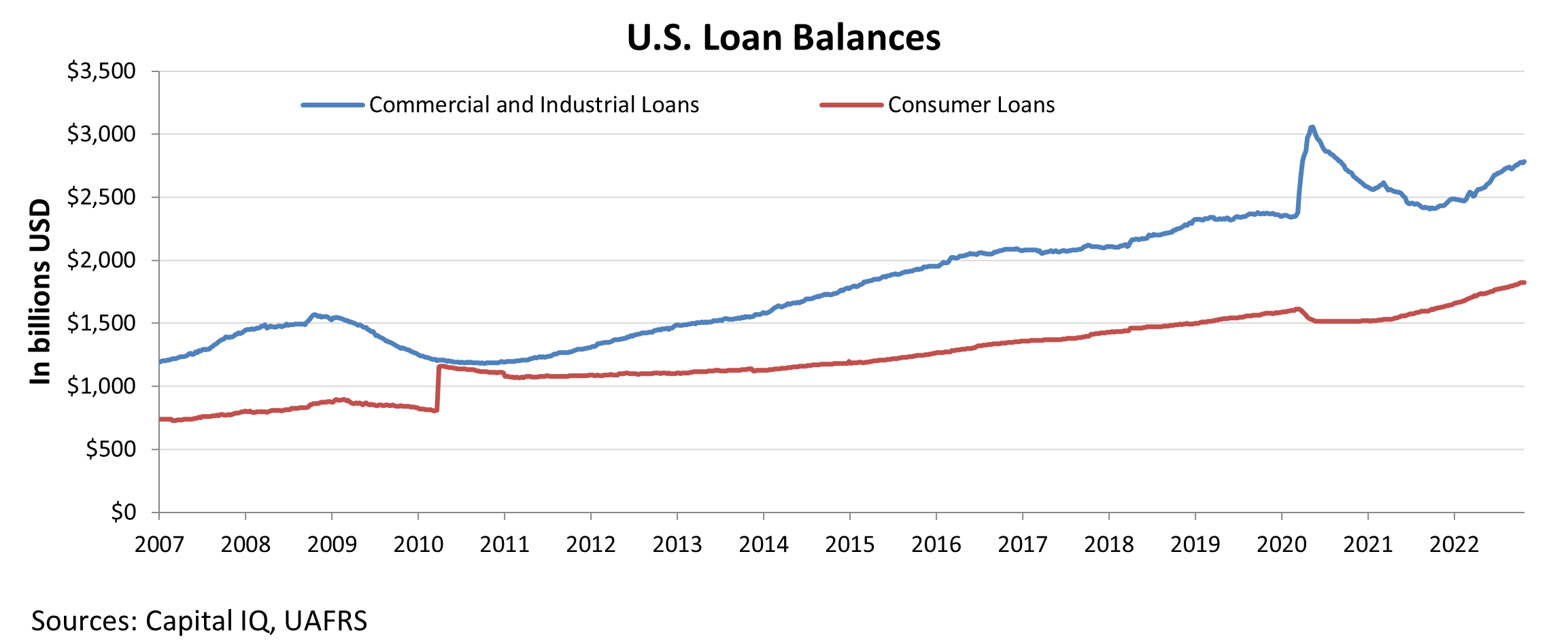

One of the surest ways we can see the rise in capital investments is by looking at commercial and industrial (C&I) loan growth. These are short-term loans used for funding projects or purchases.

Sustained C&I loan growth only happens when companies are investing in growth. Significant capital investments are often expensive. Companies opt to fund these projects through C&I loans rather than relying on cash flows.

C&I loans have continued to rise this year despite growing concerns of a recession. Take a look...

As you can see, after dipping during the pandemic, C&I loans are on the rise again. Companies are investing even in the face of higher interest rates.

Said another way, we're seeing more spending at a time when it's harder to spend. That's why we're so bullish on more capital investment going forward.

It's also why we believe that industrial firms will be big winners in both 2022 and 2023.

Capital spending doesn't look like it's slowing down anytime soon. Industrial companies will continue to benefit from this investment wave... no matter what happens in other parts of the economy.

Our brand-new investment tool backs us up...

Our brand-new investment tool backs us up...

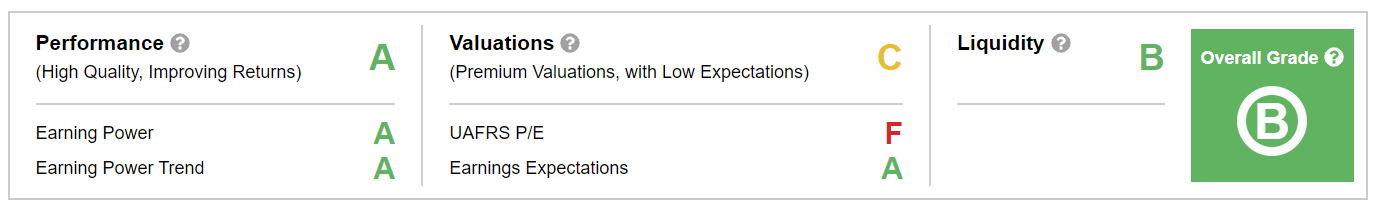

We call it the ETF Analyzer. Essentially, it works like the Altimeter – it analyzes Uniform Accounting data to provide grades across a number of categories.

Only instead of doing this for stocks, it looks at exchange-traded funds ("ETFs") and mutual funds.

We ran the industrial sector through the ETF Analyzer via the Industrial Select Sector SPDR Fund (XLI). It's an ETF that tracks a basket of top industrial stocks in the S&P 500. And we were encouraged by what we saw...

The ETF Analyzer shows that XLI's fundamentals are strong and accelerating. It receives an "A" grade for Performance and a "B" overall.

Here's how it looks...

We already realized the industrial sector had some promising trends behind it. Increased capital and supply-chain investments should propel these stocks higher in the coming months.

Thanks to the ETF Analyzer, we know the numbers agree.

And it doesn't just work for industrials... The ETF Analyzer tracks data for 125 of the 127 total industry groups.

That means you can break down almost every sector to find the biggest winners and losers of the coming year.

As I explained last week, that's the first step toward identifying great investments. After all, half of a stock's movement can be explained by what its industry is doing.

Promising companies with strong balance sheets are great. However, individual company metrics aren't enough to make a sound investment.

If you're looking for the best stock opportunities, you have to start with the underlying sectors.

Regards,

Joel Litman

December 5, 2022

P.S. The ETF Analyzer works in bull markets and bear markets across nearly every industry group. That's part of what makes it such a valuable tool in uncertain economic times like these.

I'm so excited about its potential that I recently recorded a presentation explaining exactly how it works... and how it can help everyday investors tune out the as-reported "noise" to locate the most promising corners of the market.

I also revealed the name and ticker symbol of my No. 1 stock to buy today (and one to steer clear of). And I detailed how you can get a free year of access to the ETF Analyzer for a limited time only. Click here to learn more.

Companies are getting more selective with their cash...

Companies are getting more selective with their cash...